Volcker Caused A Recession To Bring Down Soaring Inflation; Powell Hopes To Achieve The Same Without A Recession

By Seth Carpetner, Global Chief Economist at Morgan Stanley

Plus Ça Change

A strong economy, high inflation, and then an oil price shock…even if history does not repeat itself, it may rhyme. While we do not think the 1970s provide the map for the road ahead, it is always worth taking stock of the lessons of the past. The orthodoxy of monetary policy will be tested with the Russian invasion of Ukraine and the stagflationary shock. Let’s consider the implications for the Fed and the ECB.

After the inflation of the 1970s had been tamed, the views of central bankers in developed markets on commodity price shocks evolved. Inflation expectations became anchored near – indeed at times below –target inflation rates, and the received wisdom was that either cost shocks should be ignored, because the inflationary effects would be transitory, or that policy should ease, because the drag on the real economy was a bigger threat. That stance became the textbook response. Will central banks now throw the textbook out of the window?

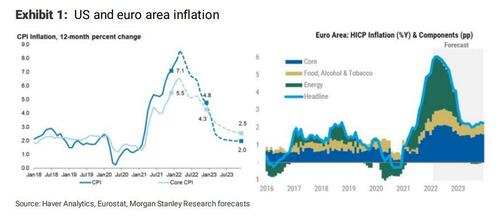

The Fed is clearly on a hiking path. The old playbook does not work with economic growth far stronger than is sustainable, inflation much higher than desired, and inflation expectations coming into question. In canonical central banker thinking, the oil shocks of the 1970s led to the Great Inflation because inflation expectations became unhinged. As for growth, any drag from higher oil prices is actually welcome – the point of hiking rates is to slow the economy. The world is indeed different now than pre-Covid: This hiking cycle is the first one since the 1970s where the aim is to lower inflation rather than prevent it from rising. The return to those difficult times is why Chair Powell’s speech last week laid out three examples of a “soft landing.” After the 1970s, then-Chair Volcker caused a recession to bring inflation down, while Chair Powell hopes to bring down inflation without a recession. I do not think we are replaying the 1970s, but the Fed’s challenge is clear.

We see the ECB hewing more closely to orthodoxy, despite the somewhat hawkish tone at its last meeting. The inflationary effect of the Russian invasion is undeniable; energy prices led our European economics team to revise up its inflation forecast by 150bp for this year. But the team also lowered its euro area GDP forecast by about a percentage point. Worse, the euro area economy entered this year on a less-solid footing than the US, so the ECB cannot take the fundamentals for granted. Moreover, the resolution to the conflict is an unknown, and if the supply of commodities to Europe is cut off, a recession is the likely result. But the fact remains that inflation is too high and, at least for now, the economy is growing. Winding down asset purchases seems unavoidable. We look for one rate hike, but not until December, given our softer forecast for growth. Thus the ECB will not look through the shock completely, but should react less forcefully than the Fed.

So, this time is different. The rules have changed, at least to some degree. But some things have not. As usual, the curve has flattened with this hiking cycle. With the Fed set to hike into restrictive territory, the curve will invert. As has always been the case in the past, markets will debate whether an inversion presages a recession. A policy mistake that causes a recession is clearly possible, but our baseline is that an inversion without a recession is more likely. The more things change, the more they stay the same.

Tyler Durden

Sun, 03/27/2022 – 16:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com