Nomura Sees Upside For Stocks (If We Can Survive Fed ‘Hawkish Surprise” & Friday’s “Messy OpEx Unclench”)

Despite the ugly misses in US Retail Sales (pretty much -2 z-score downside surprises across board), Nomura’s Charlie McElligott notes that USTs traded offered (large FV block sale 30k with $1.6mm/01, along with UST 10Y downside trade TYH2 129.5/127.5 p 1×1.5 at 18 in 25k)… but then rallying on “risk off” thereafter…

…on more equities weakness as the market seemingly is “pre-trading” and de-risking a Hawkish Fed, with lumpy QQQ downside trading (bot 36k Jan 349 Puts, ~$210mm of Delta for sale in a thin tape).

FOMC expectations are consensually for “transitory” inflation reference to be dropped in statement (duh), a doubling of Taper to $30B a month to conclude mid-March, SEPs to see PCE higher / Unemployment revised lower, DOTs revised higher with ’22 median at 2 hikes, with additional 6 hikes through ’24…

…however, any upside in those DOTs are where any “hawkish surprise” could come, i.e. 2.5 hikes in ’22 or say 4 in ’23, where either would be interpreted as HARD negatives for stocks, especially continuing the downside momentum for “Secular Growth” Tech as chief “pain point” behind the recent de-risking.

Critically, US “financial conditions” are inching marginally for the worse here, as per US 5Y Real Yields earlier breaking higher to their “least negative” point since Dec 2020, while Breakevens continue their recent bleed thanks to the Fed “inflation hawk” pivot (5Y BE’s at 2 month lows) …

US Equities – here is the deal:

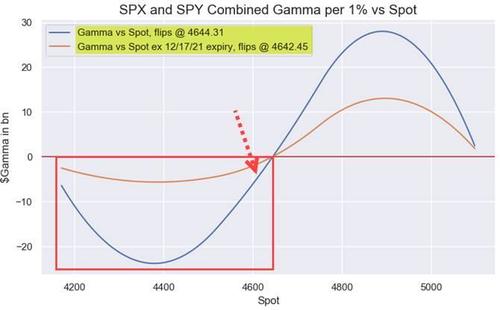

With Dealers now slipping in “short Gamma vs spot” territory (below 4644, and 37% of the Gamma dropping post Friday Op-Ex), we can certainly get one more de-risking push downtrade into year-end “risk book shutdown” mode and the market “pre-trading” hawkish-Fed, as it is hard to imagine that institutional investors are able to deploy big risk capital right now per year-end timing per Vol events cap / limit VaR, while Retail licks their wounds from Meme stocks getting rekt, ugly PNL from upside Call YOLOing and the Crypto vomit—especially if Jerome and the Fed were to hit us with a “hawkish surprise” today and further sour sentiment / risk-appetite

Source: Nomura

HOWEVER, McElligott thinks that (admittedly big) “IF” we clear Fed without said “hawkish surprise” scenario which would help to avoid any Op-Ex “messy unclench” thereafter on the turn into the new year, there is actually a scenario where where we are approaching a favorable risk / reward for turn HIGHER in US Equities over the coming month +:

1. Investors are REALLY hedged for downside, with 50dma of total US Equities Put Volumes now at all-time highs (the same 50dma in Calls is actually “off” the highs, FWIW), while SPX options 3m Skew at 96%ile and 3m Put Skew at 94%ile (both since 1996);

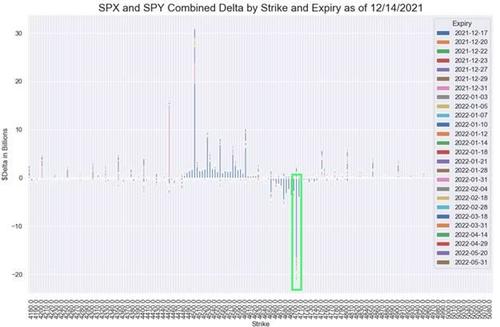

2. And with that, there is a TON of “short $Delta” associated with these downside hedges, in-particular with ~$21B of short Delta at that whopper 4700 strike in SPX / SPY equiv and ~$-16.7B of it expiring Friday / 78% of that line’s short Delta alone (which just so happens to be the largest “round number” $Gamma strike @ $3.67B, with 47% of that Gamma dropping-off at expiry); so we expect a big chunk of these Puts to expire Friday, that short $Delta will need to be bot back

Source: Nomura

3. MASSIVELY de-risked exposures of late (and much “cleaner” now):

1) Total SPX options $Delta has now come off last Thursday’s $562B (99.2%ile) down to today’s $88.2B (41.7%ile);

2) epicenter of the recent Fed / Rates –driven thematic Equities storm Nasdaq / QQQ options shows net $Delta there from $20.4B last Thursday (99.2%ile) down to -$5.6B this morning (12.6%ile);

3) IWM where a HUGE portion of the hedging has been, houses a monster -$17.7B of short $Delta (0.3%ile), with -$7.6B of that rolling-off for expiry on Friday which will need to be dealt with;

4) Our models show US Equities Vol Control having de-allocated / sold ~$78B over the past 1m and ~$112B over the past 3m,

5) while CTA Trend has sold $64B of Global Eq futs / $26B of US Eq futs over the past 1m; and 6) Street PB data showing Equities HFs at low single-digit percentile ranks for both Nets- and Grosses- on 1Y lookback.

4. As highlighted yesterday as per some really smart output from Chris Senyek and the strategic alliance with Wolfe Research, the Dec 15th through Feb 15th period is where over the past 15 years, we have seen the reversal higher and large historical OUTperformance of prior “Tax Loss Selling” LOSERS (which have been getting hammered, with the Wolfe “Potential Tax Loss Basket” -17.7% since Nov 3rd), as those trades wrap-up and instead, those “losers” begin to race higher relative to index.

5. And from a “just entertain this macro scenario” perspective, because “inflation” of course shouldn’t been entirely boiled-down into “Used Car Prices”…but the softening in the most-recent Mannheim data actually created DOWNSIDE RISK to the January release of the Dec CPI #—where IF we got a “miss” to the downside there on this optically critical Inflation datapoint, then it’s likely you could get a big “Dovish squeeze” in crowded “Bearish UST” positioning as the market might “scale back” its implied Fed hiking / tightening outlook—and where said rally in USTs / move lower in Yields would then stabilize the recent Equities pain-point in “Secular Growth” / uprofitable Tech; said another way, after all this net-down and selling of crowded longs in Growth, I’d imagine the pain-trade is ARKK ripping higher in everybody’s mush following said potential CPI miss / UST rally scenario.

So – summing things up, SpotGamma points out that gamma shifts sharply through the 4545-4700 range. In other words: hedging should be active, bringing high volatility to that zone.

-

If Powell upsets markets, that would lead to sharp selling into Fridays OPEX. However, the expiration of many puts at OPEX could lead to a sharp short covering type rally next week.

-

The other interesting scenario here is that the market catches a bid from Powell’s appearance. Typically the Fed tries to placate markets, and implied volatility (“event volatility”) subsides. In this case the vanna/charm flows may kick in pre-OPEX, leading to a sharp rally into Friday. This scenario could be the trickier one, as a short cover relief rally could lose steam post OPEX.

Trade accordingly.

Tyler Durden

Wed, 12/15/2021 – 12:22

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com