Macy’s, Kohl’s Soar On Blowout Earnings, Guidance As Americans Flood Department Stores

A year and a half after the big box retailers were left for dead, they can’t stop printing money, and this morning Kohl’s and Macy’s are soaring, the former up 9%…

… the latter up 13% at the start of trading…

… with Americans poised to splurge on steroids this crucial holiday season, an encouraging sign for department store chains that need a win after almost two years of coronavirus pandemic pain.

The reason behind the surge in the stock price: blowout results.

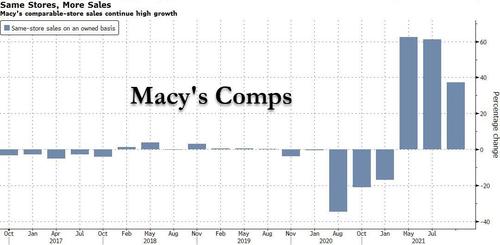

Macy’s posted stronger-than-expected results for the third quarter and raised its full-year earnings guidance, showing that consumer demand remains robust as the department-store chain enters the holidays. For Q3, M reported EPS of $1.23, trouncing expectations of 0.35 on revenue of $5.44BN, also above the $5.33BN expected. More importantly, gross margin rose from 35.6% to 41%, beating expectations of 39.8% and easing margin concerns raised by the likes of Target and Walmart earlier this week. Meanwhile, comparable sales at stores owned by the company soared 37.2%, also far above the 34.5% consensus estimate.

Finally, the company boosted its year sales forecast by more than the 3Q beat! The company now sees sales in a range of $24.1 billion to $24.3 billion for the year, and earnings of $4.57 to $4.76 a share. Previously it forecast a wider range of $23.55 billion to $23.95 billion, and $3.41 to $3.75 a share in profit.

Evercore ISI analyst Omar Saad said that “sales and margin inflection in 2Q clearly wasn’t a fluke, and accelerated further in 3Q.” He expects share momentum “to build” with stock “only up 12% on a 30% guidance raise.’ Sure enough, Macy’s CEO Jeff Gennette said in a statement that the company is continuing to “invest in positioning our company for long-term sustainable and profitable growth.”

Meanwhile, Kohl’s which was also up double digits, posted sales that beat Wall Street’s expectations. It reported Adj. EPS 1.65, also smashing expectations of 0.69, with revenue rising to 4.37bln, and beating consensus forecasts of 4.28bln as gross margin of 39.9% also beat expectations of 37.5%; Like Macy’s, Kohls also raised its FY21 financial outlook: executives now expect net sales to increase in a mid-20s percentage range as opposed to the previous projection of a low-20s range. It also increased its expected operating margin to as much as 8.5% this year, compared with the previous outlook of 7.6%.

The stellar earnings cemented the companies’ impressive outperformance in 2021: Macy’s has nearly tripled in value this year through Wednesday’s close and is at roughly double its pre-pandemic level. Kohl’s, up 39% this year through Wednesday, rose as much as 11% in premarket trading.

As Bloomberg notes, in addition to performing well despite supply-chain disruptions as flush consumers flock back to physical stores, Macy’s may be seeing a lift as it implements digital strategies that investors have sought for years. The company said it plans to launch a digital marketplace in the second half of next year, aiming to expand its product assortment and highlight third-party merchants.

That’s part of the company’s goal to generate $10 billion in sales by 2023, Macy’s said. Activist investor Jana Partners, which recently bought 1.5% of Macy’s outstanding stock, has said the department-store chain could boost its valuation by spinning off its e-commerce business.

Of course, none of this would be possible without a consumer who is spending far more than at any point in history, still flush with saved stimmies: and with consumer spending for the holidays seen reaching a record this year, the party is set to continue with department stores expecting to receive a decent chunk of it. The earnings reports are further confirmation, after similar figures this week from Walmart, Target and more, that shoppers are willing to spend at traditional stores this holiday season as they are no longer hindered by covid.

Still, these retailers aren’t out of the woods yet, because they must still contend with supply-chain logjams, consumers’ concerns about rising inflation, out-of-stock inventory and staffing shortages.

“Macy’s is bouncing back from a terrible 2020 and is, like many other retailers, taking advantage of very elevated levels of spending in the consumer economy,” Neil Saunders, managing director of GlobalData, said in a note. “None of this takes away from the positive numbers, but it places an important context around the reasons for recent success.”

Earlier this month, Macy’s said it would raise its hourly wage to $15 an hour and offer new education options. The Washington Post reported Wednesday that the company is asking corporate employees to volunteer for shifts in its stores.

Tyler Durden

Thu, 11/18/2021 – 10:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com