S&P Tops 4,600 In Fitting End To Best Month Of 2021

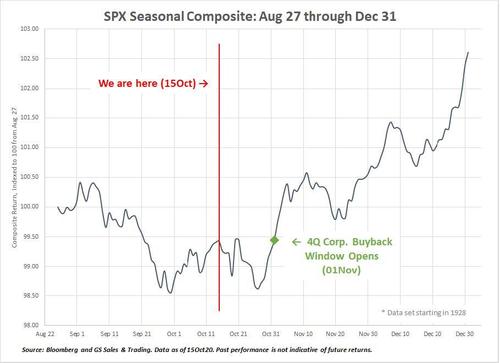

Two weeks ago, when stocks were stuck in a narrow, downward range, and the prevailing consensus was for continued declines, Goldman laid out a contrarian case predicting a market-wide melt up into the end of October and the last two months of the year. Citing technicals, such as massive inflows into equity funds and corporate buybacks to the tune of $8 billion daily, as well as a favorable gamma picture and vol control funds which had tens of billions to buy due to the sharp drop in the VIX, perhaps the most persuasive argument was that S&P seasonals pointed to strong upside in both October and year end.

The bank then doubled down on this call one week later, observing that “we are entering the strongest month (and best two month period) of the year with a median return of 2.1% and positive hit rate of 71% going back to 1985.”

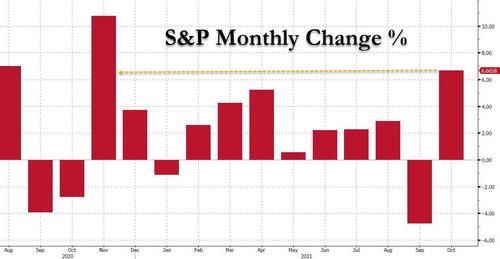

In retrospect, Goldman was absolutely correct, and one look at the S&P over the past two weeks shows an unbroken meltup from a low of 4,340, one which steamrolled over the wall of stagflation/China/rate hike/profit margin wall of worry and culminated with a new all time high today when the index topped 4,600 for the first time ever, rising as high as 4,604.

And while the S&P didn’t really need today’s ramp to new all time highs to record the best October since 2015 – a traditionally jittery month – it certainly helped. It also helped to cement October’s performance as the best month since November 2020.

Remarkably, the S&P reversed earlier losses sparked by poor guidance from Amazon and Apple’s first miss to exp. revenues. Meanwhile, the Nasdaq 100 pushed higher, offset by gains in Meta Platforms after its name change from Facebook, and Tesla, which topped the $1,100/share level. As shown below, Tesla has now gained over $300 billion in market cap in the past two weeks – the increase alone is bigger than the market cap of 90% of S&P500 companies – and propelled the auto maker to a market cap of over $1.1 trillion…

… surpassing Facebook, pardon Meta in the process. Also earlier today, Microsoft rbiefly surpassed Apple as the world’s most valuable company but a surge in AAPL stock helped the iPhone maker regain the top spot.

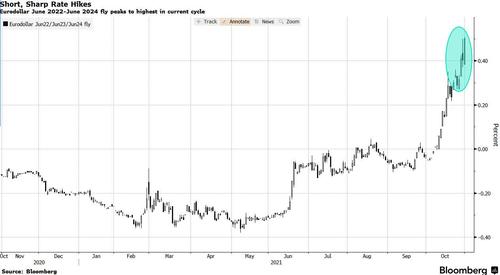

Just as remarkably, today’s meltup took place even as the market continues to brace for tightening, bringing ever closer the date of the first rate hike: as noted earlier, the market is now pricing in odds of a June rate hike as high as 87% – or around 22 bps.

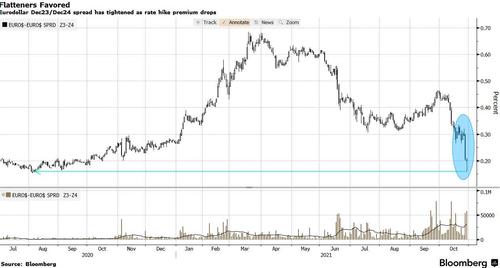

This took place amid a broad based capitulation of curve steepener trades, with the EDZ3/EDZ4 spread collapsing to around 10bp from 30bp since Wednesday, in the process leading to big losses for those who were expecting continued dovishness from either the Fed, or other central banks.

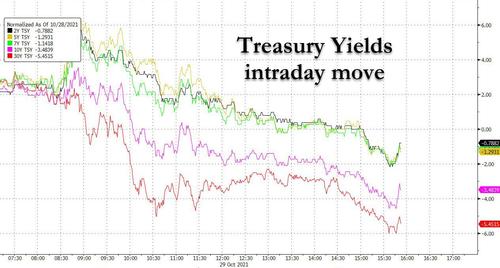

Today’s ramp is even more bizarre because it takes place as bonds are also bid…

… while the 20s30s Treasury inversion is getting worse by the day suggesting the at least the long end is starting to price in a recession.

So yes, it was one of those days when stocks jumping while Treasuries also ended higher with the yield curve flatter after erasing declines that lifted yields at the short end more than 6bp during U.S. morning. The 5s30s curve briefly reached flattest level since March 2020.

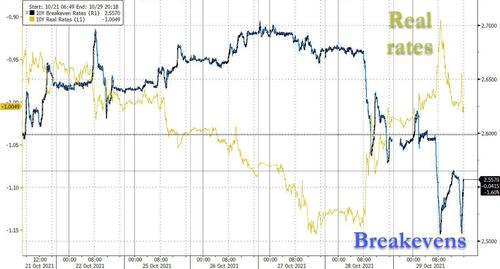

And just to make the day especially confusing, the recent trend in rising breakevens broke with a bang, as 10Y BEs slumped while real rates jumped in the past two days, sparking much confusion as to the cause.

Elsewhere, the dollar roared by the most in a month, while the euro slipped on Friday, capping a third straight month of losses, despite yesterday’s freak spike following Lagarde’s verbal mistake.

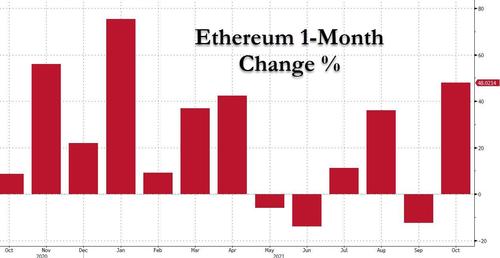

But while it was a good month for stocks, it was a stellar month for cryptos..

… and especially ether, which soared by a whopping 48%, the second best month of the year after January’s 75% gain.

Tyler Durden

Fri, 10/29/2021 – 16:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com