“Debt Piles Haven’t Shrunk”: SocGen Warns Bear Market Will Lead To Fresh Corp Leverage Concerns

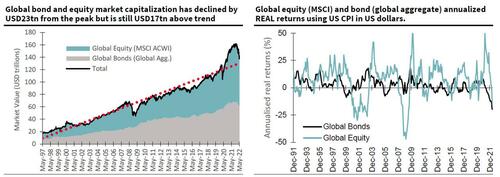

The relentless collapse in global equities, offset by the occasional bear market rally like Friday’s, may have been ignored by the rest of the corporate world but that is changing. Indeed, with the drop in market cap for the MSCI ACWI World now $12 Trillion, SocGen’s Anderw Lapthorne cautions that to see this decline happening alongside a drop in debt markets is unusual, and its consequences are likely to reverberate throughout financial markets for some time.

To be sure, there is a “glass half full” way of looking at the collapse: as the SocGen strategist notes, “this near-USD20tn drop in bond and equity market cap must be viewed in the context of the rapid growth in asset values over the last couple of years” and one could argue that all markets are doing is simply removing the excesses as monetary policy is tightened.

In fact, if we go back to trend, a simple trendline analysis argues for another $20tn decline from here.

The bad news, however, is that rapidly falling bond and equity prices are likely to create significant knock-on effects, or as Lapthorne puts it, “for risk-free assets to be so risky is bound to be problematic.”

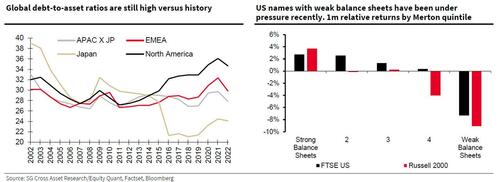

One such place is corporate leverage: Andrew warns that this problem, often swept under the carpet of rising asset prices, will no doubt emerge again as a concern as “debt piles haven’t shrunk, and instead, it is asset prices that have gone up.”

As such, SocGen’s conclusion is that it is “inevitable” that the current equity declines will lead to credit risk once again become something to avoid in equity markets.

More in the full post available to professional subscribers.

Tyler Durden

Mon, 05/16/2022 – 15:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com