Futures Coiled Ahead Of Today’s Highly Anticipated Powell Announcement

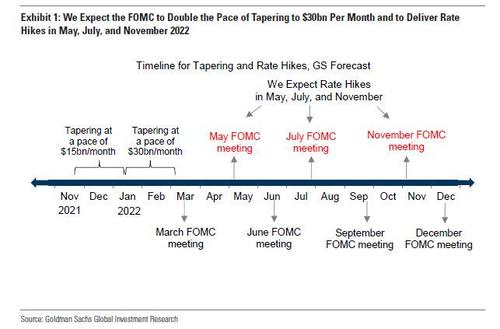

With the long-awaited Fed day finally here and Powell set to reveal the “turbo-taper” which doubles the pace of QE unwind to $30BN per month starting in January and ending by March, and to publish updated summary of economic projections, so the Fed can hike in April or May as Goldman laid out over the weekend…

… S&P futures were flat, Nasdaq futures dropped as traders braced for another dose of hawkishness on the pace of the withdrawal of stimulus measures and rate increases. Treasury yields and the dollar were little changed. Europe’s Stoxx 600 Index gained after five days of losses, Asian stocks were mixed with Nikkei closing slightly higher, the Hang Seng tumbled by as much as 2.2%, with Semiconductor Manufacturing among the biggest contributors to its decline, as the U.S. is said to be considering tougher sanctions on China’s biggest chipmaker.

Shares in U.S.-listed Chinese firms retreated in premarket trading after the Biden administration was said to be considering tougher sanctions on China’s largest chipmaker, SMIC. A pact between Trump Media & Technology Group and Rumble sent shares in Digital World Acquisition, a SPAC which has agreed to merge with TMGT, and CF Acquisition Corp. VI, which has agreed to merge with Rumble, soaring in U.S. premarket trading. Here are the biggest premarket movers:

- A pact between Trump Media & Technology Group and Rumble sent shares in Digital World Acquisition (DWAC US +5%), a SPAC which has agreed to merge with TMTG, and CF Acquisition Corp. VI (CFVI US +10%), which has agreed to merge with Rumble, soaring in premarket trading.

- U.S.-listed Chinese firms retreat in premarket trading after the Biden administration was said to be considering tougher sanctions on China’s largest chipmaker, SMIC. Alibaba (BABA US -2.3%), Baidu (BIDU US -1.9%).

- SeaChange International (SEAC US) shares rise 19% in premarket trading, following better-than-forecast third-quarter revenue in a report late Tuesday.

- The EU drug regulator’s human medicines committee concluded that a booster dose of Covid-19 Vaccine Janssen (JNJ US) may be considered at least two months after the first dose in people aged 18 years and above, according to statement.

- EBay (EBAY US) is resumed at neutral at JPMorgan, while broker upgrades Booking.com (BKNG US) to overweight from neutral, saying that it expects internet stocks to continue to see more varied stock performance and lower levels of growth in 2022.

- Albemarle Corp. (ALB US) is 4.4% lower in premarket trading after Goldman Sachs analyst Robert Koort cut the recommendation to sell from neutral.

Technology shares have been under persistent pressure, with the Nasdaq 100 down 2.6% this week, as hefty valuations face the threat of a likely tightening of monetary policy. Federal Reserve policy makers are poised to accelerate the removal of monetary stimulus on Wednesday as a step toward increasing interest rates in response to surging inflation.

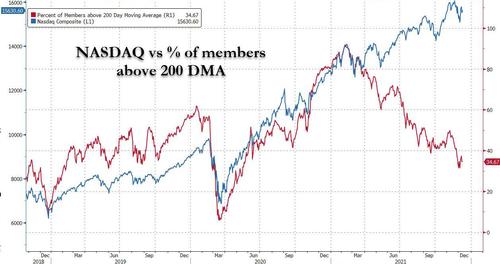

Then again, it could be worse, with the Nasdaq trading at just below its all time high despite just 40% of Nasdaq companies trading above their 200DMA.

“Belief is strong in the market and expectations of the Fed doubling the pace of its Fed purchases are having a ‘limited’ impact on Unicorns and the Nasdaq,” said Sebastien Galy, macro strategist at Nordea Funds.

Traders are looking to a wave of central bank decisions for clarity on the timing of a pullback, with the Fed decision due later on Wednesday, followed by the Bank of England and European Central Bank Thursday. As a reminder, the Fed monetary policy announcement is expected at 2pm ET, with Chair Powell news conference 30 minutes later. Policy makers are expected to double the pace of tapering to $30b a month, starting in January and ending by March, and to publish updated summary of economic projections, paving the way for the first interest-rate increases since 2018 as it pivots to restraining the hottest inflation in almost 40 years.

The mix of intense price pressures — U.S. producer-price inflation hit a record of almost 10%, while U.K. inflation surged to its highest level in more than a decade — diminishing central bank support and economic uncertainty around the omicron virus variant is testing markets.

“Even if other central banks opt for less hawkish communication this week, the Fed’s hawkish shift today will make it easier for its peers to follow suit,” ING Groep NV analysts led by Padhraic Garvey wrote in a note to investors. “The trend is resolutely towards higher rates globally.”

On the covid front, the omicron variant will likely be dominant in Europe by mid-January, European Commission President Ursula von der Leyen told the European Parliament on Wednesday, adding that the case numbers appear to be doubling every two or three days. Initial lab findings showed the vaccine made by Sinovac Biotech Ltd., one of the most widely used in the world, doesn’t provide sufficient antibodies in two doses to neutralize omicron and boosters will likely be needed to improve protection.

In Europe, the Stoxx 600 Index was 0.4% higher after posting its longest streak of daily losses since mid-March 2020. CAC outperforms. Tech, autos and chemicals are the best-performing sectors U.K. inflation surged to its highest level in more than a decade in November, exceeding 5% months before the Bank of England had expected.

Asian stocks were mixed ahead of a key Federal Reserve policy decision Wednesday, while renewed tensions between Beijing and Washington hammered Chinese stocks. The MSCI Asia Pacific Index was set to fall for a fourth day, dropping as much as 0.3%. Mainland Chinese equities edged lower after data showed the nation’s economy slowed further in November amid a housing market slump and weaker domestic consumption. Sentiment soured further in afternoon trade as fears of more investment and export sanctions by Washington sent shares of China’s biggest chipmaker and several large pharmaceutical firms tumbling, dragging down Hong Kong’s benchmark. Read: China Healthcare, Tech Stocks Tumble on U.S. Sanction Escalation “The U.S.-China tensions are structural in nature and therefore, going to persist,” said Ben Powell, chief APAC investment strategist at the BlackRock Investment Institute in an interview with Bloomberg TV. “But in 2022, we could see something of a lessening of tensions, for both sides — the U.S. and China — are so busy domestically.” The risk-off mood pervaded much of Asia’s markets while investors awaited greater clarity from the Fed on the removal of monetary stimulus. The prospect of faster-than-expected interest rate hikes also weighed on the technology sector. Japan led regional gains Wednesday as the yen remained weak against the dollar, boosting export-related shares

Indian stocks completed their longest string of losses in three weeks ahead of the U.S. Federal Reserve’s rate-setting meeting amid uncertainty over the severity of the omicron coronavirus variant. The S&P BSE Sensex fell for a fourth session, dropping 0.6% to 57,788.03 in Mumbai, while the NSE Nifty 50 Index declined by a similar magnitude. Infosys Ltd contributed the most to the decline in both indexes, decreasing 1%. Of 30 shares in the Sensex index, 10 rose and 20 fell. Seventeen of 19 sector indexes compiled by BSE Ltd. fell, led by a measure of realty companies. The Fed’s last meeting of this year is expected to pave the way for interest-rate hikes in 2022. Lower borrowing costs in the U.S. have helped drive flows to higher-yielding emerging markets like India

Australian stocks dropped the most in three weeks as miners slump. The S&P/ASX 200 index fell 0.7% to close at 7,327.10, marking its biggest plunge in about three weeks. Miners contributed the most to the benchmark’s decline. PointsBet was among the worst performers, declining for a third day in a row. Alumina was among the top performers after it was upgraded to overweight at JPMorgan. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,869.41

In rates, Treasuries are slightly cheaper across the curve, lagging a wider selloff in gilts following a higher-than-expected November U.K. CPI print which brought forward BOE rate-hike expectations. U.S. 10-year yields steady around 1.445% with U.K. 10-year yield higher by 3.6bp; U.S. 2-year yields are higher by 0.5bp vs 6bp for U.K. front-end yields. US activity has been sidelined so far ahead of Fed policy announcement, with the central bank expected to double the pace of its asset-purchase tapering. Tuesday saw a wave of activity in eurodollar options, hedging a more dovish policy path than current expectations; overnight index swaps are pricing in around 29bp of rate hikes for the June meeting and 55bp by November next year

In FX, the Bloomberg Dollar Spot Index fell very gradually throughout the Asian and European sessions and the greenback weakened against most of its Group-of-10 peers, with the Australian dollar and some other risk-sensitive currencies leading gains. Treasury and euro-area sovereign bond yields were largely steady. The pound rose to the highest level against the dollar in a week and gilt yields rose by up to 5bps led by the front end, as markets bolstered bets on Bank of England rate hikes after data showed U.K. inflation topped 5% in November, the highest level in more than a decade. Traders are pricing in seven basis points of hikes for tomorrow’s BOE rate decision, from around five basis points on Tuesday. New Zealand’s bonds rallied after the government said it’ll sell NZ$31 billion less bonds over the next four years, as the economy recovers from the pandemic and there’s less need for stimulus. The yen traded in a narrow range as investors stayed on the sidelines ahead of the Fed’s policy review. Bonds were mostly steady.

In commodities, crude futures are in the red but off worst levels. WTI is down ~0.8% but regains a $70-handle; Brent drifts back above $73. Oil fell for a third day as further restrictions were imposed to counter the spread of omicron, while the outlook for demand in China dimmed and the International Energy Agency said the global market had already returned to surplus. European natural gas gained on Wednesday but there are signs that the rally that has sent prices surging 23% this week is starting to slow. Spot gold find support near Tuesday’s lows, recovering near $1,770/oz. Base metals are under pressure; LME zinc drops over 2%, underperforming peers.

Looking at the day ahead, the main highlight will be the aforementioned decision from the Fed tonight and Chair Powell’s subsequent press conference. We’ll also hear from Bank of Canada Governor Macklem and get CPI data for November from both the UK and Canada. In addition, data releases from the US include retail sales for November, the Empire State manufacturing survey for December and the NAHB’s housing market index for December.

Market Snapshot

- S&P 500 futures little changed at 4,635.25

- STOXX Europe 600 up 0.4% to 471.26

- MXAP down 0.1% to 191.94

- MXAPJ down 0.5% to 621.81

- Nikkei little changed at 28,459.72

- Topix up 0.5% to 1,984.10

- Hang Seng Index down 0.9% to 23,420.76

- Shanghai Composite down 0.4% to 3,647.63

- Sensex down 0.4% to 57,864.45

- Australia S&P/ASX 200 down 0.7% to 7,327.08

- Kospi little changed at 2,989.39

- Brent Futures down 0.9% to $73.05/bbl

- Gold spot down 0.1% to $1,770.76

- U.S. Dollar Index down 0.13% to 96.44

- German 10Y yield little changed at -0.38%

- Euro up 0.1% to $1.1273

Top Overnight News from Bloomberg

- The upcoming monetary policy decisions by the Federal Reserve and the European Central Bank could shape the trading bias for 1Q 2022, and traders are taking no chances. Overnight volatility in euro-dollar advanced by more than 10 vols to 17.15%, highest since Nov. 4 2020, when the U.S elections were in focus

- Federal Reserve policy makers are poised to accelerate their removal of monetary stimulus as a step toward the first interest-rate increases since 2018 as they pivot to restraining the hottest inflation in almost 40 years

- The European Central Bank’s new projections show inflation below the 2% target in both 2023 and 2024, according to officials familiar with the matter, giving President Christine Lagarde ammunition to argue against a swift increase in interest rates

- The omicron variant will likely be dominant in Europe by mid-January, European Commission President Ursula von der Leyen said Wednesday, adding that the case numbers appear to be doubling every two or three days

- The vaccine made by Sinovac Biotech Ltd., one of the most widely used in the world, doesn’t provide sufficient antibodies in two doses to neutralize the omicron variant and boosters will likely be needed to improve protection, initial lab findings showed

- China’s economy took a knock last month from an ongoing property market slump and sporadic Covid outbreaks, prompting economists to warn that recent easing measures may not be enough to stabilize growth

- U.K. inflation surged to its highest in more than a decade in November, exceeding 5% months before the Bank of England expected. The soaring costs and staffing shortages plaguing the U.K.’s food-supply chain show little sign of ebbing next year

- The Swiss National Bank could transfer some of its foreign exchange holdings to create a sovereign wealth fund in exchange for franc-denominated bonds, according to a proposal by a trio of leading economists

- New Zealand Finance Minister Grant Robertson expressed confidence in central bank Governor Adrian Orr after a number of senior officials announced they are leaving the bank

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets were mixed with price action rangebound as participants remained cautious following the losses in US where a hot PPI report further supported the case for the Fed to speed up its tapering heading into today’s FOMC meeting and with participants in the Asia-Pac region also digesting mixed Chinese activity data. ASX 200 (-0.7%) was led lower by tech after similar underperformance of the sector stateside and as weak Westpac Consumer Sentiment data and a continued surge in domestic COVID-19 cases also contributed to the uninspired mood. Nikkei 225 (+0.1%) was steady with price action contained by resistance around the 28.5k level and amid the lack of direction in the domestic currency, although Toyota shares were among the top performers after its recent commitment to spend trillions of Yen to boost its electrification. Hang Seng (-0.9%) and Shanghai Comp. (-0.4%) were choppy amid several opposing forces including mixed data in which Industrial Production topped estimates but Retail Sales disappointed and with the PBoC’s previously announced 50bps RRR cut taking effect. The PBoC also announced to inject CNY 500bln via a 1-year MLF operation and Chinese press noted that China may lower Loan Prime Rates ahead of the holiday season, although the central bank’s decision to maintain the 1-year MLF rate suggested a reduction in the benchmark LPR next week was unlikely. Furthermore, US-China frictions lingered after the House passed the Uyghur bill which targets China and the White House also noted that China must be held accountable for genocide, while it was also reported that President Biden’s team is considering imposing harsher sanctions on China’s largest chipmaker SMIC. Finally, 10yr JGBs were kept afloat above the psychological 152.00 level amid the BoJ’s presence in the market for more than JPY 1.3tln of JGBs under its regular Rinban operations and with the central bank also conducting a 3rd consecutive injection via repurchase agreements, although upside was limited as markets brace for a potential faster Fed taper.

Top Asian News

- Putin, Xi Stand Together as U.S., EU Worry About Ukraine Threat

- China Hikes Copper Blister Export Tariff, Cuts Some Import Rates

- China Power Giants Call Wind Commandos to Hit Subsidy Cutoff

- BNPL Firm Net Protections Slips on Tokyo Trading Debut

The equities complex remains mixed in Europe (Euro Stoxx 50 +0.4%; Stoxx 600 +0.4%), but the mood has tilted more towards a cautious one as the clock ticks down to the FOMC policy announcement. The focus of the announcement will be on the pace of the tapering process, with the Fed is widely expected to double the pace of its asset purchase unwind to USD 30bln/mth, taking asset purchases from USD 90bln in December to USD 60bln in January, then to a final 30bln in February, for them to conclude mid-March (full preview available in the Newsquawk Research Suite). US equity futures have seen downticks in early hours with the NQ (-0.1%) narrowly lagging the RTY (+0.1%), ES (+0.1%) and YM (-0.1%). Back to Europe, exporters in the FTSE 100 (-0.4%) are pressured by the inflation-induced gains in the Sterling, whilst the sector configuration is also unfavourable for the UK benchmark with Oil & Gas and Basic Resources towards the bottom of the bunch. Spain’s IBEX (-0.6%) is the regional underperformer with heavyweight Inditex (-3.0%) slumping at the open but rebounding off worst levels as sales hit records, but nonetheless weighing on the broader Retail sector. The upside meanwhile sees Tech – following its recent underperformance, Healthcare, Autos and Personal & Household Goods. In terms of individual movers, Cineworld (-27%) plumbed the depths after a Canadian judge ruled Cineworld must pay USD 965mln in damages to Cineplex after the former backed out of takeover talks amid the pandemic. Cineworld said it will appeal the decision. Sanofi (+0.2%) and GlaxoSmithKline (-0.3%) announced positive prelim. Phase 3 booster data for their COVID-19 vaccine; Omicron variant was not in circulation during the trial. H&M (-3.2%) is pressured after Q4 revenue missed forecasts. Finally, UK electronics retailer Currys (-11%) saw pressure after highlighting a softer market in the Christmas run-up.

Top European News

- Omicron to Become Dominant in Europe by Mid-January, EU Warns

- U.K. Food Costs Set to Keep Climbing After Festive Season

- UBS Said to Plan Shutting Its Global Banking Office in India

- Fortress Buys Punch Pubs & Co. From Patron; No Terms

In FX, the Buck extended yesterday’s post-US PPI gains with added momentum from safe-haven demand as Wall Street wobbled on renewed Omicron-related jitters, but has drifted back down in what looks like typical pre-FOMC cautious and consolidative trade. However, the index remains within a firmer range around 96.500 compared to recent extremes either side of 96.000 in anticipation of faster Fed tapering and a more hawkish tightening path portrayed by new dot plots, at the very least. More immediately, NY Fed manufacturing and retail sales provide distractions or fillers before the main event. Notwithstanding the Greenback’s firm underlying bid (DXY holding between 96.405-96.569), the Pound and Aussie are both outperforming and vying for top spot among majors, with the former boosted by hot UK inflation prints as headline CPI smashed consensus and the BoE’s MPR forecast to revive rate hike bets for the MPC on Thursday. Cable is just shy of new w-t-d highs circa 1.3283 and Eur/Gbp is pivoting 0.8500, while Aud/Usd looks more comfortable on the 0.7100 handle as the Aud/Nzd cross rebounds from sub-1.0550 lows with some traction from better than expected Chinese ip rather than a retail sales miss or dip in Westpac consumer sentiment.

- EUR/NZD/JPY/CAD/CHF – Very familiar terrain for the Euro, Kiwi, Yen, Loonie and Franc in relation to their US rival, as Eur/Usd meanders from around 1.1280 to 1.1254 and well above decent option expiry interest at the 1.1200 strike (1 bn). Meanwhile, Nzd/Usd is still straddling 0.6750 amidst mixed NZ fiscal impetus via bigger than anticipated Q3 current account deficits, but a bullish HYEFU based on stronger tax revenue than previously envisaged. Elsewhere, Usd/Jpy has moved up from the 113.50 mark that has been a focus, but could be hampered by a clutch of option expiries spanning 113.75-114.20 totalling 3.7 bn, Usd/Cad is now above 1.2850 awaiting Canadian CPI and manufacturing sales in hope of some protection from further weakness in WTI (down to Usd 69.58/brl at one stage) and Usd/Chf is hovering within a 0.9250-24 band alongside Eur/Chf in a 1.0400-26 range on the eve of the SNB.

- SCANDI/EM – The Sek and Nok are both churning inside Tuesday’s extremes against the Eur with little reaction to steady Swedish money market expectations on balance or a narrower Norwegian trade surplus, but the Try is succumbing to more selling pressure ahead of the CBRT tomorrow and Zar looks significantly less relieved with the Omicron situation following the latest WHO assessment. In short, the global body says prelim evidence suggests that there may be a reduction in vaccine efficacy and effectiveness against Omicron, alongside a greater risk of reinfection, though more data is needed.

In commodities, WTI and Brent front-month futures posted initially modest losses with the contracts on either side of USD 70/bbl and USD 73/bbl respectively; however, as the session has progressed and we near the arrival of US participants this has dipped further to circa USD 69.50/bbl and USD 72.50/bbl respectively. Complex-specific news flow has remained light and thus the crude markets have derived impetus from the cautious mood seen across markets. In terms of an Omicron update, and in-fitting with the South African study yesterday, WHO’s preliminary evidence suggests that there may be a reduction in vaccine efficacy and effectiveness against Omicron, alongside a greater risk of reinfection – but more data is needed on Omicron. In terms of geopolitics, European leaders are meeting to discuss the Russian situation, with the European Commission earlier reiterating the threat of stricter sanctions in the face of Russian aggression. Meanwhile, Iranian nuclear talks are showing little progress, with the prospect of a legal return of Iranian barrels to the market diminishing, albeit Iran has achieved an agreement with the IAEA to assist in addressing nuclear concerns. Elsewhere, spot gold and silver are trading sideways with the former still within recent ranges around USD 1,770/oz (vs high USD 1,774/oz), with the yellow still above a support zone touted to be around USD 1,760-65/oz. Meanwhile, copper prices are under pressure with the LME contact testing USD 9,250/t to the downside. Overnight, Chinese steel saw modest gains after gaining momentum from the Chinese industrial production data.

US Event Calendar

- 8:30am: Nov. Import Price Index YoY, est. 11.4%, prior 10.7%; Import Price Index MoM, est. 0.6%, prior 1.2%

- 8:30am: Nov. Export Price Index YoY, prior 18.0%; Export Price Index MoM, est. 0.5%, prior 1.5%

- 8:30am: Nov. Retail Sales Advance MoM, est. 0.8%, prior 1.7%

- 8:30am: Nov. Retail Sales Ex Auto MoM, est. 0.9%, prior 1.7%

- 8:30am: Nov. Retail Sales Control Group, est. 0.7%, prior 1.6%

- 8:30am: Dec. Empire Manufacturing, est. 25.0, prior 30.9

- 10am: Oct. Business Inventories, est. 1.1%, prior 0.7%

- 10am: Dec. NAHB Housing Market Index, est. 84, prior 83

- 2pm: Dec. FOMC Rate Decision

- 4pm: Oct. Total Net TIC Flows, prior – $26.8b

DB’s Jim Reid concludes the overnight wrap

I’m booked in to get my booster this morning. My wife had hers on Sunday and she’s suffering with a dead arm and flu-like symptoms still. The UK has gone booster crazy with queues of several hours reported across many walk-in centres. My wife got boosted as soon as she could as she wanted to minimise the risk of having to self isolate over Christmas and miss all the family stuff. I’m getting boosted as soon as I can to minimise the risk of missing a golf tournament this weekend. Having said that my current injury list is as follows; 1) recovering left knee from recent big operation; 2) new intermittent stabbing pain in right knee over the last week after re-starting squats and lunges – need to go for a scan; 3) bad back – injection two weeks ago hasn’t done much good; and 4) a compressed nerve in my shoulder (painful) which has come back again after doing weights three weeks ago – I’ve been seeing a physio. The likely dead arm after today’s booster might help distract me from the above.

With just 10 days to Christmas now, I’ve asked Santa for a new body but markets will be asking for better virus news-flow and a relatively sanguine week of central banks meetings. Up first are the Fed at 19:00 tonight London time, who are gathering amidst mounting inflationary pressures, with last month’s CPI print of +6.8% being the fastest since 1982. Yesterday’s PPI release only added to that drumbeat, with a stronger-than-expected +9.6% jump in producer prices over the last year (vs. +9.2% expected). And on top of that there’s been a further tightening of the labour market in recent weeks, with unemployment down to a post-pandemic low of 4.2%, the quits rate hovering around a record high, and the weekly initial jobless claims last week at a half-century low.

At their last meeting in November, the Fed announced they would start to taper their asset purchases, but there’s strong anticipation that just 6 weeks later they’ll be accelerating that pace today. Indeed, Fed Chair Powell explicitly alluded to this in his recent congressional testimony, saying that “it is appropriate to consider wrapping up a few months sooner.” In their preview (link here), our US economists expect that the Fed will be announcing a doubling in the tapering pace, which would bring the monthly drawdown for Treasuries and MBS to $20bn and $10bn respectively. That would end the process in March and give them greater optionality for an earlier liftoff, which Fed funds futures are currently pricing in for June, although investors are also pricing in a decent 76% chance of one as early as the May meeting. Bear in mind though that even as the Fed have started to taper purchases, so long as the purchases are still happening they’re actually easing policy rather than tightening, albeit at a slower rate. Given CPI is almost at 7% it’ll be fascinating to see what future economic historians have to say about this.

On top of the policy decision, we’re also set to get a fresh set of dots from the FOMC, along with a new round of economic projections. Last month, only half of the dots saw any hikes in 2022, but this time around our economists anticipate the median dot having two hikes next year, with the risk of more. It’ll also be important to look at their updated inflation forecasts, and how they see that evolving into 2022 and 2023. As it happens, the FOMC have upgraded their median projections for inflation in 2021 and 2022 in every round of inflation forecasts over the last year, and our economists expect this pattern to continue today, with the PCE inflation projection for 2021 up to +5.2%, and the 2022 projection at +2.3%.

With all that to look forward to, the risk-off tone continued in markets yesterday as investor concern grew about a more rapid pace of monetary tightening over the coming months, particularly in light of that strong PPI print mentioned at the top. By the close of trade, the S&P 500 had shed a further -0.74%, with tech stocks in particular leading the declines. Indeed, the NASDAQ was down -1.14% yesterday, bringing its losses to more than -2.5% since the start of the week, whilst the VIX index of volatility rose another +1.4pts to 21.71pts, its highest closing level in a week. In Europe it was much the same picture, with the STOXX 600 (-0.84%) losing ground for a 5th consecutive session, the longest streak since the first wave of Covid in March 2020. And other risk assets like oil prices witnessed similar declines, with Brent Crude (-0.74%) and WTI (-0.60%) struggling, not least as growing Omicron restrictions raised questions as to whether global mobility would see a more sustained decline over the coming weeks.

Speaking of Omicron, yesterday saw a further rise in South African hospitalisations, which hit 6,895. For comparison that’s up from 3,798 just a week earlier, so an increase of over +80% in a week, albeit still well beneath peak hospitalisations of almost 20k in previous waves, even as cases match record highs, so all eyes will be on this figure to see how that progresses and what that means for elsewhere. We also got some news from Discovery Health, which is South Africa’s largest medical-insurance provider, who said that a double-dose of Pfizer still offered 70% protection against hospitalisation when it came to the Omicron variant, which is promising in the sense that it implies that even non-boosted populations elsewhere should have protection against severe disease, even if the protection against symptomatic illness is lower for those with just two doses. Separately, data from Pfizer confirmed that their antiviral pill was able to reduce hospitalisation or death by 89% among high-risk adults, while an interim analysis in standard risk adults pointed to a 70% reduction in hospitalisations.

Looking elsewhere, there were continued signs of Omicron spreading. In the US, the CDC said that Omicron had now been detected in 33 states, and now made up 3% of sequenced cases. And in the UK, a total of 59,610 Covid-19 cases were reported yesterday, which is the highest daily number since January.

Overnight in Asia stocks are trading mixed with the Hang Seng (+0.21%), the Nikkei (+0.11%), and the Shanghai Composite (+0.07%) trading in the green while the KOSPI (-0.23%) and CSI (-0.30%) are losing ground. The data dump from China for November showed a slowing economy with retail sales at 3.9% year on year, against a consensus of 4.7%, industrial production at 3.8% against 3.7% consensus, and fixed assets investments growth slowed to 5.2% YTD against a 5.4% consensus and 6.1% last month. We also learnt overnight that China’s Sinovac vaccine doesn’t protect adequately against Omicron with none of the 25 subjects in a Hong Kong study showing sufficient antibodies. Omicron could be a real challenge for China if they maintain their zero Covid approach, especially in light of the vaccine news. It still might be a mild variant but it’s seems so virulent that any containment strategy will be economically tough.

Staying on China, the Biden administration overnight blacklisted eight Chinese companies including the world’s largest drone manufacturer DJI. Futures markets are pointing a more positive start in DM markets with S&P 500 (0.14%) and DAX (+0.27%) futures both trading higher.

Back to yesterday and sovereign bond yields moved higher ahead of the various central bank decisions, with yields on 10yr Treasuries up +2.6bps to 1.44%. That was driven by a +3.0bps rise in real rates, which saw it close back above -1% for the first time in 3 weeks. In Europe, yields on 10yr bunds (+1.3bps), OATs (+1.5bps) and BTPs (+2.6bps) all moved higher as well. Notably as well in Europe, there was a further rise in natural gas prices, with the benchmark future up +10.52% to hit a fresh record of €128.30 per megawatt-hour. Bear in mind that a year earlier on December 14 2020, it was at just €16.61, so we’ve seen an absolutely massive rise over the last year that won’t be welcomed by central banks.

Congress finally passed legislation to raise the debt ceiling. The limit will be increased by $2.5 trillion, which should cover spending through the midterm elections and into early 2023. Hopefully we don’t have to cover the debt ceiling again until then. See you in just over a year!!

Looking at yesterday’s other data, the UK unemployment rate fell to 4.2% as expected in the three months to October, and the number of payrolled employees rose by +257k in November. In the Euro Area, industrial production grew by +1.1% in October (vs. +1.2% expected), and in the US the NFIB’s small business optimism index rose to 98.4 as expected.

To the day ahead now, and the main highlight will be the aforementioned decision from the Fed tonight and Chair Powell’s subsequent press conference. Otherwise, we’ll hear from Bank of Canada Governor Macklem and get CPI data for November from both the UK and Canada. In addition, data releases from the US include retail sales for November, the Empire State manufacturing survey for December and the NAHB’s housing market index for December.

Tyler Durden

Wed, 12/15/2021 – 07:52

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com