“The Move Is A Big Deal” – Yen Tumbles After BOJ Intervenes To Cap JGB Yields Amid Global Selloff

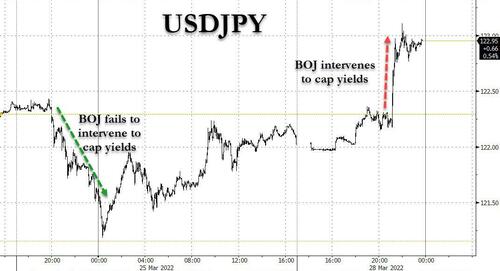

Last Friday, when the BOJ unexpectedly failed to intervene with one of its trademark offers to purchase an unlimited amount of bonds when the 10Y JGB broke above 0.23% – a level which just one month ago prompted Kuroda to step into the market to contained further yield gains – and spiked the yen while pushing the 10Y JGB yield to a 6-year high and on the verge of rising above the 0.25% upper boundary of the BOJ’s Yield Curve Control corridor, we said that “Japan, that paragon of MMT crackpots everywhere, suddenly finds itself trapped in a lose-lose dilemma: intervene in the bond market and spark a furious, potentially destabilizing and uncontrolled plunge in the yen which would also lead to galloping (if not worse) inflation, which could collapse what little faith remains in the BOJ, or do nothing and contain the slump in the yen while risking far higher yields which in a country where the debt is orders of magnitude greater than GDP, could also spell fiscal and monetary doom.”

We then added the following: “As a result, the market – having long gotten used to amicable interventions from the BOJ – will now surely test one of these two outcomes, and how the BOJ responds could have dramatic consequences for this original MMT test case. Should the BOJ’s reaction spark further erosion of faith in either Japan’s fiscal or monetary policies, the outcome for the world’s most indebted nation would be disastrous.”

So fast forward to today, when bond traders pushed the 10Y JGB yield even more, rising as high as 0.245%, and clearly intending to force the BOJ to make a decision…

… Kuroda did just that and it was to keep JGBs in line while risk an accelerating collapse in the yen.

On Monday morning, one day after the BOJ left many stunned with its refusal to announce an open-ended bond market intervention as yields spiked, the central bank changed its mind and conceded that it was not willing to risk a bond market collapse, announcing that it will purchase an unlimited amount of 10-year bonds at a fixed rate of 0.25%.

The decision comes as interest-rate hikes by major peers such as the Federal Reserve have sent yields across the globe soaring, adding upward pressure on Japan yields. The 10-year yield stood at 0.242% at 10:23 a.m. in Tokyo, compared to a tolerated level by the BOJ of 0.25% under its yield-curve control policy.

And while JGB yields will remain at or below 0.25% (for now) courtesy of the BOJ’s verbal intervention which however failed to actually prompt any actual trades…

- *BOJ SAYS NO BIDS TENDERED FOR FIXED-RATE BOND-BUYING OFFER

… the same can not be said of the Yen which fell to a fresh 6-year low of 123.11 against the U.S. dollar, with little stopping the USDJPY rising as high as 130.

The move underscores the central bank’s commitment to keep monetary settings loose, following Governor Kuroda’s earlier remarks that policy will remain unchanged even if inflation jumps. Japan’s bond yields have been moving higher after the BOJ’s fixed-rate buying offer on Feb 14 – the first such operation since 2018 – helped push them lower.

Meanwhile, the dilemma facing the BOJ grows: the growing policy divergence between the BOJ and the Fed has heaped pressure on the yen, with the currency slipping to a six-year low against the dollar in March. Of course, by failing to keep a floor under the yen, the BOJ invites even higher inflation, which will – sooner or later – force the BOJ to break, and when it does it will lose control over both the yen and JGBs.

“The BOJ will automatically conduct such operations when the 10-year yield approaches 0.25%, as waiting for the yield to rise past that would invite unnecessary speculation and also prompt players to test yield upside,” said Takafumi Yamawaki, head of local rates and currency research at JPMorgan in Tokyo. “The BOJ probably separates bond purchases from risk of a weaker yen as changing its stance on bond purchase operations would undermine the current yield curve control framework.”

Meanwhile, much of the “developed” world tightening (with the sole exception of China), traders had been speculating that the BOJ will also have to start normalizing policy at some point. However, clearly that time is not now and Kuroda has repeatedly ruled out the possibility of near-term policy adjustments. Providing a modest buffer, Inflation in Japan is also far from a 2% target, unlike other countries where red-hot price gains have stoked concerns.

Meanwhile, the collapse in the yen is set to accelerate. As Bear Traps Report Larry McDonald reminds us, by collapsing to levels last seen in 2015, the Yen’s freefall has reignited fears of a re run of events that led to the 2015 renminbi devaluation. In a recent note from last week, SocGen’s Albert Edwards called this “an earthquake in the world of foreign exchange.” So as Japan weakens the Yen to save the economy China is the loser and could force it to pursue another currency devaluation in a beggar they neighbor world.

This, as McDonald writes, is bullish hard assets; how can the Fed get aggressive into that? JPY weakness likely has the most negative impact on South Korea within emerging markets and won’t make China happy either.

Finally, McDonald quotes a CIO from a Florida based hedge fund, who writes that “I’m in the camp that the Yen move is a big deal. This is what happens when money printing goes too far… Zervos at a dinner this week in Miami said he thinks BOJ stays easy and has to … he sees the USD/Yen at 130 by year end. This would make Japan very competitive very quickly, what will that mean for emerging markets?”

And more importantly, what does that mean for China and its untenably strong currency. We are about to find out.

Tyler Durden

Sun, 03/27/2022 – 23:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com