After Secretly Pillaging Billions In Turkish Assets To Prop Up Lira, Erdogan Is Going After Foreigners’ Dollars

Back in December, when the crashing Turkish lira mysteriously soared higher on a government and central bank mandated short squeeze, which we later learned was funded by tens of billions in US Dollars soft confiscations, we wrote that “Erdogan Is Secretly Pillaging Billions In Turkish Assets To Prop Up The Lira, And His Rule.”

Confirming what many have dreaded for a while – that Erdogan is literally making up healthy economic numbers for international consumption while pillaging the country out of the back door without reporting it, Bloomberg reported that while the government has said it didn’t intervene in the currency market, it lied and the fall of $5.9 billion probably signals a backdoor intervention similar to operations carried out over two years from October 2018, when state lenders sold dollars – typically those belonging to local private savers – to support the local currency.

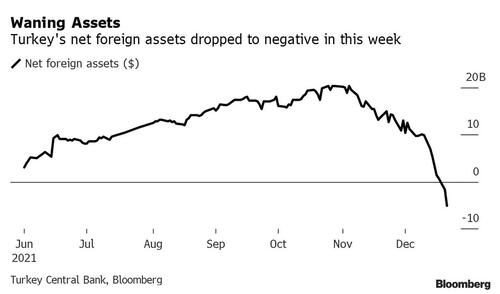

What was even more alarming is that Erdogan actually thinks the international community is so stupid, nobody will notice what is going on. As Bloomberg showed, net foreign assets dropped by $5.9 billion to minus $5.1 billion on in just days.

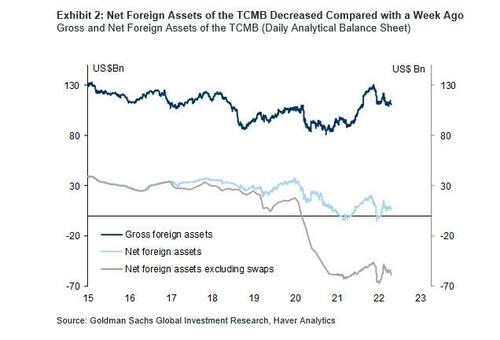

Alas since, then Turkey’s reserve position has only deteriorated and gone from bad to worse, and according to Goldman, as of April 27, the TCMB’s net foreign assets were US$7.4bn, down by US$0.33bn from a week ago. TCMB bank swaps and the stock of the FX deposit facility increased by US$1bn to US$41.8bn compared with a week ago due entirely to a rise in swaps, which picked up to US$41.2bn. The stock of the FX deposit facility has again remained flat at around only US$0.6bn.

According to Goldman’s estimates, net foreign assets excluding swaps with banks and other central banks continued to decrease to negative $57.4bn, down by US$1.3bn since a week ago.

Of course, if and when Turkey runs out of domestic FX – read dollars – which it can confiscate and buy lira with, the domestic currency, which ended 2021 as one of the world’ performers and has gone nowhere since then thanks to non stop government intervention, will crater and resume its freefall.

So what sis Erdogan to do? Simple: having confiscated most domestic gold and hard currencies, the Turkish president is now hoping to confiscate foreigners’ dollars.

But how? Doesn’t he have to make it desirable and attractive to put one’s hard currencies into the kleptocrat nation?

Bingo… and that’s precisely why Bloomberg reports that Turkey is working on a plan to attract inflows of hard currency by offering lira funding, free of interest and with a “guaranteed” 4% return in dollars, to foreign investors willing to park their money for at least two years. Needless to say, but any time Turkey “guarantees” anything, run.

Under the plan, the central bank would provide lira liquidity to foreigners for investment in local bonds with a maturity of at least two years, according to a person with direct knowledge of the deliberations. Besides extending zero-yield swaps, the monetary authority would also guarantee a 4% return in dollar terms when the securities mature, the person said.

Translation: please give us your dollars and we promise to take good care of them and even give you a much higher yield than you can earn (for now) in the US.

Remarkably, nobody has dared to speak up and point out that the Turkish dictator (and currency) is naked. Instead, investors are actually buying the worthless Turkish lira, which was headed for its first gain in over two weeks, trading 0.2% stronger against the dollar.

Bloomberg came the closest to pointing out the sheer audacity of the plan, writing that “the outreach to investors marks a new tack for Turkey and would represent a major U-turn by the central bank, a reflection of pressure on authorities to reverse capital outflows. It’s used similar measures to shore up the currency at home by rolling out state-backed deposit accounts that shield savers from lira weakness.“

Indeed, after a currency crisis in 2018, Turkey introduced numerous restrictions on foreign transactions to defend the lira, placing limits on swaps with local banks to deter short sellers. But as a side effect, foreign holdings of Turkish stocks and bonds have fallen to a historic low… and in the case of net assets ex swaps, are actually negative to the tune of $57 billion!

Meanwhile, deepening trade imbalances and the world’s most negative interest rates when adjusted for prices have made the $800 billion economy increasingly vulnerable at a time of intensifying global tightening led by the U.S. Federal Reserve.

Furthermore, courtesy of the lunacy that is Erdogonmics, where the central bank “fights” near record inflation by cutting rates, instead of using higher rates to make lira assets more appealing, Turkey has introduced a series of unconventional policies to attract hard currency and boost the central bank’s reserves.

TURKISH CENTRAL BANK GOVERNOR SAYS DEVELOPMENTS SHOW RATE CUTS WERE CORRECT DECISION pic.twitter.com/7PzWmUw6Gv

— Newsquawk (@Newsquawk) April 28, 2022

Deposits in so-called FX-protected accounts reached 782 billion liras ($52 billion) as of April 22, according to data compiled by the banking regulator. This month, the central bank revised some reserve requirement rules for banks in an effort to encourage conversion of foreign exchange into the local currency.

Expect some gullible and extremely naive investors, those who are unaware what depth Erdogan can plumb to preserve his authoritarian status quo for just one more day, to hand over a few billion in USD assets which will promptly be “repossessed” and used by Turkey to prop up the lira for as long as possible. Then when everything crashes, and when Erodgan finally disappears into some non-extradition country, good luck to all trying to recoup their money.

Tyler Durden

Fri, 04/29/2022 – 02:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com