Treasury Traders Face Read-Across From Euro-Area Inflation

By Ven Ram, Bloomberg Markets Live commentator and analyst

Interest-rate traders in the U.S. are perhaps starting to sense that the Fed may not need to raise rates by increments of 50 basis points beyond July. They need to be wary about their calculus.

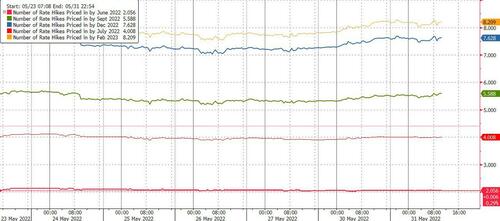

Fed funds’ futures and overnight index swaps are yo-yoing between 180 basis points and 190 basis points of tightening in the remainder of the year, having declined from near-firm pricing of 200 basis points a while ago. Given that the Fed has committed to moving by 50 basis points in both June and July, traders are factoring in just three and fractional 25-basis point hikes at subsequent meetings this year.

Yet that looks like complacency. If proof were needed, look no further than yesterday’s inflation numbers out of Germany and Spain. Price pressures in Europe’s biggest economy reached further than most economists had penciled in for May. Barely 300 miles to the west, in Belgium, inflation surged to levels a whole generation hadn’t seen before. (Meanwhile, Brent crude, a barrel of which hadn’t seen a price tag of $120 in a while, made yet another leg of ascent yesterday and is now hovering around $125.)

And yet, popular press would have wanted us to believe that we were already past “peak inflation” in March. Then April. And we still don’t know. You could split hairs trying to work out the top of inflation, but it seems more like a pedantic preoccupation at this stage than a calculus that may then tell us about how central bank pricing may evolve. For, regardless of when the peak occurs, elevated inflation — numbers running several times the Fed’s target — is here to stay.

It says something about the state of demand in the global economy that the dollar is hovering near its strongest in decades and yet commodity prices are still surging. And you only need to look at the tell-tale part of the Treasury yield curve to know that this economy can handle the Fed’s bigger-than-usual rate hikes. Even if late to acknowledge the severity of inflation, the Fed is now intent on getting it under control. And it may be nifty not to forget that the US goes into mid-term election in November. So even if headline inflation is still running at, say, 5%+/- around September, it may be premature and hasty to conclude that the Fed would make peace with a number that will represent a deceleration from current levels of around 8%+.

So, we may still get more than 50-basis point increases — in other words, there is still life in those meeting-dated swaps.

Tyler Durden

Tue, 05/31/2022 – 10:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com