Goldman Sees S&P Tumbling To 3150 When The Recession Hits

After plunging on Friday, S&P futures are starting off the new week even lower with spoos at 3,864 in Sunday evening trading, just 10 points away from a bear market, with all other assets – treasuries, commodities and cryptos – all sharply lower as well, as traders freak out that the Fed will crash and burn the market and the economy just to contain inflation, forgetting that once the Fed achieves its mission of a hard landing (because a soft-landing won’t push jobs nearly low enough to short-circuit the wage-price spiral), it will be up to the Fed to restart the US economy (since Democrats will be kicked out of Congress in an avalanche this November) and with Biden president, there will be no fiscal stimulus for at least two more years.

With that in mind, Goldman’s chief equity strategist – whose economists now expect the Fed to hike 50bps in September, if keep the June hike at 50bps despite some banks such as Barclays now expecting a “surprise”, non-consensus 75bps rate hike this week – cautions clients that equity valuations remain far from depressed, to wit:

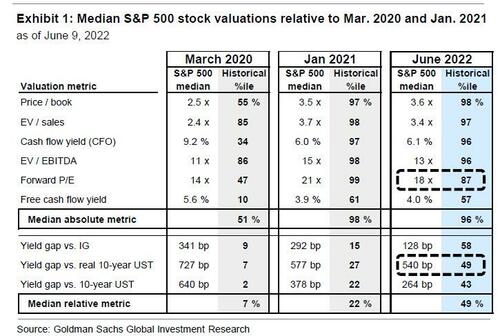

The median S&P 500 constituent’s P/E ratio of 18x ranks in the 87th percentile since 1976. For context, in March 2020 the median stock’s P/E was 14x (47th-percentile). Valuations appear more attractive in the context of interest rates, but still do not look “cheap.” The 540 bp gap between the median stock’s EPS yield and the real 10-year Treasury yield ranks in the 49th percentile, whereas in March 2020 the yield gap was 727 bp (7th percentile).

Yet as David Kostin writes in his latest Weekly Kickstart note (available to professional subs) his base case forecast valuation is expected to remain roughly flat while earnings growth does the heaving lifting and pushes the S&P back to 4300 at year-end 2022, some +10% from here – or at least until Kostin slashes his year end forecast once again, and for the 4th time in a row- as he himself hedges when warning that “inflation surprises like this morning’s will also affect the path of multiples, for better or worse.“

How do we know that Kostin is just biding his time until he cuts his S&P price target again (which will likely mark the bottom of stocks in the current cycle)? Because as he admits next, “some of the economic developments that have boded well for the Fed’s battle with inflation have intensified concerns about the earning outlook.” As a result, he notes that while “Valuations dominated investor focus in early 2022, but recent client conversations have centered on risks to EPS estimates” which of course is not news to regular readers and to those who have been focusing on Wall Street’s more bearish strategists, such as Morgan Stanley’s Mike Wilson, who has been warning for a while now that attention has shifted from multiples to earnings. Anyway, back to Kostin who writes that “company announcements have added to these concerns. Just weeks after shares fell by 25% on disappointing 1Q margins, Target (TGT) cut margin guidance this week as it struggles to manage excess inventory. Investors have also focused on a string of downbeat comments from tech companies. In recent weeks firms including AMZN, MSFT, and NVDA have signaled intentions to slow hiring. This development is positive in terms of balancing the labor market but reflects management anxiety about growth and inflation.”

Catching up to what Wilson has been saying for months, Kostin finally concedes that he, too, “expects further downward revisions to consensus earnings estimates.”

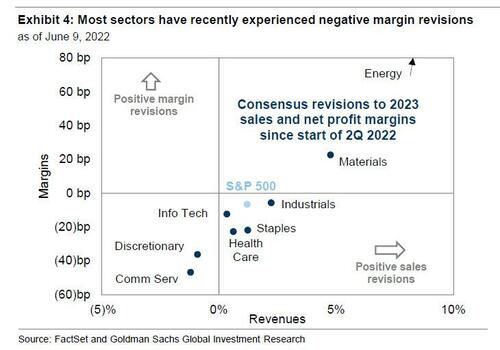

The Goldman strategist also warns that while “margins have driven the majority of recent analyst cuts, estimates still appear too high” and Kostin now expects S&P 500 net margins excluding Financials and Energy will slip from 12.7% in 2021 to 12.6% in 2023, even as consensus idiotically expects a 30 bps rise to 13.0%, even though most sectors (with the notable exception of Energy) have recently experienced negative margin revisions.

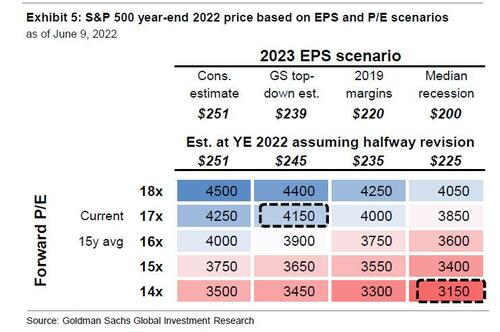

Keeping in mind that his latest note is just a placeholder for the forthcoming S&P price target cut, Kostin notes that his “base-case 2023 EPS forecast is $239, 5% below consensus of $251. If the economy contracts, the 13% median historical recession decline would bring 2023 EPS to $200. If the economy avoids recession, but margins and revenues for most sectors return to pre-COVID trends, S&P 500 EPS would equal roughly $215.”

The chart below summarizes the potential S&P 500 levels at year-end 2022 based on various EPS and P/E scenarios (which a first year analyst can do on their own, of course). The scenarios assume that by year-end consensus 2023 EPS forecasts move halfway from current estimates to eventual actual EPS. For example, if the consensus 2023 EPS estimate moves halfway to our top-down forecast of $239 and the P/E multiple remains at 17x, the implied index level would equal 4165. If the EPS estimate moves to $225, halfway to the recession scenario of $200, a 14x P/E would bring the S&P 500 to 3150.

What we find more interesting is Goldman’s admission that a worst-case scenario is likely, and what that would mean for the S&P:

In a recession, if the EPS estimate moves halfway to $200, a 14x P/E would bring the S&P 500 to 3150.

What does all this mean for investors, especially those who aren’t dumping everything yet because they realize that the coming Fed freakout and equity ETF buying will be something never before seen:

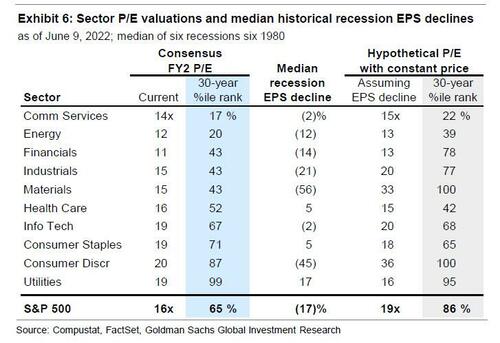

Investors looking for value opportunities should consider both valuations and potential downside risk to earnings estimates. For example, at the sector level, Energy trades well below its 30-year average P/E multiple in absolute terms, and close to record lows relative to the S&P 500. Even haircutting its EPS by the median of the past six recessions, the P/E ratio today would still rank below the 30-year average. While Health Care trades at a P/E close to its 30-year average, it has grown EPS during each of the last six recessions, and looks more attractively valued today than other defensive sectors like Utilities.

What about growth stocks ahead of the coming recession? Somewhat controversially, Kostin is not overly negative here, and writes that at a factor level, “the macro environment is becoming more favorable for Growth stocks” yet valuations is one reason he still prefer “quality” attributes.

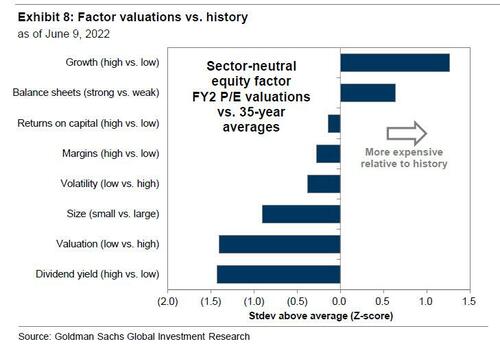

Hints of easing inflation and less need for FCI tightening help explain the recent Growth stock rebound, including the past month’s 30% return for the GS Non-Profitable Tech Basket (GSXUNPTC). Concerns about corporate earnings also increase the appeal of secular growth stocks. However, the outlook for the Fed’s battle with inflation remains uncertain, as underscored by today’s CPI data and our commodity strategists raising their Brent forecast to $140/barrel. In addition, the valuation spread between Growth and Value remains wide relative to history. In contrast, our sector-neutral low volatility, high profit margin, and high return on capital factors each trade at discounts to their historical average valuations.

Bottom line: we commiserate with Kostin who is tacitly hinting that yet another S&P price target cut is looming, especially when one considers that a recession is now just months if not weeks away, (one which as Kostin concedes would send the S&P tumbling to 3,150) an outcome which is abundantly clear when reading the latest note from that other Goldman trader and strategist, Tony Pasquariello, who unlike Kostin is not afraid to say what he really thinks.

Tyler Durden

Sun, 06/12/2022 – 20:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com