20Y Auction Sees Record Direct Bidders As Yield Rises To Highest On Record

After a trio of surprisingly strong auctions last week, moments ago the Treasury concluded the week’s only coupon auction when it sold $19 billion in 20Y paper in yet another solid auction.

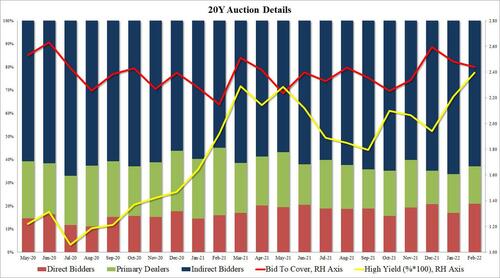

The auction, the 22nd 20Y sale since the tenor was introduced back in May 2020, stopped at a high yield of 2.396%, the highest on 20Y auction record, and on the screws with the When Issued which was also trading at 2.396% ahead of the auction.

The bid to cover of 2.44 was slightly below January’s 2.48 but was above the six-auction average of 2.41%, but was the lowest since November’s 2.34.

The internals were also somewhat soggy with Indirects taking down 62.9%, below January’s 66.2% below the six-auction average of 63.8% and the lowest since November of 2021. And with Directs taking down 21.0%, or the highest on record, Dealers were left holding just 16.1%, the second lowest on record, and below the recent average of 17.8%.

Overall, the auction priced in line with expectations, and despite some weakness in the bid to cover and Indirect takedown, the record Direct bid will likely compensate for this weakness.

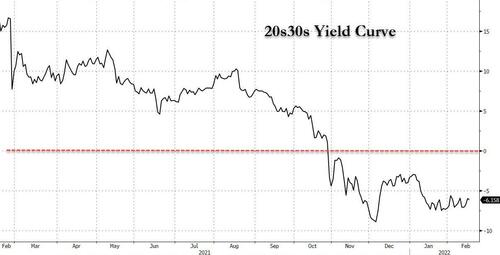

More notably, the 20s30s yield curve continued to trade inverted, after first dipping into negative territory back in October. There is no risk of this particular part of the yield curve disinverting any time soon.

Tyler Durden

Wed, 02/16/2022 – 13:14

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com