Global PMIs Promise Further Rates Downside

By Simon Flint, Bloomberg Markets Live commentator and analyst

The themes of mounting recession risks and declining price pressure – leading to lower rates – are apparent in JP Morgan’s consolidated manufacturing PMIs for June. The overall manufacturing PMIs showed a falling headline figure, and more depressed new orders. Rapidly improving price data and Supplier Delivery Times (SDTs) undercut inflation fears. In more detail:

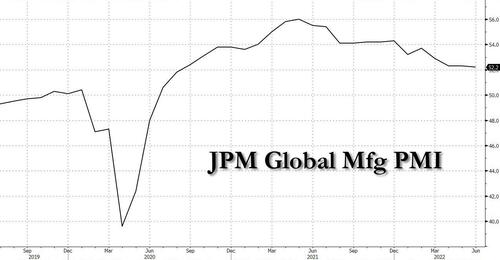

The global manufacturing PMI declined by only 0.1 point to 52.2, held up by parts of EM and rogue G-10 countries like Australia.

This figure has been trending lower since May 2021

- New orders were less encouraging, falling 0.8 points to 50.1. This bodes somewhat ill for the headline number, which has a 20% lagged correlation in changes terms since July 2019

- Output prices fell to 65.8, decisively lower than the April peak of 69.9, and the largest decline since April 2020

- SDTs improved sharply with the most rapid rate of improvement since June 2020 and now sit well above the pits of 34.7 in Oct. 2021

The global PMIs have both coincident and leading relationships with 10-year interest rates, suggesting that yields can fall.

Using data from July 2019 through June 2022, the levels correlation for the headline number, new orders, output prices, and Supplier Delivery Times (SDTs) are 30%, 55%, 63% and -15% respectively (remember SDTs are inverted, so a lower number is more inflationary). These correlations tend to rise steadily until the PMIs are lagged by four months.

Readers might immediately think that these figures are blown-up by the Covid shock, making them very unreliable.

But using data from 2015 through 2019, simultaneous changes and lagged correlations with yields are surprisingly high, at least for output prices and SDT. Output prices enjoy an 88% simultaneous correlation in terms of changes and the correlation remains above 40% until the 3rd lag. SDTs start insignificant at -10% (concurrent), but correlations intensify steadily to -43% at a 6-month lag. The headline PMI number correlated by an average of 13% over 1-5 month lags.

This makes sense. The recent focus on inflation risk has been key for rates, and can be immediately felt through higher output prices. SDTs tend to act with a delay, as unresolved supply problems are more gradually pushed into prices. This looks to be borne out by a somewhat lagged relationship between SDTs and output prices.

Tyler Durden

Tue, 07/05/2022 – 05:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com