PBOC’s Soft Dollar Peg to Help Yuan Basket Fall

By Ye Xie, Bloomberg Markets Live reporter and commentator

The PBOC has managed to keep the dollar-yuan exchange rate as flat as a pancake. It’s as if Beijing has pegged the yuan to the dollar. Luckily for Beijing, the dollar is weakening. By keeping the dollar-yuan rate steady, the PBOC is riding the wave of a weak U.S. currency and knocking the yuan down against the currencies of most of China’s trading partners. For policy makers in Beijing who are worried about the record trade-weighted exchange rate, a soft dollar came at the right time.

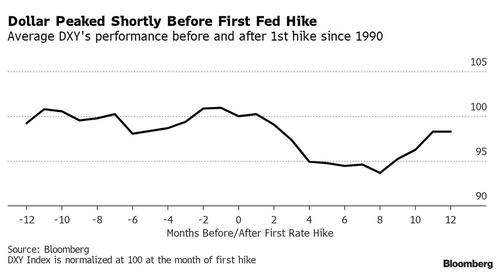

The dollar’s decline this week in the face of an increasingly hawkish Fed surprised many market observers. But historically, it’s common for the dollar to peak shortly before the first rate hike and decline more decisively once the tightening cycle commenced.

This chart shows the DXY’s average performance 12 months before and after the first rate increase during three previous hiking cycles since the 1990s. If you want to find an example of “buy the rumor and sell the fact,” this might be it.

The PBOC has capitalized on the dollar weakness. It set the fixing much weaker than analysts expected Thursday, following the dollar’s biggest decline since May. These weak fixings have been more frequent since last month when the PBOC sent a strong signal that it’s uncomfortable with the yuan rally. By pegging to a weaker dollar, the central bank allowed the yuan to fall against other currencies.

It’s hard to argue that the yuan is overvalued by too much. You can see that the yuan rally had been supported by China’s gain in market share of global exports. But understandably, Beijing is worried that once its competitors regain their foothold after the pandemic fades, a strong currency may eventually erode China’s competitiveness. In fact, the BIS’s real effective exchange rate is at the highest ever. Against the South Korean won, the yuan is approaching historical highs. With South Korea being a direct competitor in areas such as electronics, it’s small wonder that Beijing wants to lean against further yuan appreciation.

Luckily for China, a weaker dollar is coming to the rescue. And that gives Beijing some breathing room.

Tyler Durden

Thu, 01/13/2022 – 22:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com