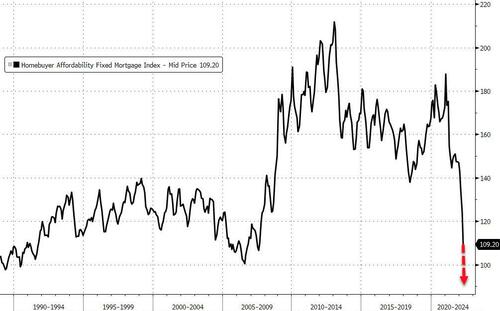

Housing Affordability Hits Record Low As Mortgage Rates Soar To 6.1%

Back in March, when the average mortgage rate was still “only” 4.5%, we anticipated the coming rate explosion and warned that “Housing Affordability Is About To Crash The Most On Record.” Fast forward to today when the latest 30Y average mortgage has just surged to a stunning 6.13% from 3.25% at the start of the year …

… the highest rate since the great housing crash of 2007/2008, in the process sending housing affordability – just as we warned – to the lowest on record.

Alas, it’s about to get even lower, because a simple back of the envelope calculation reveals that the jump in mortgage rates from 3.25% to 6.13% means that new homebuyers face an average monthly payment on a typical new $350,000 mortgage (the median existing home sale price is just under $400K) that has gone up from $1523 to $2128, a 40% increase in 6 months!

Another way of putting this: at a 6.13% mortgage (and rates will still keep rising for a long time with the Fed now set to hike between 125bps and 150bps in the next two months), the average home price needs to fall 30% to reach pre-covid affordability.

Whether it was intended or not, the Fed is about to unleash the biggest housing crisis since the bursting of the 2007 bubble. It also means that in a few weeks, the Fed’s scramble to undo the damage it has done to the US economy will make March 2020 seems like a walk in the park.

Tyler Durden

Mon, 06/13/2022 – 21:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com