Futures Rebound Strongly From Overnight Rout As Yields Stabilize

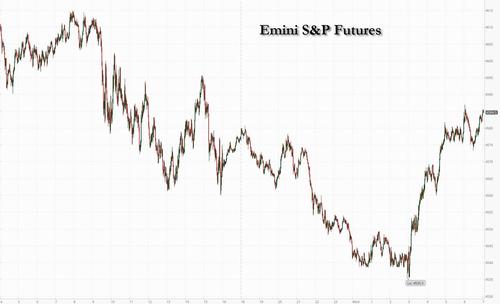

After what earlier looked like another assured overnight rout, especially after 10Y yields hit 1.90% and Brent rose as high as $89/bbl, US equity futures reversed earlier losses to trade higher as earnings optimism outweighed concerns over soaring bond yields and a 50bps March rate hike. As of 7:00am ET, emini S&P futures were up 14 points ot 0.3% to 4,585, Nasdaq futures were up 65 points or 0.44% and Dow futures were also in the green by 89 points or 0.25%. The dollar slumped after several days of sharp gains, the 10Y yield traded at 1.8826%, down from the session’s highest levels, and Brent was at $88.23.

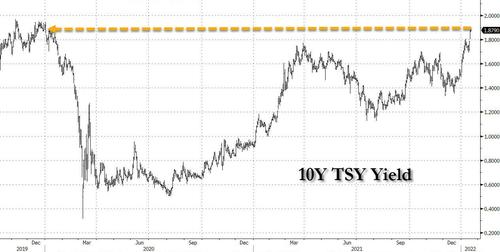

The prospect of accelerated policy tightening as well as concerns over the omicron variant and inflation hurting companies’ profits have whipsawed equities this year. The surge in Treasury yields has fueled a rotation out of expensive technology and growth shares and into cheaper parts of the market. Meanwhile, the 10Y yield has continued its aggressive push higher overnight, and hit a fresh 2 year high, rising just above 1.90% for the first time since Jan 2020, before retracing some of the move. Britain’s inflation rate surged unexpectedly to the highest since 1992 and Germany’s 10-year yield turned positive for the first time since 2019.

The surge in yields has routed high duration tech names – the Nasdaq 100 plunged 2.6% yesterday to the lowest level since mid-October. “The 2-year Treasury has moved too aggressively in pricing in Fed tightening, in our view, and we expect the yield curve to steepen,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “This steepening should further improve the positive backdrop for financial services companies,” he said.

SoFi Technologies, the financial firm led by former Twitter executive Anthony Noto, extended its gains in U.S. premarket session after the Office of the Comptroller of the Currency granted it a U.S. banking charter.

“We are in late stage of the cycle, where equities will post lower returns due to weaker growth and higher rates, but we expect the ongoing correction to be short,” Luca Paolini, chief strategist at Pictet Asset Management, said by email. He’s forecasting the S&P 500 index and U.S. 10-year yields at 2% by the end of the year.

Most European equities are in the green, recovering after a soggy start. Euro Stoxx 50 is up 0.5%, rallying ~1% from opening levels. Consumer products and services and retail names are the best performers after Richemont and Burberry Group Plc beat expectations; utilities and insurance names are the weakest. Shares in Switzerland’s Richemont are leading the STOXX 600 and up a whopping 7% after the world’s second-largest luxury group reported string demand for jewellery and watches.That had a positive effect across the sector and France’s heavyweights, LVMH, Kering and Hermes are up and lifting the Paris CAC 40 benchmark above the floatation mark.The UK’s Burberry is another strong performer, rising close to 5% as the luxury brand said annual profit would beat market expectations. The retail sector was also on a roll, rising over 2% with Spain’s Inditex leading the pack after Goldman Sachs upgraded the stock due to resilient earnings and cashflow. Marks & Spencer, Zalando and Kingfisher were all rising over 2%.

Earlier in the session, risk aversion deepened in stock markets across Asia on Wednesday as bond yields remained elevated, with investors trying to gauge the timing and scope of the Federal Reserve’s anticipated interest-rate hikes. The MSCI Asia Pacific Index slid as much as 1.5%, heading for a five-day slump, as tech and consumer-discretionary stocks furthered recent declines. Sony Group and Toyota Motor were among the biggest drags on the gauge. Energy shares climbed, even as the oil rally eased in Asia. Quantitative tightening may exert capital-outflows pressure on Asia, “which may theoretically lead to compression in asset valuations,” Nomura strategists including Chetan Seth wrote in a note. Given that valuations are currently modest, Asian stocks will not face as significant a de-rating as they did when the Fed tightened in 2017-2018, they added. Higher yields have damped investor appetite for global equities, particularly hitting richly valued tech shares. Asian firms are also weighed down by concerns over China’s economy. Still, the yield spike isn’t all bad for stocks, as “the sum total of expected rate hikes remains low,” BlackRock Investment Institute strategists wrote in a note. Japan’s stock benchmarks were the worst performers in Asia on Wednesday, with the Topix a whisker away from technical correction as Tokyo and other parts of the nation prepare to come under a state of quasi-emergency for three weeks starting Friday. Hong Kong-listed tech stocks capitulated ahead of a Reuters report in the late afternoon about China slapping new curbs on investment deals for the industry’s largest firms. Equity losses were relatively limited in mainland China, where the central bank pledged to use more monetary-policy tools.

Japanese equities fell and the yen strengthened amid extended global risk-off trading on concerns over expected Federal Reserve monetary tightening. Electronics and auto makers were the biggest drags on the Topix, which was down 3% as of 2:37 p.m. in Tokyo, with all 33 industry groups in the red. Tokyo Electron Ltd was the largest contributor to a 3% loss in the Nikkei 225 Stock Average. Sony Group Corp. dropped more than 12% after rival Microsoft Corp. announced it will acquire Activision Blizzard Inc. The Japanese currency gained 0.3% against the dollar. After initial enthusiasm following the Bank of Japan’s decision to maintain policy, Japanese stocks swung to a loss Tuesday amid regional concerns after U.S. Treasury yields spiked. U.S. stocks dropped overnight as speculation grew that central banks will have to boost interest rates sooner than earlier anticipated. “There’s market jitters over the possibility of a U.S. rate hike taking place earlier than March,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management Co. “The level of market uncertainty is high and share price swings are likely to continue into March, until there’s clarity on the Fed’s monetary policy steps.” Meanwhile, the greater Tokyo region and other parts of Japan are set to come under a state of quasi-emergency for three weeks starting Friday as the government tries to rein in a surge in Covid-19. Tokyo will seek to have bars and restaurants close early, national broadcaster NHK said.

In Australia, the S&P/ASX 200 index fell 1% to 7,332.50, closing at its lowest level since Dec. 20. Global stocks dropped as Treasury yields soared on bets that central banks will have to boost interest rates earlier than expected. Yields in Australia and New Zealand also climbed. READ: Kiwi Dollar, Yields Jump on ANZ Rate View: Inside Australia/NZ Megaport was the worst performer on Australia’s benchmark after it reported 2Q sales results. Harvey Norman was among the top performers after it was upgraded at Credit Suisse. In New Zealand, the S&P/NZX 50 index fell 1.6% to 12,612.31, marking its worst session in almost a year

In rates, Treasury yields remained cheaper on the day despite futures rebounding sharply from session lows. Yields higher by 1bp-2bp across the curve and most spreads within a basis point of Tuesday’s close; 10-year 1.885% after topping 1.90% for first time since January 2020, while in Europe, bund yields climbed above zero for the first time since before the pandemic. Treasury coupon sales resume with $20b 20-year bond reopening. $20b 20-year bond reopening at 1pm ET follows small tails for last week’s 10- and 30-year auctions; a $16b 10-year TIPS new issue is slated for Thursday. German 2s10s steepen ~2bps with 10y bund yields turning slightly positive. Gilts bear-flatten, cheapening as much as 8bps across the curve after a hot inflation print; OIS rates price ~24bps of tightening for the Feb. BOE meeting. Cash USTs bear-flatten slightly.

In FX, Bloomberg dollar spot drops 0.25%, slightly extending Asia’s weakness, and the dollar was steady-to-weaker against all of its Group-of-10 peers. The Norwegian krone and Canadian dollar rallied as oil prices continued to rise while New Zealand’s dollar gained and the nation’s short-end yields climbed after ANZ economists said they now expect the RBNZ’s official cash rate to peak at 3% by April 2023, up from a prior projection of 2% in 2H 2022. The pound inched up amid broad dollar weakening while the yield on 10-year Gilts soared through 1.30% following a report showing that Britain’s inflation rate surged unexpectedly to the highest since 1992. The euro inched up following yesterday’s deep loss versus the dollar; the rate on 10-year Bunds rose four basis points to 0.02%, crossing above zero for the first time since May 2019. The yen pared an advance as European stocks rebounded from opening losses. Commodity currencies lead broad gains against the dollar in G-10. ZAR leads in EMFX after Dec. inflation data nears the top of SARB’s target range.

In commodities, crude futures drift back up toward session highs after an early dip. WTI is up over 1% after finding support near $86, Brent regains $88. Spot gold pushes slightly higher, adding $3 near $1,817/oz. LME copper outperforms in a broadly positive base metals complex; tin lags.

Looking at the day ahead, data releases include the UK and Canada’s CPI reading for December, along with US housing start and building permits for December. Central bank speakers include BoE Governor Bailey, Deputy Governor Cunliffe and the ECB’s Holzmann. Finally, earnings releases include UnitedHealth Group, Bank of America, Procter & Gamble, Morgan Stanley, Charles Schwab, US Bancorp and United Airlines.

Market Snapshot

- S&P 500 futures down 0.1% to 4,565.50

- STOXX Europe 600 little changed at 479.76

- MXAP down 1.3% to 191.05

- MXAPJ down 0.5% to 628.97

- Nikkei down 2.8% to 27,467.23

- Topix down 3.0% to 1,919.72

- Hang Seng Index little changed at 24,127.85

- Shanghai Composite down 0.3% to 3,558.18

- Sensex down 1.0% to 60,142.26

- Australia S&P/ASX 200 down 1.0% to 7,332.50

- Kospi down 0.8% to 2,842.28

- Brent Futures up 1.1% to $88.45/bbl

- Gold spot up 0.2% to $1,817.04

- U.S. Dollar Index down 0.13% to 95.61

- German 10Y yield little changed at 0.01%

- Euro up 0.2% to $1.1343

- Brent Futures up 1.1% to $88.44/bbl

Top Overnight News from Bloomberg

- China’s central bank pledged to use more monetary policy tools to spur the economy and drive credit expansion, sending its clearest signal yet of an easing bias to boost market confidence

- The European Central Bank’s inflation forecasts aren’t a “blind certitude” and the institution will take action if the price surge proves more persistent, Bank of France Governor Francois Villeroy de Galhau said

- A group of rookie Tory MPs gathered on Tuesday to discuss whether there was any appetite to move together against the prime minister, several lawmakers said

- Oil held gains above the highest close since 2014 as the International Energy Agency said the market looked tighter than previously thought, with demand proving resilient to omicron. Some in the market now think it’s now a question of when — not if — oil hits triple digits

- The Cyberspace Administration of China is drafting new guidelines that will require any company with more than 100 million users or over 10 billion yuan ($1.6 billion) in revenue to seek the watchdog’s approval before such deals, Reuters reported. Any internet firm in sectors named on a “negative list” issued last year will also require approval, the news agency said

A more detailed look at global markets courtesy of Newqsuawk

Asian stocks followed suit to the losses on Wall St where all major indices declined led by tech and growth as US yields climbed to two-year highs and with financials also hit following earning releases in which Goldman Sachs and Charles Schwab both missed on their bottom lines. ASX 200 (-1.0%) traded lower in which tech mirrored the underperformance of the sector stateside as Nasdaq 100 futures dipped into correction territory after shedding 10% from its November peak and with BHP failing to benefit from an increase in its quarterly iron ore and petroleum output as the mining giant also reported a decline in coal production and warned of short-term disruptions from next month’s proposed easing of Western Australia border restrictions. However, the energy sector was buoyed by continued advances in oil prices due to the geopolitical risk premium and after an explosion in Turkey forced the shutdown of the Iraq-Turkey crude oil pipeline which is Iraq’s largest crude oil export line. Nikkei 225 (-2.8%) was heavily pressured by recent currency strength and with Japan set for tighter COVID-19 restrictions in key areas including Tokyo, while Toyota and Sony were the notable laggards after the automaker flagged a miss to its output targets due to chip shortages and with Sony impacted by news that rival Microsoft is to acquire video game publisher Activision. Hang Seng (U/C) and Shanghai Comp. (-0.4%) were choppy and initially fared better than their regional peers after the PBoC continued with its liquidity efforts and recently hinted of more easing, but with upside restricted amid reports of further scrutiny by the US on Chinese businesses including an examination into Alibaba’s cloud unit to determine if it poses a risk to US national security. Finally, 10yr JGBs were kept afloat amid the broad risk aversion in Tokyo although gains in JGBs were gradual as T-note futures remained pressured by a further rise in yields and following slightly weaker demand at the enhanced liquidity auction for 2yr-20yr JGBs.

Top Asian News

- Sunac China Dollar Bonds’ Record Surge Approaches 20 Cents

- Hamsters, Wings, Shrimp Ensnared by China’s Covid Zero Zeal

- China’s Sinopec Floods LNG Spot Market with Cargoes for 2022

- Tokyo to Press Bars to Close Early as Covid Cases Hit Record

Major bourses in Europe are now mostly in positive territory (Euro Stoxx 50 +0.5%; Stoxx 600 +0.3%) as the region recovered from the losses seen at the cash open – which saw the Euro Stoxx 50 and DAX 40 open lower by 0.5% and 0.8% respectively. US equity futures have also nursed earlier losses and now reside in positive territory, with the NQ recuperating from losses of over 1.0% at one stage as the US 10yr cash yield eclipsed 1.90% and the German 10yr yield turned positive for the first time in over three years. Back to cash equities, the CAC (+0.6%) and IBEX (+0.6%) outperform amid their large retail exposure, with the sector bolstered after stellar updates from Richemont (+9.1%) and Burberry (+6.0%) coupled with a broker upgrade for Inditex (+3.5%) at Goldman Sachs; in turn lifting the likes of LVMH (+3.0%) and Kering (+3.3%). Delving deeper into the sectors, the earlier defensive bias has evolved into a more cyclical one, with Basic Resources, Travel & Leisure and Retail at the top of the bunch, whilst Healthcare and Food & Beverages make their way down the ranks. Tech has recovered from its earlier yield-induced underperformance with the aid of a post-earnings ASML (+1.1%) which missed on net sales expectations, but the group announced a 100% Y/Y increase in its dividend, whilst the CEO suggests their production capacity cannot accommodate higher demand. For reference, ASML accounts for around 7.5% of the Euro Stoxx 50. In terms of other individual movers, Leoni (-14.0%) slumped as Co. sites were searched by the German Federal Cartel Office as part of an investigation into various cable manufacturers and other industry-related companies.

Top European News

- Richemont, Burberry Signal That Luxury Market Is Thriving

- Airbus Gears Up for Growth With Plans to Add 6,000 New Staff

- 5G Rollout Disrupts Flights Into U.S. From Across the World

- Hamsters, Wings, Shrimp Ensnared by China’s Covid Zero Zeal

In FX, sterling remains somewhat caught between stalls after stronger than forecast UK CPI readings that add more weight to expectations and pricing for further BoE policy normalisation, but cautious about carrying too much rate hike premium given the growing prospect of change at the highest level in Government and the rising rebellion against Tory Party leader Boris Johnson. Hence, the post-data pop above 1.3600 in Cable was relatively limited and short-lived, while Eur/Gbp only dipped marginally within a tight 0.8342-23 range before stabilising. However, the Pound is holding off Tuesday’s lows vs the Dollar by virtue of the fact that the Greenback has faded generally and topped a key Fib retracement level at 1.3610 as the index slips back a bit further towards 95.500 having reached 95.832 at best yesterday and consolidating between 95.792-549 ahead of US housing data and the 20 year auction.

- NZD/AUD – In contrast to Sterling, the Kiwi has no political inhibitions on the domestic front inhibitions and is outperforming amidst hawkish RBNZ calls from ANZ Bank, as Nzd/Usd bounces from overnight lows towards the psychological 0.6800 mark and the Aud/Nzd cross retreats through 1.0600 again. To recap, ANZ expects a 25 bp hike at every meeting from February to April 2023 that would push the OCR up to 3% from the current 75 bp. Meanwhile, the Aussie is lagging in wake of a fall in Westpac consumer sentiment and in advance of more pivotal jobs data tomorrow, albeit with Aud/Usd also off worst levels within a 0.7177-0.7214 band following a strong rise in iron ore prices.

- CAD/CHF/EUR/JPY – All recouping some lost ground against the Buck, and the Loonie still getting a lift from crude as WTI extends its heady rise to probe Usd 87/brl, while the Franc is approaching 0.9150 from sub-0.9175 and remains above 1.0400 vs the Euro even though Eur/Usd has regained enough poise to retest offers/resistance into 1.1350, including the 21 DMA that comes in at 1.1347 today (and incidentally matches Tuesday’s 55 DMA). Elsewhere, the Yen is rather betwixt and between on respective UST/JGB yield and broad risk grounds, as Usd/Jpy pivots 114.50 before Japanese inflation on Thursday. Back to Usd/Cad, Canadian CPI looms and could either compound BoC tightening perceptions or undermine, while the near term technical backdrop is basically flanked by resistance around 1.2550 and support circa 1.2450 beyond the current 1.2525-1.2472 bounds.

In commodities, WTI and Brent front month futures remain elevated following an initial blip lower in early European hours – which at the time emanated from reports that the Iraq-Turkey pipeline will resume oil flows after an explosion yesterday – said to have been an accident as opposed to an attack, which had been feared. The explosion was the cited driver behind yesterday’s rise in crude, with WTI Feb reaching a USD 86.41/bbl high and Brent March a peak of USD 89.05/bbl before waning off best levels. Nonetheless, prices see tailwinds in European trade as equities recovered off lows and following the IEA Monthly Oil Market report which raised its global demand growth forecast and suggested Omicron has had less of an impact than initially expected. Furthermore, the report suggested that OPEC+ effective spare capacity will be just 2.6mln BPD in H2-2022, “held primarily by Saudi Arabia and the UAE.” Saudi Arabia has usually kept more than 1.5-2mln BPD of spare capacity on hand for market management, according to the EIA. Elsewhere, spot gold has been driving higher as the Dollar remains near lows, with the yellow metal finding some support around USD 1,810/oz. LME copper meanwhile is on the front-foot and prices have extended on their APAC gains as stocks trim earlier losses, whilst mining giant Antofagasta sees the demand picture for the red metal continuing. Elsewhere, Indonesia has not issued any export permits for tin for 2022, according to a commodity exchange official.

US Event Calendar

- 7am: Jan. MBA Mortgage Applications, prior 1.4%

- 8:30am: Dec. Building Permits MoM, est. -0.8%, prior 3.6%, revised 3.9%

- 8:30am: Dec. Housing Starts MoM, est. -1.7%, prior 11.8%

- 8:30am: Dec. Building Permits, est. 1.7m, prior 1.71m, revised 1.72m

- 8:30am: Dec. Housing Starts, est. 1.65m, prior 1.68m

DB’s Jim Reid concludes the overnight wrap

Yesterday we published our latest global monthly survey. It was a more bearish survey than last month, with the majority of respondents reacting more negatively on bonds and equities than they did in December. Higher-than-expected inflation remains the biggest risk, with Fed policy alongside this. Covid-related risks again dropped out of the top three after re-entering last month with Omicron. Respondents thought the policy risk was towards the Fed being too hawkish, while the risk from the ECB was towards the top dovish direction. An overwhelming majority think the next 25bp move in 10yr Treasuries is higher, with the average respondent edging up their year-end yield target for both Treasuries and Bunds. The average expected S&P 500 return also dropped more than a percent point to around 3% for 2022. The bearish tilt to this month’s survey ended with the latest US recession forecasts. 73% of respondents thinking the next US recession will hit by 2024, up from 63% last month. See the full report here

I appreciate the average reader doesn’t want to hear about my latest injuries but part of the payback for being subscribed is you have to partly act as my therapist. Yesterday I got the results of my latest knee scan. A chunk has come off my knee cartilage leaving a pothole. I ironically did this whilst doing gentle squats and lunges whilst rehabbing my other knee after surgery in December. My surgeon has suggested more microfracture which will be another 6 weeks on crutches and no weight bearing. It was giving way around once a day over Xmas but has calmed down a bit and is just stiff now, indicating that the broken piece has been absorbed leaving just the hole. My dilemma is whether to just get it done asap and move on or wait until towards the end of the year. The risk being that the “pothole” will likely get bigger. All advice from those having gone through this gratefully received. Meanwhile I think I have sciatica in my back as I’m experiencing searing nerve pain in my hip that is starting to go down my leg. The latest scan results when they come in might help identify the problem that my consultant can’t exactly pinpoint. I’m not sure what’s more likely, Tiger Woods playing at the Masters in April or me in the monthly medal at my club this weekend.

Sovereign bonds and equities landed deep in the rough yesterday, as the hawkish drumbeat in markets grew louder, with investors increasingly pricing in tighter monetary policy over the coming months. In fact, a number of fresh milestones were reached over the last 24 hours alone, and a notable one was that Fed funds futures are now pricing in at least 4 full hikes in 2022 for the first time. For reference, it’s been little more than a month since the FOMC released their dot plot in December, and back then just 2 of the 18 members signalled they were in favour of 4 hikes this year, with all the others expecting 3 or less.

While the Fed is naturally gaining the most attention, this hawkish pivot is being echoed right across the advanced economies, with imminent hikes expected in multiple countries. Looking at overnight index swaps, they’re currently pricing a +92% chance of a hike at the BoE’s next meeting in early February, an 82% chance of one at the Bank of Canada’s meeting next week, and are fully pricing in one at the Reserve Bank of New Zealand’s next meeting as well. The UK CPI just after we go to press will be the next central bank hiking pricing hurdle.

As markets moved to price in more and more tightening, US Treasuries sold off as they caught up following the previous day’s holiday, and the 10yr yield followed up 4 consecutive weekly gains by rising another +8.9bps to a 2-year high of 1.87%. Front-end yields also moved higher, with the 2yr yield up +7.6bps to close above 1% for the first time since the pandemic began. As has generally been the case this year, that move was driven by higher real rates, with the rise in the 10yr real yield leaving it at its highest level since last April, at -0.62%, while the 30yr real yield is now just 6bps from crossing into positive territory for the first time since last spring.

Over in Europe, there were similar moves higher in sovereign bond yields, with those on 10yr bunds (+0.7bps) closing at -0.02%, also nudging closer to positive territory than at any point since May 2019. That said, the growing divergence in policy expectations between the Fed and the ECB meant there was a further widening in the spread between 2yr yields on US and German debt, and yesterday saw the spread widen to a post-pandemic high of 162bps. Elsewhere in Europe, yields on 10yr gilts (+3.1bps) hit their highest since May 2019 as well, whilst those on 10yr OATs (+1.3bps) hit a post-pandemic high.

The prospect of a more rapid pace of hikes sent US equities to their lowest levels so far this year, with the S&P 500 (-1.83%) experiencing a broad-based decline that left just 58 companies in the index in the green for the day. Over the last year, there’s only been 9 days with fewer stocks advancing. Tech stocks underperformed yet again, with the NASDAQ down a further -2.60%, which in turn brings its decline since its all-time high in November to over -9%, so not far off a -10% correction. And against this backdrop, the VIX index of volatility rose +3.7pts to 22.9pts, its highest level so far this year, albeit still some way beneath its peak above 30 that it reached shortly after the news of the Omicron variant arrived. European equities struggled too, with the STOXX 600 down -0.97%.

To the extent one believes the recent equity market performance is driven by tighter central bank policy, which will be reversed should enough pain be endured (the proverbial Fed put, as it were), the problem in this cycle is that inflation will make that more troublesome. So the last 40 years of the central bank put could be severely tested before this cycle is out.

The one sector in the S&P 500 that actually ended the day in positive territory yesterday was energy (+0.40%), having been bolstered by a fresh rise in oil prices that took them to their highest levels since 2014. By the close, Brent Crude (+1.19%) had surpassed $87/bbl, whilst WTI (+1.92%) was above $85/bbl, which won’t be welcome news for policymakers who’d been hoping for some respite on the inflation front. The latest surge has had a number of drivers, one of which is that the Omicron variant proved much less severe than initially feared and helped prices recover their losses from late November when they fell into the mid-$60s. Separately, a drone attack in the UAE on oil facilities has alerted investors to supply-side risks, which comes amidst production outages elsewhere. Oil has again found support in the Asian session after a key pipeline that brings crude from Iraq to Turkey was knocked down by an explosion adding to supply concerns.

While financials have benefitted from the recent run higher in yields, their fourth quarter earnings have been a bit underwhelming so far. Six financials reported yesterday and only one beat on both earnings and sales estimates. A common finding among financials reporting thus far is that trading revenues were lower in the fourth quarter while expenses were higher. So the sector has stalled after the good start to the year on the higher rates/yields story.

Overnight in Asia, major bourses across the region are trading lower again led by the Nikkei (-2.27%) after Toyota Motor’s (-4.7%) sharp decline as the company warned that it would be very difficult to meet its production target for this fiscal year due to supply-chain constraints. Sony Corporation fell as much as -10.0% in Tokyo, recording its biggest intraday drop in almost two years following Microsoft’s Activision Blizzard deal worth $69 billion. Elsewhere the Kospi (-0.47%), CSI (-0.58%) and Shanghai Composite (-0.30%) are moving lower. However the Hang Seng Index (+0.02%) is holding in better.

Looking forward, stock futures in the DM world are indicating that the declines will continue with the S&P 500 (-0.67%), Nasdaq (-0.89%) and DAX (-0.67%) all trading in the red.

Back to yesterday and on the data front, UK unemployment fell to a post-pandemic low of 4.1% in the three months ending in November (vs. 4.2% expected). Meanwhile in Germany, the January ZEW survey saw the expectations component rise to a 6-month high of 51.7 (vs. 32.0 expected), although the current situation fell back to an 8-month low of -10.2 (vs. -8.8 expected). Finally in the US, the Empire State manufacturing survey for January fell to -0.7 (vs. 25.0 expected), and the NAHB’s housing market index fell to 83 (vs. 84 expected).

To the day ahead now, and data releases include the UK and Canada’s CPI reading for December, along with US housing start and building permits for December. Central bank speakers include BoE Governor Bailey, Deputy Governor Cunliffe and the ECB’s Holzmann. Finally, earnings releases include UnitedHealth Group, Bank of America, Procter & Gamble, Morgan Stanley, Charles Schwab, US Bancorp and United Airlines.

Tyler Durden

Wed, 01/19/2022 – 07:34

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com