Morgan Stanley Releases 2022 Outlook, Sees S&P Closing 6% Lower At 4,400

Back in August, Wall Street’s biggest sellside bear, Morgan Stanley chief US equity strategist Mike Wilson, reluctantly and grudgingly lifted his year-end S&P price target from 3,800 – tied for lowest at the time to… 3,900 but not before telling his clients how he really felt about the added boost of optimism – “on net, the risk reward skew looks poor to us at the index level.” Well, three months later, and not only was the risk reward skew poor – but to the upside, with the S&P trading just shy of all time highs and some 800 points higher than Wilson’s target (granted there are still 32 trading days left in the year so everything can happen)…

… but it’s time for Morgan Stanley to issue its 2022 full year forecasts. And, as those who have been following his recent weekly notes can already predict, there is no capitulation from Morgan Stanley’s chief equity strategist, who remains just as bearish for 2022 as he was for 2021.

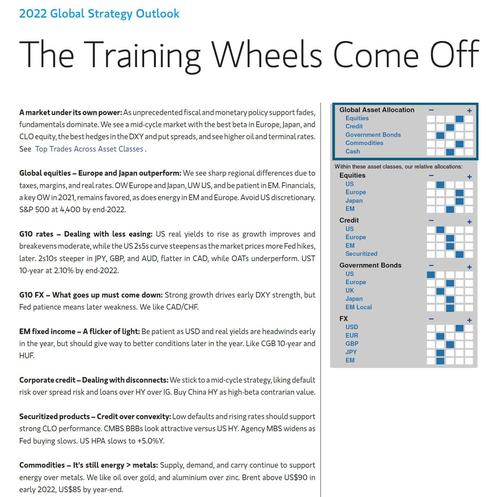

As part of Morgan Stanley’s broader global strategy outlook for 2022, which is titled “The Training Wheels Come Off”, and which we summarized yesterday courtesy of the report’s organizer Andrew Sheets, the bank writes that “Growth improves and inflation moderates, but central bank buying slows and rates rise. Own equities in Europe and Japan, securitized credit, and CAD/CHF, and resist buying Treasuries, US stocks, and EM assets until more is in the price.”

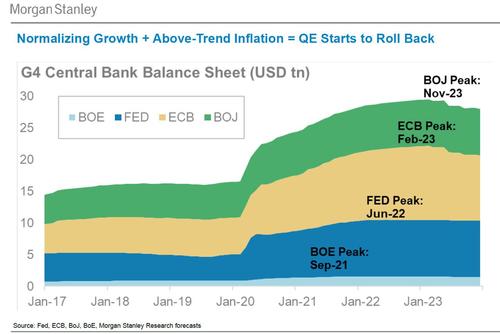

It is the italicized text that matters most, because the coming end of central bank generosity means all major central bank balance sheets peak in the coming 1-2 years (at least until they reverse and resume QE)…

… which coupled with high valuations, that has prompted Morgan Stanley to urge clients to stay away from U.S. stocks and bonds next year even as growth (supposedly) improves and inflation moderates, while seeking better returns in Europe and Japan where central bankers will be more patient and inflationary pressures are lower, according to the strategists in their annual investment outlook.

This is how Morgan Stanley’s Chief Cross-Asset Strategist summarizes where markets now stand:

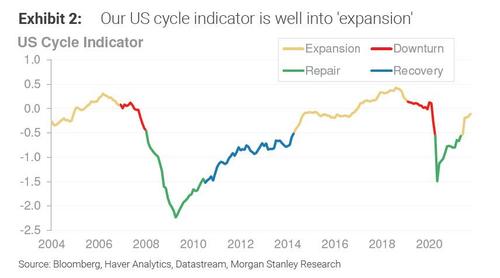

‘Normal’ is the last word any of us would use to describe the last few years, but our core thesis remains that markets are following many ‘normal’ cycle-based patterns at an accelerated pace. In mid-2019, inflation was above-trend, the yield curve inverted, and our cycle model entered ‘downturn’. In early 2020, activity collapsed and then ‘early cycle’ investment strategies led a blistering recovery. In early 2021, this early-cycle leadership stalled, and gave way to a mid-cycle transition.

For 2022, we think that this ‘hotter and faster’ recovery continues, powered by strength in consumer spending and capital investment. We are above-consensus on 2022 growth in the US, Europe, and China, and see the US unemployment rate falling all the way to 3.6% by the end of 2022.

Good growth and moderating inflation would seem like another version of ‘Goldilocks’, and for some assets we think that the backdrop does look benign. But we think that 2022 is really about ‘mid-to-late cycle’ challenges: better growth squaring off against high valuations, tightening policy, rambunctious investor activity, and inflation being higher than most investors are used to.

Navigating these will be about finding an alignment of risk premiums and fundamentals. We think that this exists in Europe and Japan equities, loans and junior securitized tranches, oil and US equity volatility, and the US and Canadian dollars. At the same time, we see plenty of challenges, including downside to the S&P 500 and US 10-year yields being well above forwards, and think that it is too early to turn bullish on EM assets.

With that big picture in mind, we shift to equities where Mike Wilson picks up the baton to tell clients clients that going into 2022 he is Underweight US stocks due to “slower EPS growth and higher starting valuations versus global peers leave us underweight the S&P.” And yes, the bank’s year-end 4400 price target (about 500 points higher than its 2021 year-end PT) implies 5% downside potential.

Having predicted downside in the US, Wilson then turns optimistic on Europe and Japan where he sees risk/reward more appealing:

“We are overweight Europe and Japan (8% and 12% upside potential, respectively), where we see the best EPS growth for 2022 and where valuations have already reset to more attractive levels. We remain neutral on EM and China for now.”

His recommendation: since the potential for sector and style dispersion feels more limited than usual, Wilson is “overweight financials across all regions and positive on energy in Europe and EM. Consumer discretionary is a high-conviction underweight in the US.”

Taking a closer look at equities, it will not be a surprise to anyone who has followed Wilson’s thoughts in recent weeks why he has been especially bearish on stocks. He carried that pessimism into his year-ahead forecast, writing that he expects more volatile equity markets in 2022:

At face value our global macro forecasts suggest a continued benign backdrop for equities in 2022 with strong nominal (and real) GDP growth, moderating inflation through the year and no rate hikes from any of the G3 central banks. However, underneath the surface we think there are a number of reasons to suggest that global equities’ serene progress over the last 18 months will become somewhat more volatile going forward as earnings growth slows, bond yields rise, and corporates continue to juggle the challenges of disrupted supply chains and elevated input costs. We think that these issues weigh most heavily on the US equity market but are more optimistic elsewhere, especially in Europe and Japan, where our risk/reward frameworks still look quite appealing.

Wilson next details why he is cautious on US equities versus global peers. There are three main reasons:

-

1) Greater EPS uncertainty in the US… The persistent price outperformance of MSCI USA versus MSCI ACWI for much of the last decade has been driven by superior and more durable EPS trends. While our US equity strategists see solid EPS growth in 2022, uncertainty around that expectation goes up materially given cost pressures, supply issues, and tax/policy uncertainty that is unique to the US. The recovery in rest of world EPS has lagged the US so far and hence offers (1) more ‘catch-up’ potential and (2) less earnings volatility over the next 12 months.

-

2) …against a backdrop of a record US P/E premium… It is natural for P/E ratios to de-rate as we progress through the initial phase of the earnings recovery and towards a more mid-cycle environment. While this has happened to a reasonable degree for non-US equities, Exhibit 18 shows that the S&P de-rating remains modest so far, with the current N12M P/E of 21 still close to a 20-year high. Consequently, US equities currently trade at a record valuation premium to global peers.

-

3) …and the prospect of higher bond yields that tend to favor Europe and Japan: This record valuation premium also exists at a time when bond yields look set to rise further, a situation that has typically favored the likes of Europe and Japan more than the US or EM. In particular, the US’s high exposure to growth stocks means that its relative performance has been inversely correlated to real bond yields in recent years – our bond strategists expect the latter to increase materially through 2022

While US equity underperformance has indeed been rare post-GFC, the secular backdrop may be shifting: Wilson predicts that while a decade of strong and steady outperformance from US stocks may have made the potential for sizeable underperformance versus global peers unlikely, the strategist warns that “it is worth noting that such occurrences were not so uncommon before the GFC, as shown in Exhibit 23 .

In effect, US equities have been large relative beneficiaries of the secular stagnation environment of the last cycle, “but a shift towards stronger nominal growth in this new cycle (which would be consistent with higher real yields) makes a return to pre-GFC performance patterns more plausible.”

Curiously, Morgan Stanley’s equity strategist is bearish on stocks even as the bank’s rates strategists are surprisingly dovish, and don’t see the Fed hiking until 2023, well beyond when the market is pricing in the first two rate hikes in (2022), an outlook that coincides with that of Morgan Stanley CEO, James Gorman, himself who is far more hawkish. it is these rate hike delays that will eventually lead to dollar weakness after a period of strength at the beginning of next year, according to the note.

Outside of developed markets, Sheets’ team urged patience, suggesting investors wait until the greenback weakens before considering emerging market stocks and bonds. In currencies, they favor the Canadian dollar and Norwegian krone and expect a largely stable yuan.

On the commodity front, the bank prefers oil to gold and suggested metal prices face a challenging outlook. Here is a bigger picture snapshot of what the bank expects across various asset classes:

We will cover the bank’s outlook on other key assets – and its top preferred trades – in a subsequent note. However, those who wish to read the full 64 page report, it is available to professional subs in the usual place.

Tyler Durden

Mon, 11/15/2021 – 12:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com