Despite Modest Tail, 30Y Auction Is Solid With Strong Foreign Demand

Similar to yesterday’s 10Y auction (and price action), moments ago the Treasury held the final coupon auction for the week and the first 30Y auction for the year, when it sold $22 billion in a 29-year 10-month reopening, in an auction that – like yesterday – tailed the When Issued but was otherwise not overly weak.

The high yield of 2.075% was the highest since June, and was 18bps higher than December’s 1.895% with much of the repricing due to last week’s FOMC minutes. The auction tailed the When Issued 2.072% by 0.3bps, which was the third consecutive tailing 30Y auction, however in light of the sharp drop in yields today which left no concessions for buyers, this was perhaps to be expected.

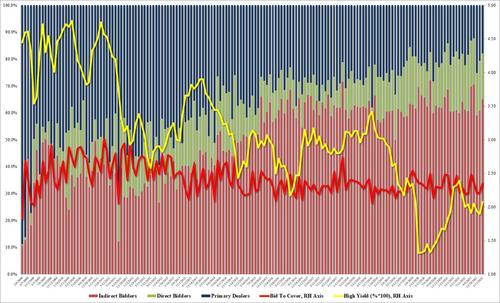

The Bid to Cover was more solid, and at 2.354 it was well above last months 2.219 and the six-auction average of 2.278.

The internals were likewise more solid, with Indirects taking down 65.0% of the auction, which was the highest since October’s 70.6% and above the recent average of 63.6%. And with Directs taking down 17.1%, Dealers were left with 17.95% or the lowest since October.

With yieds having traded near session lows ahead of the auction, before recovering some of the move, the kneejerk response was to push yields down again as markets assessed that despite the tail the auction was solid and not a reason to freak out after last week’s bond market mayhem. Curiously, despite the strength in rates, the Nasdaq continues to trade weak and was last spotted just off session lows.

Tyler Durden

Thu, 01/13/2022 – 13:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com