Futures Dump Ahead Of Payrolls Despite Musk’s “Super Bad Feeling”

Tech stocks led US index futures slumped on the last day of the week, after a report about looming job cuts at Tesla deepened concerns about economic growth, and confirming what we wrote a week ago in “We Could See A Million Layoffs Or More” – Here Comes The Job Market Shock. Futures were lower as dismal trading volumes accentuating every sell order, and further reduced by UK holidays marking the Queen’s Jubilee. And speaking of the job market, in less than an hour we get the May payrolls print, where Wall Street consensus expects the a +320k number vs. +428k in April, although the whisper number is currently lower than survey at +301k, and as we noted last night, the odds of a negative print are non-trivial. Of course, should we get a subzero print, watch stocks explode higher as the Fed’s tightening plans are for all intents and purposes crushed. The Bloomberg dollar index steadied after overnight losses, Treasury yields held at around 2.91%, bitcoin resumed its slide and gold rose.

Anyway, back to markets, where S&P futures dropped 0.7%, down 30 points to 4,145 and Nasdaq 100 futures fell 1.1% trading at session lows…

… with Tesla, one of the biggest members of the tech-heavy index with a 4% weight, sliding 5% in premarket trading after Elon Musk said he had a “super bad feeling” about the economy and the electric carmaker needed to cut staff by about 10% and pause hiring. Other electric-vehicle stocks dropped in New York premarket trading following the Tesla report, with Nikola Corp. and Rivian Automotive Inc. lower. Elsewhere, Lululemon Athletica Inc. climbed after the athletic-wear retailer’s results surpassed analyst’s expectations and software company Okta Inc. rallied after its earnings.

“It’s very prudent by Tesla to reduce the staff,” Peter Garnry, head of equity strategy at Saxo Bank A/S, said on Bloomberg Television. “This market is not rewarding high revenue growth at all costs. You’re being rewarded from improvement in return on investor capital and free cash flow generation.” Here are other notable premarket movers:

- Okta (OKTA US) shares are up 16% in premarket trading after the software company reported first-quarter results ahead of expectations and raised its full-year forecast. Piper Sandler notes revenue acceleration and strength across key growth metrics, adding that it has increased “confidence in the story going forward.” BMO highlights “impressive” revenue that beat estimates.

- StoneCo (STNE US) soars 20% in premarket trading after its quarterly revenue more than doubled, but analysts expect the rally could be short-lived amid concerns about higher interest rates.

- RH (RH US) shares slipped 0.3% after the home-furnishing retailer warned of further slowdown in demand since Russia’s invasion of Ukraine and cited expectations for challenges for “several quarters” ahead.

- CrowdStrike (CRWD US) drops 2.5% after the security software company reported first-quarter results that were seen as mixed.

- PagSeguro (PAGS US) jumped after Brazilian fintech peer StoneCo reported quarterly adjusted net income that topped analysts’ expectations.

- Asana (ASAN US) dropped after the software company forecast an adjusted loss per share for the second quarter of 38c to 39c.

Investors remain on edge as some fear the pace of US monetary tightening could throw the world’s largest economy into a recession. Friday’s May labor report is likely to show the smallest gain in jobs since April 2021 alongside a down shift in average hourly earnings growth, Bloomberg Economics said.

“Investors remain nervous, trying to collect more information about earnings prospects on one side and economic data on the other,” said Cedric Ozazman, head of investment solutions at Mirabaud & Cie SA in Geneva. “The jobs report will be crucial as any bad news will reignite speculation about a pause in the Fed monetary tightening cycle during the last quarter of the year.” Of course, that means that “any bad economic news might be actually good for risky assets, as they will probably remove some pressure on interest rates,” Ozazman said.

On the other hand, Fed Vice Chair Lael Brainard said it was hard to see a case for a September pause in rate hikes and that increases of 50 basis points in June and July seemed reasonable.

In Europe, gains for real-estate and consumer companies outweighed declines in the cars and banking sectors, with the Stoxx Europe 600 Index rising 0.1%, erasing earlier gains. Here are the most notable European movers today:

- Rheinmetall gains as much as 3.9% after Warburg raised its rating on the stock to buy, noting comments by CEO indicating stronger-than-anticipated mid-term revenue potential, with peer Leonardo rising as much as 3.6%.

- Ringkjoebing Landbobank, or Rilba, rise as much as 8.4%. after the Danish lender boosted its FY pretax profit guidance. Handelsbanken notes a “positive development” in lending.

- Leonteq shares jump as much as 18% after the Swiss technology and service provider announced it expects to generate significant revenue growth on the back of strong net trading results.

- Avance Gas and BW LPG gain as Fearnley Securities calls the sector a “long-term value play,” increasing their target prices for the LPG firms it covers despite a strong year-to-date share rally.

- Lotos shares gain as much as 7.9% after Orlen offered a premium of about 9% with its all-stock deal to buy Lotos in a planned merger of Polish state-controlled refiners.

- PGS rise as much as 23% as Kepler Cheuvreux resumes coverage of the shares with a buy recommendation, seeing a more supportive macroeconomic environment and better liquidity.

- Aperam rises while Acerinox falls as Morgan Stanley says in a note that potentially combining their businesses would bring top-line and cost synergies via improved pricing power.

- Faurecia falls as much as 6.6% after the French automotive part maker launches EU705m rights issue as part of refinancing of Hella acquisition.

Asian stocks rose, poised for a third straight week of gains as investors awaited US non-farm payrolls for clues on the trajectory of interest rates. The MSCI Asia Pacific Index advanced as much as 0.7%, led by energy and material firms, with BHP Group and Reliance Industries among the biggest contributors. Gauges in Japan and Australia were the region’s best performers, while markets in China, Hong Kong and Taiwan were shut for a holiday. Investors are turning their attention to Friday’s data on non-farm payrolls following the release of weak private payrolls figures overnight. This comes as Federal Reserve Vice Chair Lael Brainard said expectations for half-percentage-point increases in interest rates this month and next were reasonable.

“The wide underperformance in job gains took the spotlight and the hopes that the Fed may take on a more cautious and gradual approach in tightening toward the latter part of the year may lead to some unwinding of hawkish expectations,” Jun Rong Yeap, a market strategist at IG Asia, wrote in a note. Asia’s benchmark index has climbed more than 7% from a trough in mid-May as the reopening of Shanghai supports stocks in China and Hong Kong. Still, the outlook for the region remains uncertain amid prospects of aggressive US monetary tightening, soaring inflation and China’s ongoing Covid-Zero stance.

Japanese stocks gain ahead of US labor report and as OPEC+ agreed to increase its oil production rates. Markets are closed in Hong Kong and China. The Topix index rose 0.4% to 1,933.14 as of market close in Tokyo, while the Nikkei 225 advanced 1.3% to 27,761.57. Sony Group Corp. contributed the most to the Topix Index gain, increasing 1.9%. Out of 2,170 shares in the index, 1,135 rose and 940 fell, while 95 were unchanged. “Inflation concerns are receding as labor market tensions are seen to be weakening from the US economic indicators and Beige Book,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities

Australian stocks rebounded, with the S&P/ASX 200 index rising 0.9% to close at 7,238.80, recouping Thursday’s 0.8% loss in a rally led by miners. Champion Iron gained on higher iron ore prices. Healius was the worst performer after flagging more difficult conditions in 2H. In New Zealand, the S&P/NZX 50 index rose 0.6% to 11,417.34. The gauge added 3.2% since Monday, posting its best week since Feb.

In FX, a Bloomberg dollar gauge steadied after yesterday’s loss and the euro traded around $1.0750. A day after pricing in a 50 basis-point rate hike by the ECB by the end of the year, traders are now betting that the move will happen by October itself. Australia’s swap spreads widened to the most in almost six years on speculation that the Reserve Bank will become more hawkish next week.

In rates, Treasuries are mostly unchanged across the curve with losses led by front-end, flattening spreads with 2s10s and 5s30s both tighter by over 1bp. 10-year TSY yields around 2.92%, flat on the day; bunds lag by additional 2bp in the sector. European bonds drifted at the open after yields rose to multi-year highs Thursday. US IG dollar issuance slate empty so far; four borrowers priced $3BNBThursday, pushing weekly volume up to $30b and high end of $25b to $30b forecast. Bloomberg notes that there has been some speculation that a jumbo Oracle deal (around $20BN) could come as early as next week which may see some rate lock selling flows weigh over Friday’s session.

In commodities, oil headed for a sixth weekly advance after a keenly anticipated OPEC+ meeting delivered only a modest increase in output that failed to assuage concerns over a widening supply deficit. Gas traders are rushing to secure LNG tankers ahead of winter with ship rates surging as sanctions on Russia reshape global energy flows, according to FT. NHC notes of a disturbance producing tropical-storm-force winds; with a new Tropical Storm warning issued for Florida, Cuba, and North-western Bahamas; additional strengthening possible late Saturday and Sunday. Spot gold is steady and comfortably above USD 1,850/oz pre-NFP, whilst base metals futures see the closure of Chinese and UK exchanges amid domestic holidays.

To the day ahead, where nonfarm payrolls will be the main event. We expect headline nonfarm payrolls to (+325k forecast vs. +428k previously) to slightly outperform private sector hiring (+300k vs. +406k). If our forecast is close to the mark, it should have the effect of lowering the unemployment rate by a tenth to 3.5%. With respect to other details of the report, average hourly earnings (+0.3% vs. +0.3%) will likely be a key focus for Fed policymakers. US ISM and PMI services readings are due, along with PMI composites. Service and composite PMIs are also due across Europe along with industrial production for France.

Market Snapshot

- S&P 500 futures down 0.6% to 4,148.00

- STOXX Europe 600 up 0.2%

- MXAP up 0.4% to 168.75

- MXAPJ up 0.4% to 555.45

- Nikkei up 1.3% to 27,761.57

- Topix up 0.4% to 1,933.14

- Hang Seng Index down 1.0% to 21,082.13

- Shanghai Composite up 0.4% to 3,195.46

- Sensex up 0.6% to 56,166.51

- Australia S&P/ASX 200 up 0.9% to 7,238.75

- Kospi up 0.4% to 2,670.65

- German 10Y yield up 1bp to 1.25%

- Euro up 0.1% to $1.0761

- Brent futures down 0.5% to $117.03/bbl

- Gold spot down 0.1% to $1,866.02

- U.S. Dollar Index down 0.1% to 101.69

Top Overnight News from Bloomberg

- Turkey is planning to restrict purchases by domestic investors of new lira bonds sold by multinational lenders, the latest effort to curb short selling of the local currency by limiting the supply of liquidity in the offshore market

- Turkey’s inflation soared in May to the fastest since 1998 as it came under more pressure from the rising cost of food and energy, while ultra- loose monetary policy contributed to currency weakness

- New Australian Prime Minister Anthony Albanese has made a submission to the country’s labor watchdog, proposing to lift minimum wages by more than the inflation rate in a bid to fulfill one of his key election promises

- The Japanese government will maintain its 2013 joint policy statement with the Bank of Japan and basically stick with the current macro economic policy, Prime Minister Fumio Kishida says Friday

- The yen is likely to come under more pressure as Japanese life insurers slash the proportion of the dollar-denominated investments they hedge to the lowest in more than a decade. The companies hedged just 43.3% of the 42.8 trillion yen ($330 billion) of their dollar assets at the end of March, down from 45.8% six months earlier. The figure was as high as 62.8% in September 2016

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks took impetus from the gains in the US but with advances capped in holiday-thinned conditions. ASX 200 was led higher by tech with the sector inspired following the outperformance of the Nasdaq stateside and with mining-related stocks underpinned by the recent gains across commodity prices. Nikkei 225 benefitted from recent currency weakness and with index heavyweight Fast Retailing among the biggest gainers after a double-digit percentage jump in its same-store sales. KOSPI is firmer but lagged behind regional counterparts after CPI data climbed to its highest in nearly 14 years and added to the pressure for the BoK to continue with its hiking cycle

Top Asian News

- Deputy USTR Bianchi said all options are on the table regarding tariff decisions on Chinese imports and that the USTR is seeking strategic realignment with China and a tariff structure that makes sense, while she added the USTR is to focus the China trade relationship on US concerns about Chinese non-market practices and economic coercion, according to Reuters.

- South Korean Finance Ministry said they are taking the inflation situation very seriously, while the BoK noted that demand-side inflation pressure is likely to build and that inflation is to be above 5% in June and July, according to Reuters.

- India Cumulative Monsoon Rainfall 35% Below Normal as of June 3

- India Reports Biggest Jump in Covid Cases in Almost Three Months

- Toshiba Director Opposes Board Nominees From Elliott, Farallon

- Meituan 1Q Beat Raises Optimism on Stock, Business: Street Wrap

European cash bourses are trimming the Wall Street-induced gains seen at the open (Euro Stoxx 50 +0.2%; Stoxx 600 +0.2%) – with volumes also low as British and Chinese traders observe domestic holidays. European sectors are mostly higher with the breadth of the market narrow. US equity futures post modest losses across the contracts, with the NQ (-0.7%) straddling behind peers, ES -0.4%. The modest downside coincided with Reuters reports that Tesla (-3.7% pre-market) CEO Musk, via an email, said they need to make roughly a 10% staff reduction and he has a “super bad feeling about the economy”.

Top European News

- SAS Woes Mount With Reports on Risks From Chinese Debt, Strikes

- Allianz Takes $430 Million Profit Hit in Retreat from Russia

- Aperam Says in Talks With Acerinox on Potential Combination

- Yara Takes Next Step on Path to Clean Ammonia Unit IPO

- Eurozone May Composite PMI 54.8 vs Flash Reading 54.9

- CRH to Buy Barrette Outdoor Living of US for $1.9 Billion

FX

- Greenback cagey and rangy pre-NFP with DXY holding between 102.000-101.500.

- Euro eyes more decent option expiry interest around 1.0750 – 1.1bln rolling off between 1.0755-45 to be precise.

- Yen relying on Fib retracement (130.17) for support as Treasury yields remain firm and risk sentiment buoyed, USD/JPY towards upper end of 130.08-129.69 range.

- Sterling somewhat sidelined as UK gears up for Jubilee Day festivities, Cable contained within 1.2589-69 confines, EUR/GBP tight around 0.8550.

- Lira extends losses as acceleration in Turkish PPI outweighs sub-forecast, but still firmer CPI, USD/TRY tops 16.5100.

- Yuan breaches more technical resistance levels as correction continues, USD/CNH sub-6.6200 at one stage overnight.

- Russian Foreign Ministry does not plan to conduct market forex operations this year as per its early decision to temporarily suspend budget rules, according to Reuters

Fixed Income

- Debt on the defensive after a few dead cat bounces ahead of US jobs data.

- Bunds unable to defend 150.00 or 1.25% in cash, Treasuries more contained and curve flat awaiting NFP amidst a busy pm docket.

- T-note just under par between 118-30/24 parameters.

Commodities

- Bitcoin is little changed on the session, holding above USD 30k, in-fitting with the broader contained tone as we await the afternoon’s US data docket following particularly thin APAC and European sessions owing to CWTI and Brent futures have been waning off best levels following the overnight consolidation seen in the aftermath of the OPEC+ confab.

- Gas traders are rushing to secure LNG tankers ahead of winter with ship rates surging as sanctions on Russia reshape global energy flows, according to FT.

- NHC notes of a disturbance producing tropical-storm-force winds; with a new Tropical Storm warning issued for Florida, Cuba, and North-western Bahamas; additional strengthening possible late Saturday and Sunday.

- Norway’s Industri Energy Labour Union says 573 members at oil/gas platforms would go on strike on June 12th, if wage negotiations fail; such action would impact nine installations; would not initially impact output, via Reuters.

- Spot gold is steady and comfortably above USD 1,850/oz pre-NFP, whilst base metals futures see the closure of Chinese and UK exchanges amid domestic holidays.hina and UK market holidays, respectively.

US event calendar

- 08:30: May Change in Private Payrolls, est. 302,000, prior 406,000

- May Change in Nonfarm Payrolls, est. 320,000, prior 428,000

- May Unemployment Rate, est. 3.5%, prior 3.6%

- May Labor Force Participation Rate, est. 62.3%, prior 62.2%

- May Average Hourly Earnings MoM, est. 0.4%, prior 0.3%; YoY, est. 5.2%, prior 5.5%;

- May Average Weekly Hours All Emplo, est. 34.6, prior 34.6

- 09:45: May S&P Global US Composite PMI, est. 53.8, prior 53.8

- 09:45: May S&P Global US Services PMI, est. 53.5, prior 53.5

- 10:00: May ISM Services Index, est. 56.5, prior 57.1

DB’s Jim Reid concludes the overnight wrap

Yesterday’s US employment data painted a mixed picture ahead of today’s official employment situation report. OPEC+ agreed to increase production targets but oil prices still managed to climb. Vice Chair Brainard and President Mester provided guidance ahead of the Fed’s blackout period, reinforcing expectations for the near-term path of policy. Sovereign bond markets were quiescent in ahead of jobs data today, which created fertile ground for equity markets to rally.

After a steady news leak about expanded production, OPEC+ agreed to increase production to +648k b/day, above the recent +400k b/day. Nevertheless, brent crude futures gained +1.14% over the session, as it was not clear whether all members had the capacity to increase production to the putative headline figures, if the totals merely represented production brought forward in time, or if the market expected larger increases after the week of rumors. After the production increase, the New York Times reported that President Biden plans to visit the crown prince in Saudi Arabia after much speculation.

Fed Vice Chair Brainard provided lucid guidance in the waning days before the Fed’s June communication blackout. She first put a pin on the intermeeting period by endorsing +50bp hikes for June and July, in a robust show of Committee consensus. As we mentioned yesterday, what the Fed will do in September is the next ‘live’ policy decision; Brainard weighed in, downplaying the chance of a pause given the current data outlook, instead dimensioning the decision between 25bp or 50bp hikes depending on the pace of inflation in the interregnum. President Mester later took things a step further, noting the pace of rate hikes could be accelerated if inflation readings merited, and that rates would probably need to get above neutral. Further, for those looking for evidence of a Fed put, Brainard noted that financial conditions are not yet at a concerning level.

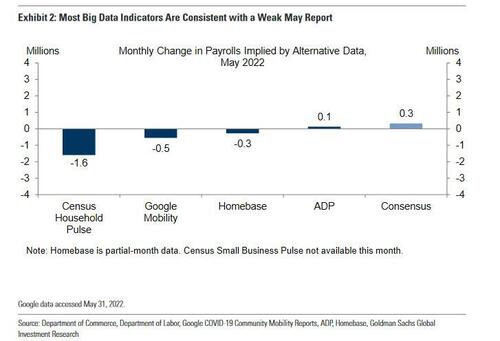

On the other side of the Fed’s mandate, ADP employment payrolls surprised to the downside, adding just +128k jobs versus expectations of +300k while the prior month was also revised lower. Small businesses, construction, and leisure hospitality sectors were sources of weakness. The series does not always have a strong signal for the nonfarm payrolls out later in the week, so it’s not clear if the miss is noise or signal of a labor market naturally slowing as ADP payrolls are now above their pre-pandemic levels.

Initial and continuing jobless claims, meanwhile, reinforced data elsewhere this week that shows the labor market is currently very robust. Initial jobless claims slowed to +200k, below expectations of +210k, while continuing claims hit their lowest level since 1969. Elsewhere in data, Eurozone PPI printed at +1.2% versus +2.0% expectations.

European sovereign yields underperformed, with 2yr bunds selling off +7.6bps ahead of next week’s ECB meeting, while 10yr yields gained +5.0bps. 10yr BTP spreads widened another +4.6bps to +206bps above bund equivalents. Treasury yields were much more subdued, with 10yr yields barely budging (+0.2bps). 10yr Treasury yields are about +1bp higher this morning. The relative calm in sovereign yields helped drive equity indices higher on both sides of the Atlantic. The STOXX 600 gained +0.57% while the Dax (+1.01%) and CAC (+1.27%) outperformed. US stocks performed even better, with the S&P 500 climbing +1.84% with every sector but energy in the green, and a solid shift from cyclical sectors. The small cap Russell 200 climbed +2.31% while the tech-heavy NASDAQ gained +2.69%. The S&P 500 is now +0.45% on the holiday shortened week, as it looks to make it back-to-back weekly gains for the first time in two months.

Asian equity markets are trading higher this morning amid thin holiday trading riding a strong Wall Street close . The Nikkei (+1.14%), Kospi (+0.38%) are in positive territory while markets in mainland China, Hong Kong are closed for a holiday.

Outside of Asia, US stock futures are fluctuating with contracts on the S&P 500 (+0.04%) and NASDAQ 100 (+0.07%) are little changed.

To the day ahead, where nonfarm payrolls will be the main event. We expect headline nonfarm payrolls to (+325k forecast vs. +428k previously) to slightly outperform private sector hiring (+300k vs. +406k). If our forecast is close to the mark, it should have the effect of lowering the unemployment rate by a tenth to 3.5%. With respect to other details of the report, average hourly earnings (+0.3% vs. +0.3%) will likely be a key focus for Fed policymakers. US ISM and PMI services readings are due, along with PMI composites. Service and composite PMIs are also due across Europe along with industrial production for France.

Tyler Durden

Fri, 06/03/2022 – 07:57

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com