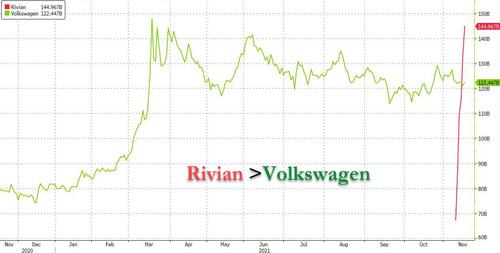

Rivian Soars, Surpassing Volkswagen Market Cap

Having surged every single day since going public last Wednesday at a price of $78/share, moments ago electric-car maker Rivian surged as much as 12%, rising to a high of $169.7, more than double its IPO price less than a week ago, and pushing its market cap north of $146 billion surpassing Germany’s auto-giant Volkswagen, which in 2020 delivered around 9.3 million cars.

Rivian remains the second most valuable U.S. automaker after Tesla Inc whose share price surges and tumbles on a daily basis but was recently worth around $1 trillion. Despite just having started selling vehicles and having no revenue to report, Rivian ranked ahead of General Motors at $86.05 billion (last Wednesday GM CEO Mary Barra was quick to point to Rivian’s IPO saying it showed how undervalued her company is), Ford at $77.37 billion, and Lucid at $65.96 billion.

Similar to those car companies, Rivian has also had trouble ramping up production in Illinois as supply-chain constraints have hit automakers globally. Last July, the EV maker said COVID-19 and its impact on suppliers had delayed the launch of vehicles out of Illinois

Rivian’s IPO allowed the company to raise about $12 billion to fund growth, and that figure could rise to $13.7 billion if the full over-allotment of shares is exercised. This makes it the biggest U.S. IPO since Alibaba Group Holding Ltd went public in September 2014.

Wall Street’s biggest institutional investors, including T. Rowe Price and BlackRock are betting on Rivian to be the next big player in a sector dominated by Tesla Inc (TSLA.O) amid mounting pressure on automakers in China and Europe to eliminate vehicle emissions.

Amazon.com is Rivian’s largest shareholder with a 20% stake.

Rivian has been investing heavily to boost production, doubling down on its upscale all-electric R1T pickup truck launched in September. It plans to follow that with an SUV and delivery van, hitting some of the hottest segments in the market.

The Irvine, California-based company plans to build at least one million vehicles a year by the end of the decade, Scaringe said. It has a plant in Illinois, and has announced plans to open a second U.S. factory and eventually setting up production in China and Europe.

Founded in 2009 as Mainstream Motors by Scaringe, the company was renamed in 2011 as Rivian, a name derived from “Indian River” in Florida, a place Scaringe frequented in a rowboat as a youth. Scaringe will hold all outstanding Class B common shares after the IPO and get 10 votes per share, Rivian said in a filing.

Tyler Durden

Tue, 11/16/2021 – 10:02

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com