This Was The Biggest Rate Shock Since Volcker’s Intermeeting Rate Hike In 1979

When commenting on yesterday’s post-Bullard VaR Shocknado, we pointed to the stunning move in 2Y rates which jumped by 22bps – a move the kinds of which we last saw when Bear Stearns wasn’t fine.

And while there were more charts addressing the historical context of yesterday’s bond rout in our market wrap on Thursday, this morning DB’s Jim Reid has truly excelled in showing just how striking the market reaction was to two one-two punch of soaring CPI and Bullard’s “unprofessional” comments, with the following two charts.

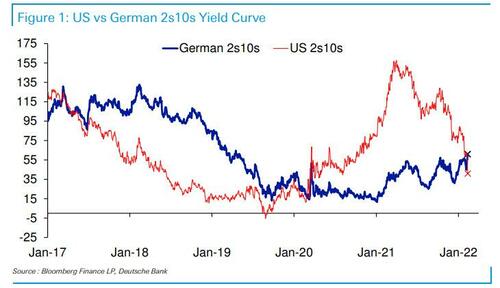

First, the dramatic US curve flattening yesterday, meant that US 2s10s dipped below the German equivalent for the first time since the pandemic hit. The market is getting comfortable that while the Fed is likely to be aggressive upfront on hikes, the ECB will be more measured. As such Reid notes that “there is probably more concern about the sustainability of the US cycle than the European one at the moment.” On this measure the US has flattened -36.5bps YTD and the German curve has actually steepened +17bps.

Second, and more important, yesterday’s 2yr US move (+21.4bps) was a truly historic event. Similar to the October spike in Australian front-end rates, which was a 6 standard deviation event, Reid compares the standard deviation of daily moves with the movement seen over the previous 12 months, and finds that yesterday’s was the biggest “shock” since October 1979 when Volcker announced his intentions on the world (a couple of months after taking office) with an inter-meeting weekend hike.

I suppose like the Aussie market this is a feature when forward guidance gets attacked. If the Fed hadn’t still been in a position where they were systematically winding down QE before hiking rates then they would likely have already raised a few months ago. As such when the dam breaks, the water floods aggressively through.

Tyler Durden

Fri, 02/11/2022 – 11:19

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com