The Yield Curve Just Inverted So… Buy Banks?

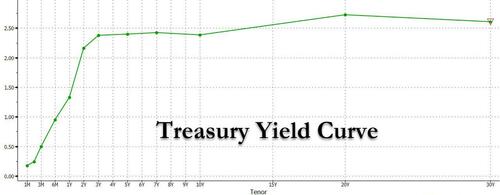

The yield curve is increasingly inverted…

… with the 3s10s, 5s10s and 7s10s all below zero…

… which has traditionally been viewed as the clearest early warning indicator that a recession is coming.

Which is also why the permabulls have been busy deflecting attention from this flashing red alert, and instead pointing to secondary indicators such as the 3M10Y yield curve (which is irrelevant at a time when the Fed plans to hike aggressively in the 3M+ horizon unless a recession hits first)… or dismissing yield curve concerns outright.

That’s what Bank of America has done in a note published today, in which the bank’s chief equity strategist – who is still somewhat bullish unlike her colleague and Chief Investment Strategist, Michael Hartnett, who has turned downright apocalyptic in recent weeks – writes that there is really no reason to care that the “The 3Y/10Y yield curve inverted today”, or that the 5s10s also inverted. Why? Because “the conventional view that Financials benefit from a steepening yield curve and are hurt by a flattening one appears to no longer apply.” Uhm, whatever you say…

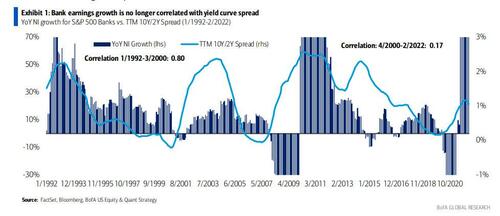

According to BofA, while Bank earnings growth was 80% correlated with the 10Y/2Y spread from 1992 to March 2000, that correlation has dropped to just 17% following the Tech Bubble, and our Banks team has highlighted that the short end of the curve has become more important for Banks vs. in the 90s. Well, let’s see: maybe it has something to do with the persistent Fed bailouts starting with the first tech bubble, continuing through the credit bubble, then the global sovereign debt crisis, and culminating with the Covid crash. The only problem is that nothing seen since 2000 has prepared markets for what is coming: a massive tightening stampeded in which the Fed put is dead, and where the Fed’s only mandate is to push the economy into recession to crush commodity demand and contain inflation!

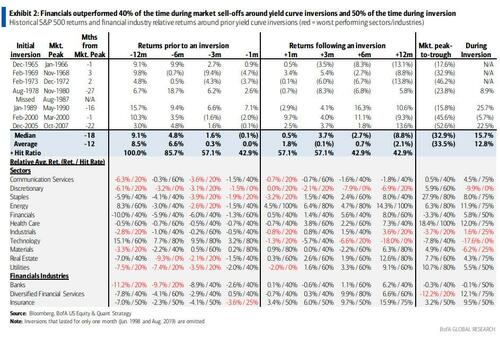

Of course, none of this matters to BofA whose only task is to goalseek a bullish view on bank, and as a result the bank notes that historically Financials have outperformed 50% of the time during curve inversions (which one can simply argue is a residual of the steeper curve that preceded the flattening just as the economy entered a recession).

Subramanian then notes that even yield curve inversion does not always signal trouble for the sector, noting that “Financials outperformed 40% of the time during market sell-offs around yield curve inversions and 50% of the time during the full period of inversion.” Did it maybe have something to do with expectations of an imminent Fed bailout?

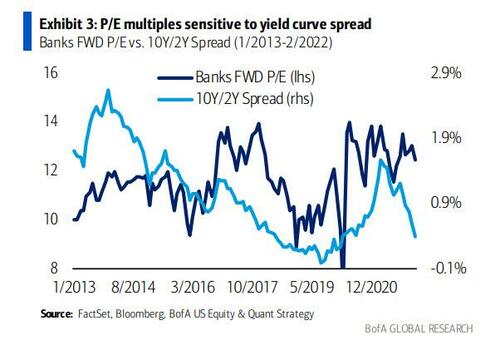

Still, not even BofA can ignore that the Financial sector’s P/E’s still move in lockstep with the curve, which however according to Subramanian – who is of course bullish on banks (she works in one) – is “an overly simplistic reaction that ignores history and fundamental sector changes.” Actually, no it isn’t overly simplistic to trade cautiously ahead of a recession, but we understand why Savita may be conflicted (and compromised).

And just in case her lame attempt at talking up banks wasn’t enough, Savita then doubles down and after advising clients that US M&A activity has slowed to 2009 lows, deal values are near 2013 lows and IPOs have fallen off, she says to ignore this too, because while “this sounds bad for fees/revenues” the correlation between Financials’ relative returns and M&A activity (or deal values/IPOs) is roughly zero.

And then, as a hilarious punchline, Savita does everything in her power to crush the last bank bulls out there, stating that “bank buybacks slowing.” As a reminder, this is the same strategist who a few months ago explained that the bulk of S&P growth in the past decade was attributable to buybacks… just ignore it this time because – well – she has to pitch banks, and instead of objectively warning that the end of buybacks is a potential disaster for banks, she tries hard to spin it as positive:

Our Banks team expects buybacks to slow, and loan growth to pick up. Cash balances have more than doubled since 2019, but they note that management will likely prioritize organic growth and dividends above buybacks. In our view, Financials should be lauded for slowing buybacks amid higher multiples: Financials have generally timed buybacks better than other sectors like Tech.

It gets funnier, because realizing her argument is terribly weak, she goes on to note that “dividends matter more than buybacks for Financials – periods of dividend growth saw 5.5ppt 12-mth excess returns, whereas periods of net buybacks saw 1.9ppt excess returns in the sector.” Uh, no, dividends do not and have never mattered more than buybacks. Just ask Warren Buffett, an expert when it comes to investing in banks.

Bottom line: a note which was meant to bolster the case for buying banks just cemented the conviction of the bears who we are confident will be dumping the sector as soon as the latest short/gamma/delta squeeze rally ends in a day or two and the next flush lower into the recession resumes.

But don’t take our word for it: just read any of the recent reports from Savita’s far more objective colleague, Mike Hartnett, who now expects a recession in just a few months. Then again, we are confident that as part of Savita’s next homework assignment she will explain why recessions are actually bullish.

Tyler Durden

Tue, 03/22/2022 – 17:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com