Kemp: White House Tries To Blame US Refiners For Its Own Overheating Error

By John Kemp, senior energy analyst at Reuters

The White House has sought to deflect the blame for high gasoline prices onto refiners for cutting capacity and not making enough fuel, but the real source of the price increases is the attempt to run the economy “hot”. In conjunction with the Federal Reserve, White House policy has been to run the economy as fast as possible to minimise unemployment and under-employment, especially among the most disadvantaged groups in the labor market.

But spare capacity is not evenly distributed across the economy; there has proved to be much less unused capacity in the fuel market than in the labor market. As a result, capacity has run out in the fuel market before it is exhausted in the job market. Tensions in the fuel market are generating rapid price increases which are propagating across the rest of the economy.

The imposition of sanctions in response to Russia’s invasion of Ukraine has intensified the inflation problem because Russia was one of the world’s largest exporters of both crude and middle distillates.

In the event, the fuel supply system, not the job market, has proved to be the economy’s rate-limiting factor, which has thrown the White House’s economic and political strategies off course.

The Pinch Point

In trying to lower fuel prices and tame inflation, the White House has focused on gasoline, which is the price most visible to consumers and therefore the most politically sensitive ahead of congressional elections in November. But the most severe fuel shortage is actually in middle distillates, a category including diesel, jet fuel and kerosene, which is hitting freight hauliers and airlines hardest.

Increased costs for moving freight and passengers are, in turn, spilling over into faster price increases for a broad range of merchandise and services.

Shortages of diesel and jet fuel are also pulling up the international price of crude, and with it, gasoline prices for motorists.

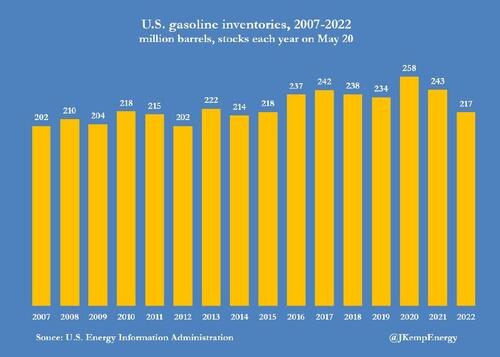

On June 10, U.S. gasoline inventories were 16 million barrels (7%) below the pre-pandemic five-year seasonal average, according to the Energy Information Administration (“Weekly petroleum status report”, EIA, June 15).

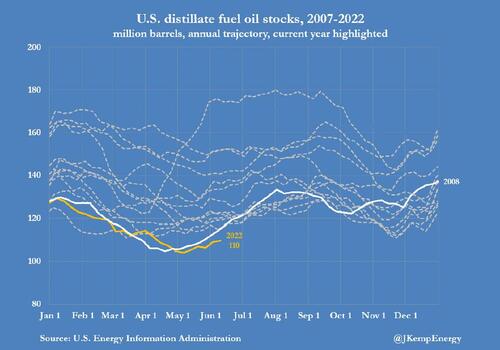

But stocks of distillate fuel oil were 26 million barrels (19%) below the seasonal average for 2015-2019, leading to intense upward pressure on distillate prices and margins.

Max Distillates

Responding to record margins, refineries have been running flat out to produce more middle distillates, especially the diesel used by truckers, railroads, manufacturers, miners, farmers and the oil and gas industry itself.

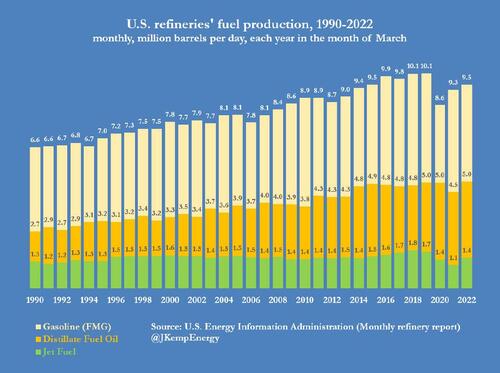

U.S. refiners produced 6.4 million barrels per day of mid-distillates in March 2022, the most recent available data, only slightly lower than the record 6.7 million bpd in March 2019. The reduction was attributable to jet fuel, where refiners produced 1.4 million bpd in March 2022, compared with 1.7 million bpd in March 2019, reflecting reduced in airline schedules.

Production of distillate fuel oil, the category including road diesel, was 5.0 million bpd in March 2022, equaling its previous peak in March 2019.

Refineries have adjusted their downstream units to squeeze as much middle distillate as possible from the crude they process.

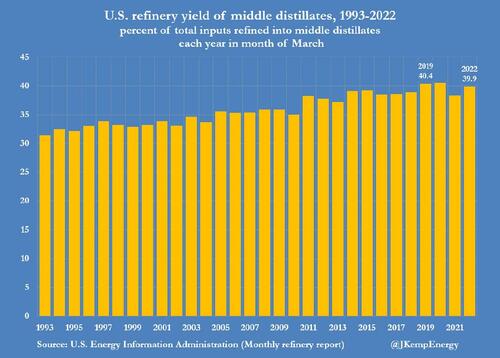

Refiners turned 39.9% of the crude they processed into mid-distillates in March 2022, only slightly less than the pre-pandemic record of 40.4% in March 2019.

Once again, the entire reduction was accounted for by jet fuel, where demand remains down compared with before the pandemic. Excluding the pandemic year, where yields were heavily distorted, refiners turned a record 30.9% of crude processed into distillate fuel oil in March 2022, up from 29.9% in March 2019.

Refiners have now run out of spare capacity to produce more mid-distillates to meet booming demand and rebuild depleted inventories.

The intense focus on making mid-distillates is already coming at the expense of lower gasoline production and stocks, which is driving up gasoline margins and prices, costing motorists even more at the pump.

Rather than blaming refiners for not making enough fuel, the White House needs to realize that its attempt to run the economy as fast as possible has caused it to overheat. To bring inflation under control, the economy needs a period of slower growth to allow fuel production and other supply-side measures of industrial capacity to catch up.

Tyler Durden

Fri, 06/17/2022 – 15:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com