Euro Area Inflation Smashes Expectations, Soars To Record High Ahead Of Critical ECB Meeting

Now that even Fed Chair Powell admits that inflation is no longer “transitory”, it’s suddenly safe to report inflation for how high it truly is, and as a result earlier today the Euro area was not at all ashamed to report that inflation in the old continent surged to a record for the common currency era and exceeded all 40 forecasts, adding to the ECB’s challenge before a crucial meeting next month on the future of Europe’s money printing and negative rates.

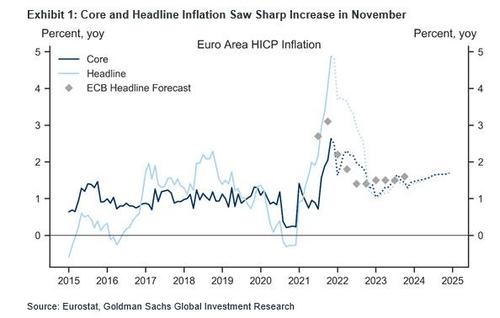

In today’s flash inflation release for November, Euro area core HICP inflation rose 58bp to 2.63%yoy, sharply above consensus expectations of 2.3% and up from last month’s 2.05% to a new all time high. Meanwhile, headline HICP inflation soared 83bp to 4.88%Y/Y from 4.0%, also well above consensus expectations of a 4.50% print and also a new record high.

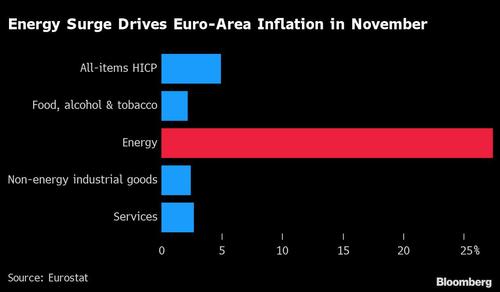

The breakdown by main expenditure categories showed that services inflation rose six-tenths of a point to 2.7%, and non-energy industrial goods inflation rose four-tenths of a point to 2.4%. Of the non-core components, energy inflation rose 3.7pp to 27.4%, while food, alcohol and tobacco inflation rose three-tenths of a point to 2.2%.

Commenting on the burst higher in prices, Bloomberg economist Maeva Cousin, said that “while energy costs and statistical effects can explain the bulk of this month’s jump, today’s reading also revealed some stronger than anticipated underlying pressure. That will add to concern over upside risks to the outlook, but the ECB is still likely to see inflation falling below 2% by the end of next year.”

Anticipating the spike in inflation this month, ECB officials had redoubled efforts in recent days to reassure citizens that they are facing a once-in-a-generation cost-of-living squeeze that won’t endure, driven by energy and a series of one-time factors.

While over in the US, Powell is finally admitting the truth that “transitory” inflation is dead, ECB President Christine Lagarde still hasn’t gotten the memo and is sticking to the “transitory” script, even as some colleagues are warning that price pressures might take longer to subside, stoking speculation about the future course of monetary policy. As such, at the ECB’s Dec. 16 meeting, the Governing Council is set to announce the end of its pandemic bond-buying plan and outline how regular purchases and interest rates will develop as the economy continues its recovery.

Updated projections for growth and inflation will guide the ECB’s decision. In September, forecasts showed inflation easing to 1.5% in 2023; expect that number to be much higher now, but just how high is uncertain after the sudden emergence of the omicron coronavirus strain, potentially more infectious than previously known variants, raised the risk of new restrictions.

Pressure for a quick exit is coming from Germany, where inflation hit a whopping 6% this month, the fastest since the early 1990s. Bundesbank President Jens Weidmann, who will step down at the end of the year, has already sounded the alarm, saying it’s possible the euro-area pace will remain above the ECB’s 2% target in the medium term.

His Spanish counterpart Pablo Hernandez de Cos is warning against a premature removal of support however even though data showed that Spanish inflation hit a stunning 5.6% – also the highest in nearly three decades; Despite this crushing blow to consumer wallets, he argued there’s no reason to rush to stop bond purchases given price pressures will ease “very significantly” in the second quarter. He too, appears to not have gotten the memo.

And with the market focusing on what Lagarde whether with or without the Omicron context, even before the new strain arrived, resurgent cases in recent weeks had already prompted the Netherlands and Germany to impose new curbs. Austria and Slovakia went into lockdown. If replicated elsewhere, such measures could weigh on output and amplify already unprecedented supply chain bottlenecks.

It’s probably why Goldman expects November to be the all time high, and looks for both core and headline European inflation to fall going forward as base effects and weight changes wash out.

Tyler Durden

Tue, 11/30/2021 – 13:12

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com