$2.2 Trillion In Options Expire Today: Here Are The Stocks That Will Move The Most

It’s not the biggest option-expiration Friday, but it is big with $2.2 trillion in index and single-stock options, split between $820TN in early settlement and $1.3TN in afternoon settlement.

Heading into today’s opex, there has been an unprecedented surge in purchases of downside protection, with Goldman calculating that put volumes as a proportion of total single stock options notional is up to the highest level since April 2020.

What is perhaps more troubling is that while not staggering, today’s opex takes place at a time when market liquidity is at abysmal levels, on par with the liquidity drought observed in March 2020.

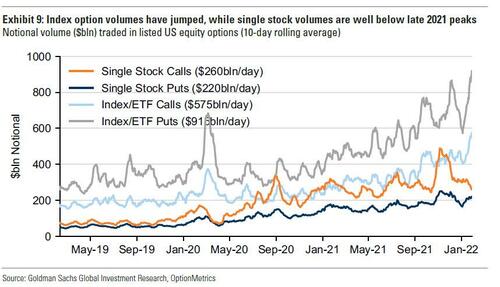

Drilling down into these numbers, on average investors traded $195bn of single stock puts daily over the past month, nearly 43% of total volume, and the highest since April 2020. Meanwhile, single stock options volumes have broadly moderated since Q4 of last year (when the bulk of trading was in calls), and are averaging $470bn per day in 2022, in line with 2021 levels.

Putting these numbers in context, ahead of today’s expiry, $545BN of options are expected to roll off today, the lowest since May 2021.

Why does op-ex matter? Well, as we explained previously, at major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stock price), delta-hedging activity can impact the underlying stock’s trading that day. If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is often referred to as a “pin” and can be an ideal situation for a large investor trying to enter/exit a stock position. Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves.

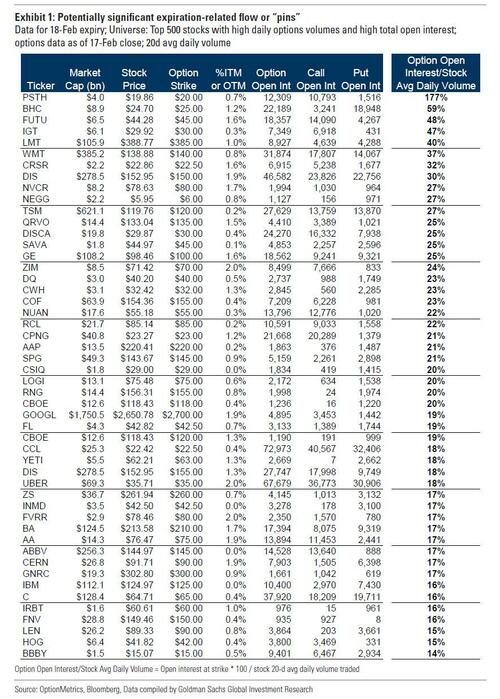

With that in mind, Goldman’s Vivak Vishel has identified stocks where option activity could have a big impact. The full list of large-ca[ names that could see substantial volatility today due to significant expiration-related flow or “pins”, is shown below. It includes LMT, WMT, DIS and TSM.

Tyler Durden

Fri, 02/18/2022 – 08:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com