30Y Gilts Soar Most Since Covid Crisis In Giant Short Squeeze After UK Slashes Debt Issuance

While it is of secondary importance to US readers, in the UK everyone was glued to the telly following today’s Autumn Budget and Spending Review, and the budget speech in Parliament by Chancellor of the Exchequer Rishi Sunak. For the benefit of our British readers, and for gilt traders everywhere, here is a snapshot of what was just announced courtesy of Bloomberg:

- Sunak presented his third budget, pledging a “new age of optimism” even as the risk of inflation lurks:

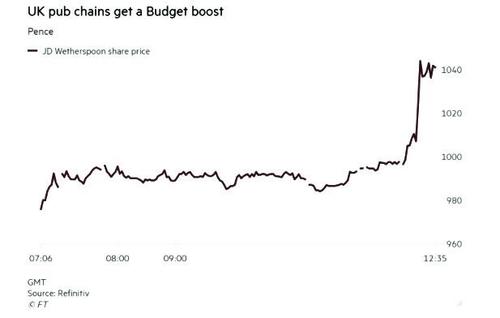

- Sunak cut taxes on alcohol, part of his “radical” plans to simplify alcohol duty, aligning higher rates with stronger drinks, causing pub stocks to rally, and froze a planned rise in fuel duty. He also gave a one-year 50% reduction in business rates to the retail, leisure and hospitality sectors

- With the cost of living rising for Britons, Sunak reformed Universal Credit, increasing how much welfare people will keep as their incomes rise. Specifically, the taper rate on universal credit will be reduced by 8% — from 63 to 55%, a much higher level than expected.

- Pivoting from his spending announcements, Sunak made a philosophical statement that “government should have limits — it needed saying”. He added: “I want to reduce taxes — by the end of this parliament I want taxes to be going down not up . . . that’s my mission over the remainder of the parliament.”

- With upgraded forecasts to economic growth and tax revenues, Sunak committed to real-term increases in departmental spending in all areas of government. As the FT notes, “there’s a lot of spending in this Budget but quite a bit of it is undoing the austerity years under David Cameron and George Osborne. The rise in per pupil funding, for example, is substantial but also returns the country to where it was in 2010.”

- But perhaps most important to bond traders, despite those sweeteners, Sunak also focused on strengthening the public finances. As a result, the borrowing forecast for the next five years was lowered by a whopping 154 billion pounds, while planned debt sales for this fiscal year were cut by a fifth.

- As Resolution Foundation’s Torsten Bell writes, “this is a much much bigger Budget than expected. Why? Because the @OBR_UK have become hugely more optimistic: borrowing down because taxes are up. And it’s a Boris Budget because the Chancellor has basically gone and spent it.”

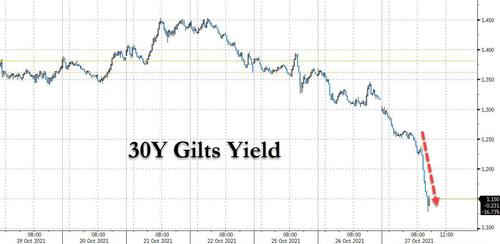

While the details in the budget are secondary, as they will surely change once the BOE does hike rates throwing the entire forecast for a loop, the one thing worth emphasizing is the projected reduction in gilt issuance: the Debt Management Office has released its gilt issuance plans, and they contain a bigger cut than expected. The U.K. is slashing gilt issuance by 57.8 billion pounds compared to an estimate of 33 billion pounds. This according to Bloomberg shows how far the U.K. is willing to go to curb the debt spree at the height of the pandemic. It also confirms that a BOE taper is now inevitable as there will be far less need to monetize the debt spree.

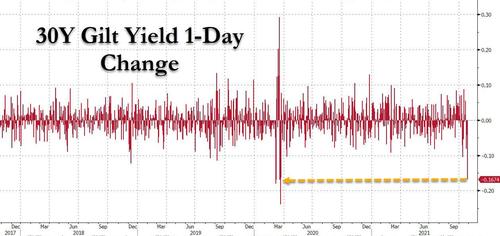

And while it took a while for them to respond, 30Y gilts have plunged by a whopping 17bps…

… the biggest one-day move since the covid crisis, and one that is surely VaR shock inducing among the countless shorts who are currently spitting blood.

Tyler Durden

Wed, 10/27/2021 – 09:52![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com