Are Used Car Prices About To Peak For Real This Time?

The Manheim Used Vehicle Value Index, a wholesale tracker of used car prices, fell 3.8% in March from February, the largest monthly decline since April 2020 (only Feb 2007 and two prints in the fall of 2008 were worse before that). Given its significance as a contributor to the overall headline inflation rates in the US, this could well be a critical inflection point (as rising rates begin to work their disinflationary way through the economy and peak supply chain crisis passes).

Used car prices have gone bonkers over the last two years, reaching record highs in February, but appear to have stalled since February. Last month, the used car index declined to 222.4 (the lowest since Sept 2021). That is still up about 24.5% from a year ago (but, most notably the upside momentum is slowing).

As Bespoke shows in the chart below, CPI for used vehicles hasn’t been perfectly correlated to the Manheim index, but the two are at least loosely related. Manheim tends to lead used auto CPI, and has fallen faster during recent price slowdowns than the BLS estimate of prices paid by consumers.

As a result, we are skeptical that the 2.1% decline in prices for February will lead to a huge CPI Used Auto drop in March, but it will likely work out to 1-2%. Similarly, we are skeptical that a 3.9% drop MoM in March Manheim Used Auto prices will lead to a similarly large fall in the equivalent CPI index for April.

Notably, given The Fed’s recent hawkishness, used car prices crested just as the average interest rate for used vehicles sank as low as 4% and has since moved higher…

Since early February, we’ve pointed out that used car prices could be at “yet another major inflection point.” By late March, used car prices declined even more as Goldman Sachs and others suggested peak supply chain congestion might have already passed. Goldman’s high-frequency congestion scale of global supply chains is well off its high of 10 earlier this year, currently at 6/10. The index is still elevated, though it appears to be passed the peak, encouraging news for automakers who may soon boost new car supply.

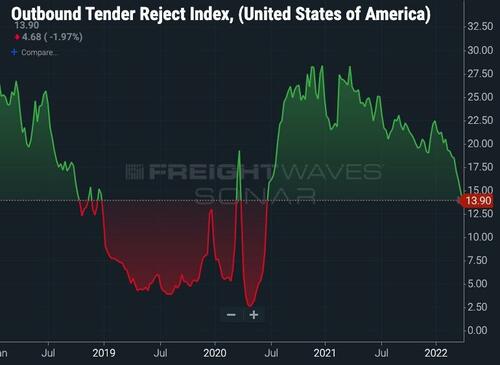

Another key to the puzzle of figuring out if used car prices have reached a climax is a new warning about a looming freight recession. FreightWaves’ CEO Craig Fuller explains that tender rejections, the best indicator of real-time supply/demand in the trucking sector, will soon go negative. The last time this happened was during the 2019 freight recession. This could mean that consumer spending, the most significant part of the economy, could be pulling back as consumer sentiment remains crushed by soaring inflation

Fuller’s freight recession call could also suggest a durable goods slowdown. Perhaps this would also mean consumers could go on a buyer strike as they’re battered by high inflation.

However, BofA’s US economist Anna Zhou points out there’s “pent-up demand for cars should provide another boost to consumer spending when the supply side constraints ease, though this might not happen until later this year.”

Zhou said the supply-demand imbalance has driven up prices of used cars while retail inventories to sales ratio is at multi-decade lows. She even said as dealers face low supplies of new cars, they are forced to continue bidding up used cars to keep inventories full.

We have pointed out several factors that could produce a top in used car prices, such as soaring interest rates, supply chain alleviation, impending freight recession, and also provide readers with a counterargument from BofA that suggests there’s still a lot of pent-up demand out there. The good news is that used car prices have faded from record highs and may mean overall inflation will peak soon.

Tyler Durden

Fri, 04/08/2022 – 07:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com