Vaccine Mandates Are A Driver Of Wage Inflation

Submitted by QTR’s Fringe Finance

This is Part 2 of an exclusive interview with Doomberg, the collective that runs the Doomberg Substack. During this interview series, we discuss their outlook on 2022, China-based equities, Joe Rogan’s influence on the media, ARK Invest, silver and gold, the Elizabeth Holmes trial and inflation.

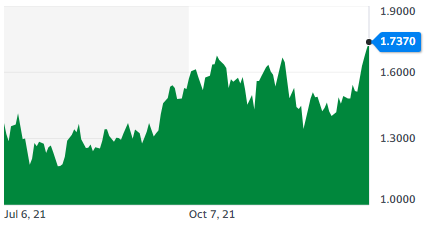

On my last interview series with Doomberg, they predicted uranium would “double or triple” and laid out a semi-serious case for oil going to $300 per barrel.

Doomberg publishes skeptical analyses through the hard money/Austrian lens and its objective is to be funny without being silly, to teach without being self-indulgent, and to provoke without being polarizing. They publish 10-12 pieces a month, which you can read for free here.

You can read Part 1 of this interview here.

Q: What’s your favorite piece you’ve written of late and why? How can it be informative for investors?

That’s like asking us to select our favorite child!

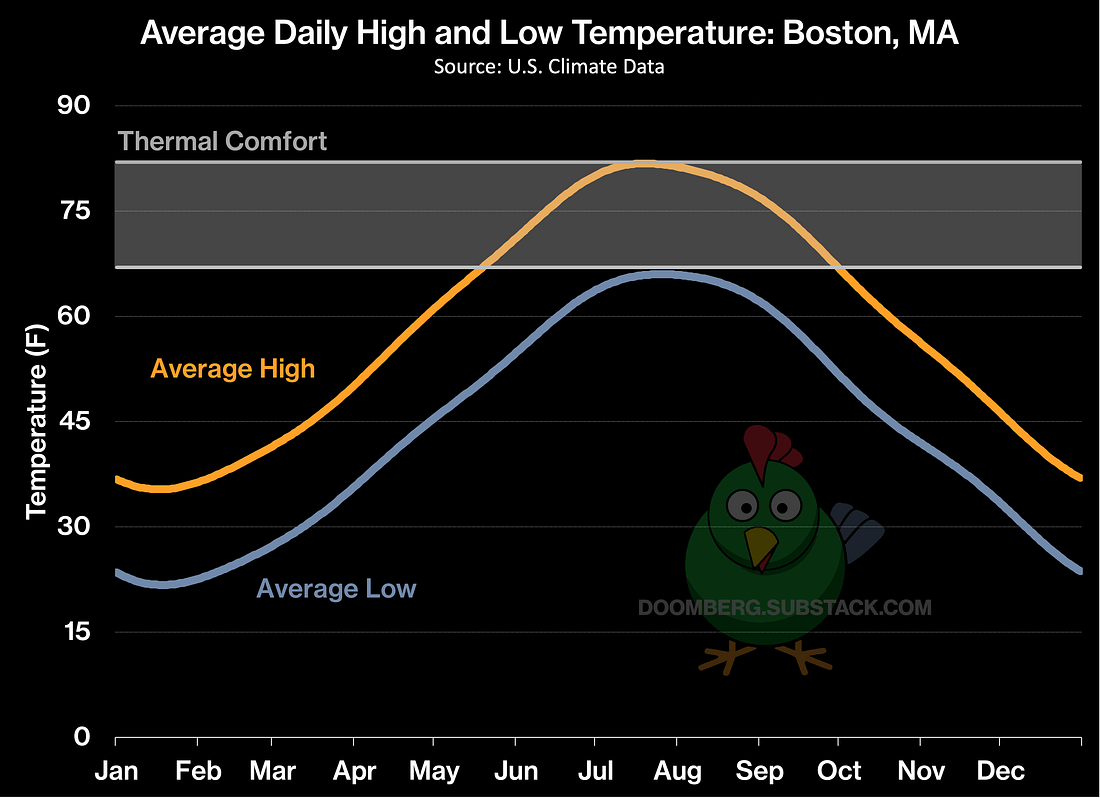

But seriously, a recent piece titled New England is an Energy Crisis Waiting to Happen went viral, with 90,000 views on Substack and a similar number when Zerohedge reprinted it to their website.

We don’t give stock advice on Doomberg, but we do highlight interesting opportunities for other investors to consider. Documenting the sheer insanity of New England’s energy predicament is one such example. The piece drew on our extensive technical background and allowed us to connect the seriousness of the situation to how the reader’s own body works.

It also gave us the opportunity to highlight the work of another great content creator, Meredith Angwin, and her excellent book Shorting the Grid.

How do you think the Biden administration will replace the lost Fed governors, since your prognostication about Powell on his way out was incorrect. Will Biden appoint hawks?

Given how poorly we called the Powell renomination, we are abstaining from any other prognostications on the future of the Fed.

We would direct your readers to the formidable Danielle DiMartino Booth who, unlike us, has relevant experience at the Fed and knows what she is talking about.

Has inflation become an issue big enough to span both political aisles? Are you a Rickards guy that thinks the worst is over in terms of prices or a Schiff guy that thinks the worst inflation is yet to come?

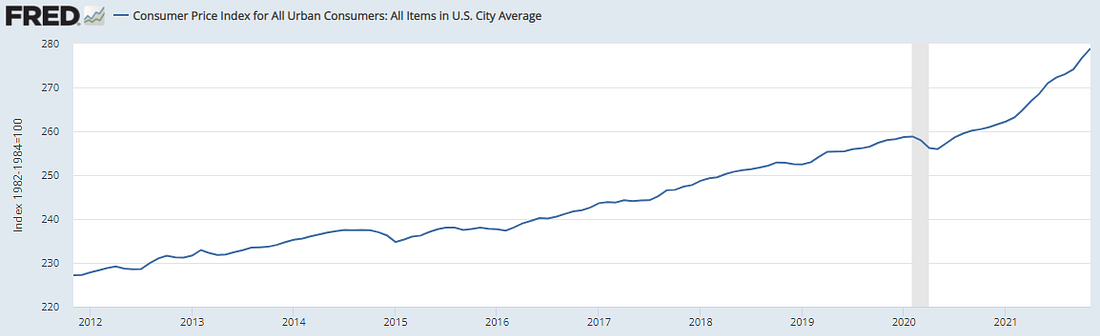

We do believe inflation has become a huge issue for both sides of the aisle.

We respect Rickards’ work, but we have a different view that stems from our extensive experience in industry. Our network of C-suite contacts is signaling that inflation is real and ongoing, especially wage inflation. These costs are being passed on to the consumer.

We also believe the confusion around and heterogeneous implementation of various vaccine mandates is an underreported driver of wage inflation.

A meaningful number of workers in the country will simply refuse to get vaccinated, which is shrinking the labor supply for some jobs. Once we do get through the pandemic, we believe a shortage of energy is on the horizon, which we wrote about in There’s Not Enough Oil.

We fall firmly into the Schiff camp on this one.

Any chance of a growth to value rotation this year? Which indexes will fare the best in ‘22, relative to one another?

That seems like a popular idea which is being written about by several market observers we follow.

Historically, if inflation runs hot, that’s bad for stocks in general, but especially growth stocks. For example, the basket of stocks in the Ark Invest portfolios would probably not stand up well to a bout of sustained inflation.

Other smart people tell us we need to be watching the bond market, and especially the long bond, which doesn’t seem to be doing much right now – at least compared to how hot CPI and PPI are running.

As a rule, with real yields this negative and valuations this elevated, all stocks are susceptible to a correction. We are the out-of-touch, cranky old folks standing on the lawn shaking our fist at the next generation on this one.

I recently wrote that the Elizabeth Holmes trial is a reminder that “risk on” doesn’t always work out. What did you make of the jury’s decision and what does it tell you about today’s market climate?

We are the last people to defend the actions of Elizabeth Holmes, but this sure seems like a case of selective prosecution.

The market is filled with frauds, crypto rug pulls, NFT wash trading scams, and blatant pump-and-dump shenanigans.

If lying to investors to raise money is a crime punishable by extended prison sentences, we need to get busy building more prisons.

Thanks, my Doomy friend.

* * *

For the next 48 hours, readers of Zero Hedge can get 22.20% off FOR LIFE as subscribers by using this New Year’s link to help usher in 2022: Get 22% off forever

—

DISCLAIMER:

I am short ARKK, long KWEB, TME, XOM, CCJ, URA, URNM, oil and uranium and various gold and silver miners/names. I may add any name mentioned in this article and sell any name mentioned in this piece at any time. It should be assumed Doomberg has positions in any security or commodity mentioned in this article and may transact in them. Answers are the opinions of the interviewee. None of this is a solicitation to buy or sell securities. Doomberg has contributed to my podcast but this interview was not part of any sponsorship or ad deal or contract, it was initiated by me because I enjoy the blog’s content and wanted to ask questions that I believed my readers would benefit from. It is only a look into our personal opinions and portfolios. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe.

MORE DISCLAIMER:

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot. If I am here listing things I got right or things I think will happen in the future, note that there are likely twice as many things I got wrong over the same period of time. I’m not a financial advisor, I hold no licenses or registrations and am not qualified to give advice on anything, let alone finance or medicine. Talk to your doctor, talk to your financial advisor or your therapist. Leave me a alone and do your research elsewhere. If you can find somewhere to rate this Substack one star, please do so as to save future readers from the misery of my often wholly incorrect prognostications.

Tyler Durden

Tue, 01/11/2022 – 22:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com