China Cuts RRR By 50bps; More Easing Expected

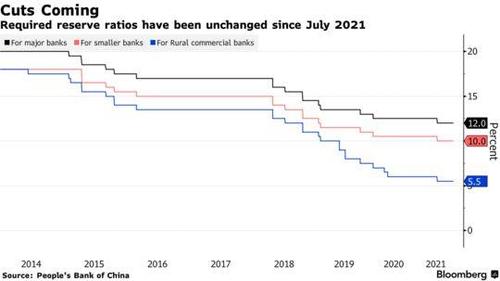

Just last night we predicted that China would cut its Required Reserve Ratio “Within A Week”, and not even six hours later, that’s precisely what happened when the PBOC announced that it would cut the amount of cash banks must hold in reserve, acting to counter the economic slowdown in a move that puts the central bank on a different policy path than many of its peers.

Specifically, the PBOC cut the RRR by 50bps effective 15th Dec. The move will release CNY 1.2 trillion in liquidity – some of this new money will be used by banks to repay maturing loans from the PBOC’s medium-term lending facility and some of it will be used to replenish financial institutions’ long-term capital, the central bank said. There are almost 1 trillion yuan worth of the 1-year loans maturing on Dec. 15, the day the cut takes effect.

“The aim of the RRR cut is to strengthen cross-cyclical adjustment, enhance the capital structure of financial institutions, raise financial services capabilities to better support the real economy,” the PBOC said. The cut will effectively increase long-term capital for banks to serve the real economy, and the PBOC will guide banks to step up their support for small businesses, it said.

The cut is a “regular monetary policy action,” the PBOC said, pre-empting expectations that the decision was the start of of an easing cycle, although that’s what the PBOC always says – the fact that it has again capitulated and has eased for the first time since July confirms that Beijing is now looking for excuses to cut, not the opposite, and with Evergrande set to default as soon as today, it will find them. “Prudent monetary policy direction has not changed,” it said, adding that the bank “will continue with a normal monetary policy, maintaining the stability, consistency and sustainability of policy, and won’t flood the economy with stimulus.”

Among other things, the PBOC:

- Reiterates that liquidity will be kept reasonably ample.

- Will step up cross cyclical adjustments.

- Will not resort to flood-like stimulus.

- Will reduce capital costs for financial institutions by around CNY 15bln per annum.

With the U.S. Federal Reserve and other global central banks looking to tighten policy, the move to add stimulus by the PBOC makes the divergence between China and much of the rest of the world even clearer.

A cut in the reserve ratio doesn’t directly lower borrowing costs, but quickly frees up cheap funds for banks to lend. The reduction will lower the capital cost for financial institutions by about 15 billion yuan each year, which will lower the overall financing cost of the economy, the PBOC said.

As noted last night, the RRR cut was telegraphed last week by Premier Li Keqiang when he said that authorities would cut the RRR at an appropriate time to help smaller companies, and is the second reduction this year. The decision comes after recent data showed the economy and industry stabilizing, although Beijing’s tightening curbs on the property market have led to a slump in construction and worsened a liquidity crisis at developer China Evergrande Group and other real-estate firms.

In immediate reaction to this RRR cut, modest upside was seen in the equity space with US futures rising to marginal fresh highs for the session and European counterparts erring higher as well but remaining within ranges. Amidst this the FX space saw some modest choppiness, though USD/CNH is within pre-release levels. Additionally, WTI Jan and Brent Feb futures respectively experienced upside, bringing them back to overnight highs of around USD 2.00/bbl.

While some said the development was neutral and underscores China’s lack of desire to pump the system with excess liquidity, after all the PBOC said it “will continue with a normal monetary policy, maintaining the stability, consistency and sustainability of policy, and won’t flood the economy with stimulus”, we disagree and believe this is the start of a move that will inject much more liquidity in China’s economy, especially now that coal prices are sliding and oil has plunged from its recent highs, keeping inflation in check.

Indeed, in their kneejerk responses to China’s easing, analysts said that China will need to cut banks’ reserve ratio further to boost risk assets, given its stance of fine-tuning monetary policy has already been somewhat priced in by the domestic financial markets.

Below, courtesy of Bloomberg, is a snapshot of what market participants said.

Shenzhen Flying Tiger Investment & Management (Yu Dingheng, managing director)

- “We are in the midst of a policy shift. If we consider this cut and the one in July — there should be more to follow as this is not yet enough to counter the downward pressure”

- “This is all within expectations” and the market had already reacted to it partially in today’s session

- The firm recently positioned for a move like this by picking up undervalued shares of companies in the property-related cohort

Bocom International (Hao Hong, head of research)

- “I expect more cuts, because the property situation is still unfolding and cutting interest rate is not practical given high inflation”

- RRR cut is the easiest and it is within the PBOC’s control, given it doesn’t need to be signed off by the State Council, China’s cabinet

- A cut at this point in time can boost liquidity just in case, even though the market doesn’t lack liquidity, and can also boost some confidence as the central bank shows “its willingness to support if the bottom falls out”

Standard Chartered (Becky Liu, head of China macro strategy)

- RRR cut may have been brought forward by concerns about potential China Evergrande contagion risks

- “This is still faster than the median forecast, as some were still looking for the cut to come in the coming several weeks or even in Q1”

- Slowdown in economic conditions point to more easing

- Announcing the cut will allow banks to lend more at the start of next year to boost credit growth and “hopefully start to be reflected in real economic activities by mid-2022”

Shenzhen Frontsea Asset Management (Hou Anyang, fund manager)

- “Market is still going to focus on the fact that help is needed in the flagging economy, rather than the fact that help has come”

- Market reflected a lot of the optimistic expectations today, and while this may be a policy shift rather than fine tuning, “we’ve not hit the bottom in terms of fundamentals yet”

Zhuhai Greenbamboo Private Fund Management (Jiang Liangqing, managing director)

- “It’s too early to call it shifting of gears, though it should be more than a marginal move considering the impending concerns over property”

- The RRR cut shows “that the higher-ups are paying close attention to the risks of the housing market, and making it a priority”

- Investors can be “a bit more optimistic” on the policy outlook next year, and the policy bottom for real estate has passed so we need only wait a few more months for fundamentals to bottom out”

Nanjing Securities (Hao Yang, analyst)

- China’s 10-year bond yields should stay in the 2.8%-2.9% range with limited boosts from the RRR cut as market waits to see whether the easing would be effective in offsetting growth headwinds

- The timing of the RRR cut is sooner than market expectation, “showing the PBOC’s strong will to ease concerns on property strains due to Evergrande contagion risks”

- The unleashed funds from RRR cut should help lowering funding costs for banks who are expected by regulators to step up credit supports for the real economy

Bloomberg (David Qu, economist)

- “We think the reduction would help offset the headwinds facing the economy, particularly in the first quarter of 2022.

- We maintain our view that an additional 50-100 basis points of RRR cut would come next year.”

Tyler Durden

Mon, 12/06/2021 – 07:24

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com