Profit Recession Is Coming To US Equities

By Simon White, Bloomberg Markets Live Analyst and Commentator

There are pervasive and increasingly pronounced signs that US equities will be in a profit recession before the end of this year. Target’s warning on margins yesterday is emblematic of the problems faced by firms in an inflationary regime. Even if an economy-wide recession is avoided, the backdrop for equities is set to get worse before it gets better.

Inevitably — given the unequivocal message from leading indicators earlier this year — the emphasis in the market debate has shifted from inflation to growth. Higher rates and tighter liquidity have a more immediate effect on growth than inflation, and while inflation has yet to conclusively peak, growth is beginning to show the cracks you’d expect in the face of a Fed on the warpath.

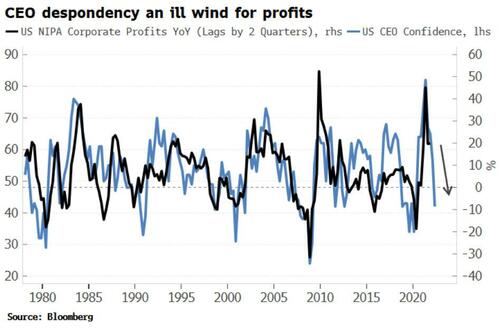

US large-cap earnings have been resilient this year, but here too there are worrying signs that seem set to worsen. One of those is sentiment. The Conference Board’s CEO Confidence Index has fallen sharply this year. This typically leads to weaker profit growth in the next 3-6 months. Furthermore, analysts are revising down their earnings estimates which also often precedes weaker earnings growth.

The stronger dollar is squeezing profits too. The direct effect comes from the ~40% of S&P revenues that come from abroad. But all revenues are impacted by the depressive influence of a higher dollar on global trade. South Korea, as a relatively small and open economy with a large export sector, is a leading indicator for global trade conditions. A steady decline in South Korean exports growth is a strong indication US earnings growth is facing more downside.

The weaker outlook for manufacturing is another rain cloud for earnings. Manufacturing may only be around 11% of US GDP, but it accounts for almost a third of corporate revenues, and therefore has an outsized impact on the whole economy. The fall in manufacturing new orders is gathering pace, yet another bad omen for earnings.

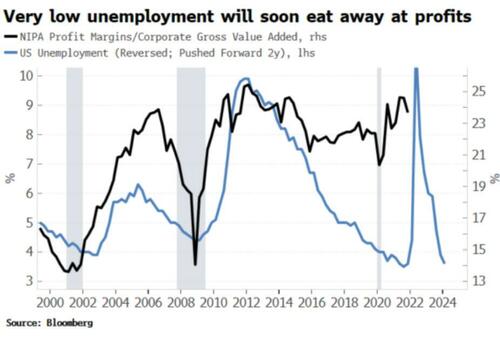

The largest corporate cost is labor, and the tightness of the US labor market is the biggest headwind US earnings face. Low unemployment leads to higher wages which eventually erodes margins. Margins will be increasingly squeezed by rising wages in the coming years, the effect multiplied if inflation triggers a wage-price spiral.

An earnings recession, though, does not guarantee the hammer-blow of a full recession. Over the last sixty years, there have been several large-cap earnings recessions – e.g. in 1975, 1985-86 and 2015-16 — that did not coincide or immediately precede an economy-wide recession.

Either way, there is no positive angle for equities. Even if a full recession — when all bets are off for stocks — is avoided an earnings recession still means equities will find it hard to stage a sustainable rally.

Selling in May, and going away until September’s St Leger’s Day, continues to seem like a sound decision.

Tyler Durden

Wed, 06/08/2022 – 12:39

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com