Who’s Hiring And Who’s Firing In October: Strength All Around Except Government Teachers

Besides the strong headline print today of 531K, which came above 10 of the 75 forecasts in the Bloomberg economist survey, the other notable highlight was the dramatic prior month revisions which saw the Sept print revised from 194K to 312K, while August rose from 366K to 483K resulting in a combined 235,000 upward revision for the two prior months. This shouldn’t come as a surprise: last month, when looking at the dismal 194K (pre-revision) September print, we said that “next month the BLS will revise its seasonal adjustment model to account for the easing in the pandemic, and reverse much if not all of this report’s drop. And if it doesn’t, it means that even more jobs will come on line in October and November.”

That’s precisely what happened, and not only was September revised more than 50% higher, but October indeed came in solidly above consensus; and if one looks at the not seasonally adjusted payrolls last month, the gain was even more impressive – a whopping 1.56 million, which was more than the prior three months combined! As Bloomberg notes, “in terms of actual people actually heading to work, that’s a whole lot more than we had in summer.”

Drilling down into the headline jobs print, we find several notable highlights:

- First, the number of private payrolls, at +604K, was even stronger and far above the 420K estimate. Of note here, leisure and hospitality hiring is still looking slower than before the delta wave although it is picking up a bit, at +164,000 in October. August and September were also revised up a bit to +71,000 and +88,000, respectively.Recall that the original August jobs report showed 0 gains for the sector. In September, another 74,000 jobs were added, and it has since been revised to +88,000. Looking at the components, the biggest source of growth was old faithful “food services and drinking places”, i.e., waiters and bartenders, which added 119,000 jobs in October.

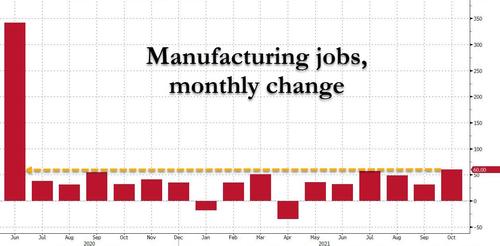

- Second, the renaissance in US manufacturing continues apace, and in October the US added a solid 60K mfg jobs, double the expected 30K, and the biggest monthly increase since last June’s outlier +342K surge.

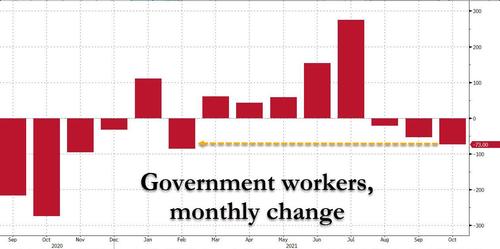

- Second, the single biggest detractor to the otherwise solid jobs report was the striking continued drop in government workers, which tumbled by 73K, the third consecutive drop in this series, and the biggest decline since February (but only after September was revised higher to -53K from -133K). As in September, the biggest driver here was a decline in local government education (-43.4K) and state government education (-21.5K). As the BLS notes, “employment changes in public and private education are challenging to interpret, as pandemic-related staffing fluctuations have distorted the normal seasonal hiring and layoff patterns.”

Here another reminder: last month’s pre-revision drop of -133K was entirely due to a 144K loss in government education jobs. Commenting on the plunge in local government teachers, the BLS last month said that “hiring this September was lower than usual, resulting in a decline after seasonal adjustment. Recent employment changes are challenging to interpret, as pandemic- related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns.”

As we said at the time, “wat this likely means is that next month the BLS will revise its seasonal adjustment model to account for the easing in the pandemic, and reverse much if not all of this report’s drop.” We saw precisely this take place in October.

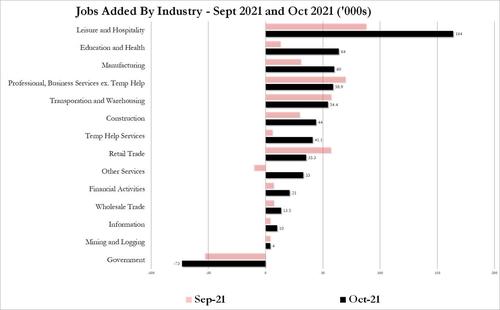

With these caveats in mind, here is who was hiring and firing in October:

- Employment in leisure and hospitality increased by 164,000 in October and has risen by 2.4 million thus far in 2021. Over the month, employment rose by 119,000 in food services and drinking places and by 23,000 in accommodation. Employment in leisure and hospitality is down by 1.4 million, or 8.2 percent, since February 2020.

- Professional and business services added 100,000 jobs in October, including a gain of 41,000 in temporary help services. Employment continued to rise in management and technical consulting services (+14,000), other professional and technical services (+9,000), scientific research and development services (+6,000), and legal services (+5,000). Employment in professional and business services is 215,000 below its level in February 2020.

- Employment in manufacturing increased by 60,000 in October, led by a gain in motor vehicles and parts (+28,000). Employment also rose in fabricated metal products (+6,000), chemicals (+6,000), and printing and related support activities (+4,000). Manufacturing employment is down by 270,000 since February 2020.

- Employment in transportation and warehousing increased by 54,000 in October and is 149,000 above its February 2020 level. In October, job gains occurred in warehousing and storage (+20,000), transit and ground passenger transportation (+16,000), air transportation (+9,000), and truck transportation (+8,000). Employment in couriers and messengers decreased by 5,000 in October, after increasing in the prior 3 months.

- Construction employment rose by 44,000 in October, following an increase of 30,000 in September. In October, employment increased in nonresidential specialty trade contractors (+19,000) and in heavy and civil engineering construction (+12,000). Construction employment is 150,000 below its February 2020 level.

- Health care added 37,000 jobs in October, with most of the gain occurring in home health care services (+16,000) and nursing care facilities (+12,000). Employment in health care is down by 460,000 since February 2020.

- In October, employment in retail trade rose by 35,000. Employment gains occurred in food and beverage stores (+16,000), general merchandise stores (+15,000), health and personal care stores (+8,000), and electronics and appliance stores (+6,000). These gains were partially offset by a job loss in building material and garden supply stores (-10,000). Retail trade employment is 140,000 lower than its level in February 2020.

- Employment in the other services industry increased by 33,000 in October, as personal and laundry services added 28,000 jobs. Employment in other services is 169,000 below its February 2020 level.

- Employment in financial activities rose by 21,000 in October and has returned to its February 2020 level. Over the month, job growth occurred in real estate and rental and leasing (+12,000) and in securities, commodity contracts, and investments (+11,000).

- Employment in wholesale trade increased by 14,000 in October, reflecting a gain in the durable goods component. Employment in wholesale trade is 158,000 lower than in February 2020.

- Mining employment continued to trend up in October (+5,000) but is down by 87,000 from a peak in January 2019.

And visually

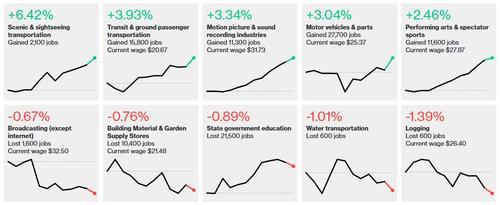

Finally, courtesy of Bloomberg, here are the industries with the highest and lowest rates of employment growth for the most recent month.

Tyler Durden

Fri, 11/05/2021 – 10:27![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com