Morgan Stanley: As The Fed’s Balance Sheet Runoff Begins, The Withdrawal Of Liquidity Will Have Profound Impacts

By Vishwanath Tirupattur, head of Quantitative Research at Morgan Stanley

The Devil Is in the Details

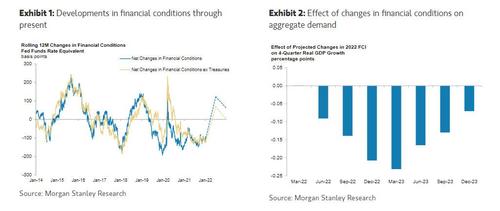

The first two weeks of the year have reinforced the key message from our 2022 Strategy Outlook – the policy training wheels are indeed coming off, and fast! The hawkish shift in the minutes of the FOMC’s December meeting, reinforced by the rhetoric from a number of Fed officials, signals policy tightening through more hikes. They are coming sooner than expected, and the timeline between the first rate hike and the beginning of balance sheet runoff will be compressed. Our economists now expect the Fed to deliver four 25bp hikes this year, at its March, June, September,and December meetings, in addition to an August start for the balance sheet runoff announced last July. Market pricing already reflects this hawkish shift, with the March liftoff nearly fully priced in along with 3-4 hikes in the subsequent 12 months.

Given the size of the Fed’s balance sheet (US$8.2trillion, consisting of US$5.6 trillion in Treasuries of varying maturities and US$2.6 trillion of agency MBS), the runoff has important market implications. However, quantifying its impact is far from straightforward. One could look to the balance sheet expansion in the post-GFC years with the view that if the buildup lowered interest rates, the runoff should have the opposite effect. A rule of thumb (with a lot of handwaving) suggests a 4-6bp change in the 10-year interest rate from a US$100 billion change in the balance sheet. However, we would argue that the market effects are unlikely to be symmetric and a simple sign reversal between the buildup and the runoff ignores the complexity of the modalities. We expect different impacts for Treasuries and agency MBS, given the different ways they were acquired during the buildup and the share of the Fed’s holdings in their respective markets.

During the balance sheet buildup, Treasury securities were predominantly acquired through the US Treasury’s new issue process. The Fed consciously decided how much duration to take out of the market by picking securities with varying maturities. In contrast, we expect the balance sheet runoff to be implemented by allowing securities to mature without reinvestment. That means the impact on the yield curve depends on how the Treasury responds to its increased issuance needs as the Fed decreases its Treasury holdings. Our interest rate strategists estimate that US Treasury issuance needs will rise by ~US$850 billion by the end of 2023and ~US$1,300 billion by the end of 2024. If we assume that the Treasury follows the advice of the Treasury Borrowing Advisory Committee, the optimal targets for increased issuance would be at the 7-year and 10-year points of the yield curve. Consequently, our strategists now forecast 10-year rates to reach 2.30% by the end of 2022.

The story with agency MBS is quite different. Agency MBS were purchased in the secondary market,and we expect their runoff to come through paydowns resulting from prepayments and amortizations of the underlying mortgages. Since the Fed has been a non-price-sensitive and programmatic buyer, the Fed’s portfolio of agency MBS would have received faster-prepaying mortgages (cheapest-to-deliver, in mortgage parlance). In addition, Fed holdings constitute a much larger share of the outstanding agency MBS market than of the Treasury market, hence the runoff will have a greater negative impact on agency MBS. In 2021, the Fed bought US$575 billion of agency MBS versus net issuance of US$875 billion, resulting in US$300 billion of MBS that the market absorbed. Our agency MBS strategists project that in 2022 the runoff will remove US$15 billion from the Fed’s balance sheet against projected net issuance of US$550 billion, implying that the market needs to absorb US$565 billion in mortgages, the largest amount of mortgages the private market would ever digest. What’s more, the market will have to find a more price-sensitive buyer for the cheapest-to-deliver mortgages. Putting it all together, the balance sheet runoff clearly will have more impact on agency MBS than other asset classes.

Of course, the markets have already begun to price in some of these effects,as mortgage spreads have widened about 20bp in the last two weeks. Still, our agency MBS strategists have advocated being short the mortgage basis for some time,and they think there is still room for modest widening (~10bp) in the mortgage basis from here, with mortgage rates rising towards 4%.

Do not underestimate the effects of liquidity withdrawal. The mammoth balance sheet the Fed has built up was a key determinant of liquidity across markets. As balance sheet runoff is put into motion, the withdrawal of liquidity will have profound impacts. Determining how it plays out is far from straightforward and will be determined by a variety of factors. Understanding the details matters. So hold on tight – there’s volatility ahead.

Tyler Durden

Sun, 01/16/2022 – 19:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com