Euro Parity Will Probably Be Short-Lived Thanks To China

By Simon White, Bloomberg Markets live commentator and reporter

The vulnerabilities of Europe and the euro are well known. Contrarily, the euro is unlikely to spend too long below parity, before the halting recovery in China gains momentum and supports the European economy.

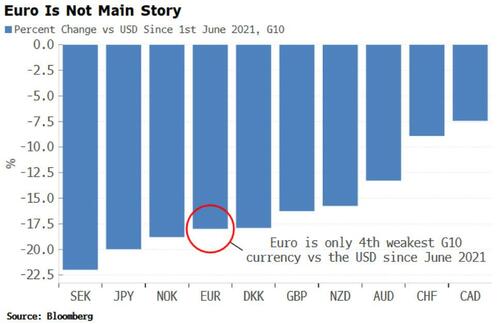

The euro looks very likely to sink below the dollar parity level for the first time in 20 years. While that is the story today, it’s really been a dollar story over the last year. The euro is only the fourth weakest G-10 currency versus the USD since June 2021, when the DXY started rising.

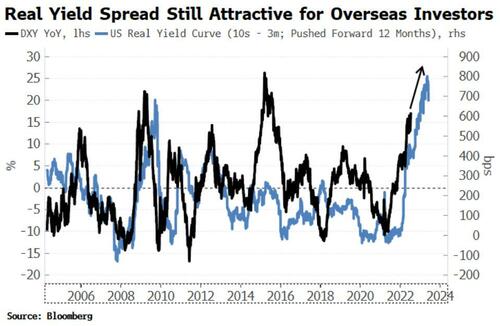

The Fed remains the most dominant influence on the dollar. The best leading indicator for the currency I have found is the real yield curve, which has been steepening as short-term real yields have fallen by more than long-term ones, pointing to the stronger USD.

The relationship, if it continues to hold, suggests the dollar may not be quite done yet. But we can also see the real yield curve has started to flatten, which may mean the USD is nonetheless nearing some sort of top.

This would take some pressure off the euro — but not yet — and a move below parity is still very likely, with some inevitable follow-through as FX option levels are no longer protected by dealers.

The problems of Europe are well known. The economy is sclerotic, and the collapse in real money growth to below zero implies a recession is all but guaranteed. Europe’s energy dependence is also well discussed, and the euro-zone’s trade balance has slipped into deficit for the first time since the 2012 crisis. This is another drag, although the current account remains in surplus, buoyed by net income inflows.

It is easy to paint a doom-laden picture for the euro, but markets tend to do the opposite when fear or greed is extreme. Relative trends are what matters for currencies. While real money growth is falling in Europe, it is falling much faster in the US (from a higher level). EUR/USD also looks overdone versus real interest-rate differentials, which have started to rise in the euro’s favor.

But it’s China that may prove to be a decisive arm of support in the coming months. The recovery there is faltering somewhat at the moment, but real money growth (deflated by PPI) gives a very good lead on European growth (proxied by the manufacturing PMI). Further momentum in China’s recovery will promise to help stabilize Europe and support the euro.

Tyler Durden

Wed, 07/13/2022 – 06:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com