Flouting Sanctions, Iran Says Oil Sales Have Enjoyed “Staggering” Rise Over Past Year

While the seemingly endless negotiations to revive the 2015 Iran nuclear deal – which was ended by Donald Trump in 2018 when the president reimposed heavy sanctions on Iran’s economy – have gone nowhere, it appears that Iran no longer has a pressing need to get to the finish line while conceding to all US demands, for one reason: China is flagrantly (and openly) flouting US-imposed sanctions blocking purchases of Iranian oil.

Indeed, according to Iran’s oil minister, sales of Iranian crude oil, gas condensates and petrochemical products have seen a “staggering” rise in the past 10 months, and while he didn’t thank China directly it was clear who the end buyer is: the country which continues to demonstrate to the world that it will never follow US demands when it comes to its own geopolitical interests .

Addressing lawmakers in Tehran, Javad Owji said that Iran’s budget for the year to start March 21 has factored in daily oil sales of 1.2 million barrels, the ministry’s official Shana news agency reported on Sunday.

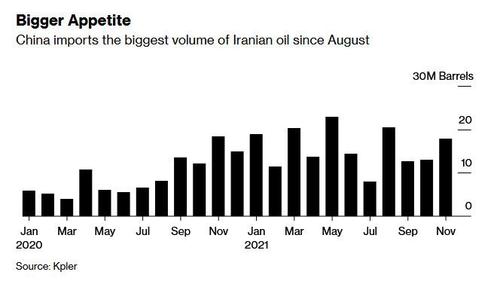

Owji’s comment come after a December report from Bloomberg that China has ramped up its buying of cheap Iranian crude after independent refiners were granted additional import quotas for 2021.

The nation imported almost 18 million barrels in November, equivalent to about 600,000 barrels a day, according to market intelligence firm Kpler. That’s up almost 40% from October and the biggest volume since August. December purchases were likely a continuation of the recent trend.

China’s independent refiners, known as teapots, were set for a buying spree before the end of the year as they sought to use new import allocations they received in mid-October. That put Russian ESPO oil from the Far East, which usually takes less than a week to be shipped, and Iranian crude stored on ships off China and around Singapore and Malaysia in the spotlight.

The overall volume of crude and condensate stored at sea off key Asian regions fell to the lowest level since September as of Dec. 9, according to Kpler, which estimates that more than half of the oil in floating storage is from Iran and Venezuela. Traders say Iranian cargoes have been sold at a discount of at least $4 a barrel to the ICE Brent price.

Of course, the import figures from Kpler are at odds with official Chinese data, which indicate the nation hasn’t taken Iranian oil since December 2020, because doing so would be a flagrant violation of US sanctions. And while China does not want to openly challenge Washington, Beijing has nonetheless been waving in Iranian oil with supplies often re-branded as originating from Oman and Malaysia.

Teapots have the flexibility to purchase cheap Iranian oil because many don’t have long-term deals with other Middle Eastern producers, unlike other Asian refiners. The independents buy cargoes via third parties that normally don’t own any assets in America, although China has opposed U.S. sanctions on Iran and accused Washington of reaching beyond its jurisdiction.

Tyler Durden

Tue, 01/18/2022 – 05:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com