The EU Is Set To Label Nuclear Energy “Green”

Submitted by QTR’s Fringe Finance

When it comes to broad investing themes that I noticed in 2021, that I plan on being invested in for years to come, two sectors come to mind: marijuana and uranium.

I laid out my case for getting long marijuana stocks/ETFs in this comprehensive writeup from November 2021 and detailed my case further in my 22 Stocks I’m Watching For 2022.

Readers of my blog know that I have been delivering monthly, sometimes weekly, updates on the growing adoption of nuclear power globally – a “must” for anyone invested in uranium with a lengthy time frame.

A key part of my argument for investing in uranium is that the world is going to “wake up” one day and realize that nuclear power fulfills the practical energy needs of the world, while appeasing ESG investors and “green” activists at the same time. For all intents and purposes, when considering the power it generates and its carbon footprint, nuclear is as close to a “holy grail” of energy that we have at the present moment.

The major pitfall of nuclear continues to be the sour taste left in the mouths of many people after disasters like Fukushima. In my initial writeup about why I own uranium stocks, I talked about why I think this concern is misguided and how one or two big name incidents like Fukushima belie the true, safe nature of nuclear as a power source.

Since my initial writeup in Fall 2021, I have noted that Japan has called nuclear “key” it its decarbonization goals, pointed out that Germany, Finland, France and Poland were all pushing for nuclear power, made my case as to why nuclear presents a perfect common sense solution for China’s energy crisis, and interviewed bloggers who believe uranium’s price could “double or triple”.

Today, the positive catalysts for nuclear look as though they are set to continue. Over the last month:

-

The European Union has considered giving some nuclear projects a “green” investment label

-

Asia’s planned adoption of nuclear continues, while some other European countries continue to drag their feet

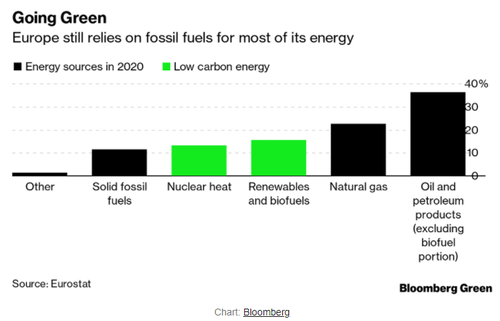

First, let’s talk about the EU, where they are considering allowing both natural gas and nuclear to be be labeled “green” in an attempt to help the shift to net zero emissions.

“The European Commission is weighing whether to classify as sustainable investment in gas plants that replace coal and emit no more than 270 grams of carbon dioxide equivalent per kilowatt-hour, according to two people with knowledge of the matter. The projects would have to be finalized by 2030, said the people, who asked not to be identified as the talks on the proposal are private,” Bloomberg wrote in late 2021.

This falls precisely in line with my argument that the practicality of nuclear would start to push it toward the front of the “Common Sense Solutions” list for countries looking to address climate change. As countries globally continue to move closer to deadlines they have set for themselves to address emissions, nuclear will look more and more like a viable option.

For example, Bloomberg writes: “Europe wants to become the world’s first continent to reach carbon neutrality by the middle of the century under the Green Deal, a sweeping overhaul that aims to accelerate pollution cuts in all areas from energy production to transport.”

The best way to be “first” is to consider all options. Nuclear, which has already been adopted in places like Poland, France and the Czech Republic as key to helping achieve net zero emissions, is likely climbing the list of “green” options for Europe, as well.

Furthermore, the proposed new label looks as though it could also provide an investing tailwind for nuclear companies and funds with exposure to uranium. “Covering almost every sector of the economy, the taxonomy aims to guide investors to clean projects,” the report said.

Just days ago, in January 2022, the debate on the “green” label continued. While there was some opposition from Green Politicians in Austria and Luxembourg, Bloomberg reported that “the biggest political group in the European Parliament threw its weight behind the plan”.

A new proposal being passed around in Europe reportedly says that nuclear may be classified as sustainable energy “if the new plants granted construction permits by 2045 meet a set of criteria to avoid significant harm to the environment and water resources”.

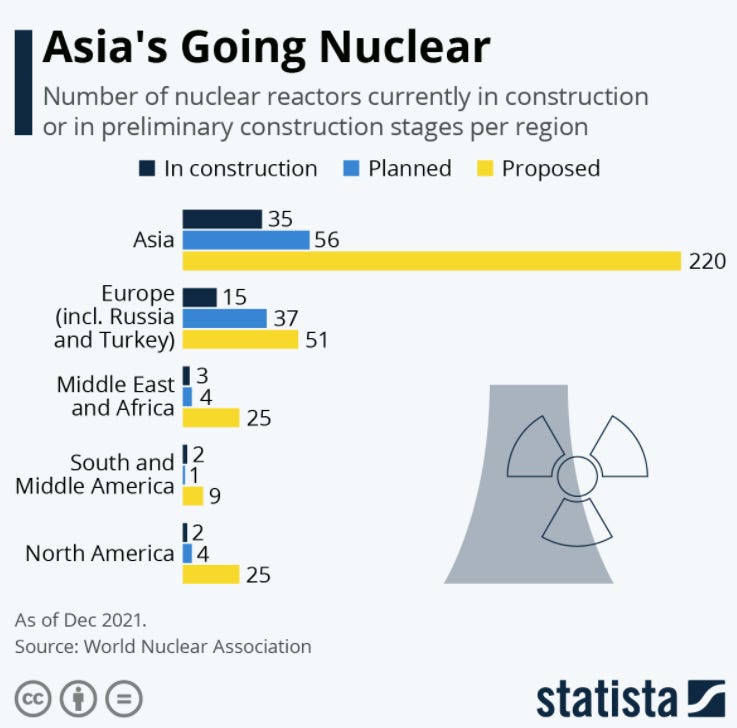

Meanwhile, as Europe grapples over “green” labels, most Nordic states are adoption nuclear and Germany continues to take its nuclear power offline, Asia’s planned nuclear projects have skyrocketed.

“Japan still has 33 reactors in commission while proposals, planning or construction have started on an additional eleven,” according to a late-December analysis from Statista.

Statista continues: “India plans to triple its number of nuclear power plants to 72 in total, while China has proposed the construction of 168 new reactors in addition to 18 being built and 37 being planned, which would amount to an increase of 337 percent. Overall, 35 reactors around Asia are already in construction, with Europe coming in second with 15 plants.”

And it may not be long before we find out who, exactly, is serious about pushing nuclear projects forward into the new decade.

About 66% of the 441 currently active nuclear power plants are older than 30 years, analysis by the International Atomic Energy Agency. This will put several countries to a decision as to whether they should overhaul, or replace, these key sources of power.

If there’s one thing I’ve learned about the world in my 40 years here, it’s that no one wants to work hard. Nuclear isn’t just a clean solution for the emissions problem, it’s an easy one: we already know how to do, it doesn’t require massive infrastructure overhaul and it checks the boxes that many whiny environmentalists want to check to virtue signal to neighboring nations that they’re doing their part in the “fight” against climate change.

Personally, I continue to believe the environment is shaping up nicely for uranium heading into the third year of this decade. I am predicting that by mid-decade, countries’ thirst for appeasing environmentalists and hitting “green” targets will overcome their decision making and, in the absence of wanting to create seismic change (or upset lobbyists), they will meet everyone in the middle at the prospect of nuclear power.

From there, once they meet their “targets”, politicians can do their photo ops in front of fields of windmills and solar panels, while the nuclear reactors off in the distance do the heavy lifting for their country’s energy needs.

Disclaimer: I own, or have recently owned, tons of names with exposure to uranium, including but not limited to CCJ and URA. I may own options in these names as well. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. My positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make investing decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

—

Special deal for Zero Hedge readers: I am extending a 20% off subscription price that literally never changes for as long as you have your subscription, regardless of inflation: Get 20% off forever

Tyler Durden

Fri, 01/07/2022 – 03:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com