Global Markets Slump With Terrified Traders Tracking Pelosi’s Next Move

Forget inflation, stagflation, recession, depression, earnings, Biden locked up in the basement with covid, and everything else: today’s it all about whether Nancy Pelosi will start World War 3 when she lands in Taiwan in 3 hours.

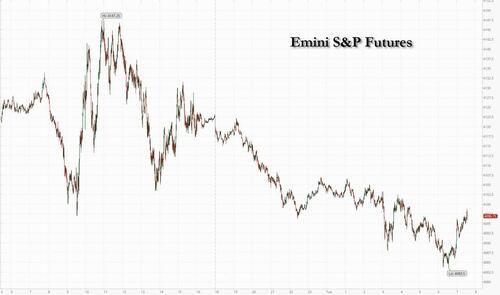

US stocks were set for a second day of declines as investors hunkered down over the imminent (military) response by China to Pelosi’s Taiwan planned visit to Taiwan, along with the risks from weakening economic growth amid hawkish central bank policy. Nasdaq 100 contracts were down 0.7% by 7:30a.m. in New York, while S&P 500 futures fell 0.6% having fallen as much as 1% earlier. 10Y yields are down to 2.55% after hitting 2.51% earlier, while both the dollar and gold are higher.

Elsewhere around the world, Europe’s Stoxx 600 fell 0.6%, with energy among the few industries bucking the trend after BP hiked its dividend and accelerated share buybacks to the fastest pace yet after profits surged. Asian stocks slid the most in three weeks, with some of the steepest falls in Hong Kong, China and Taiwan.

Among notable movers in premarket trading, Pinterest shares jumped 19% after the social-media company reported second-quarter sales and user figures that beat analysts’ estimates, and activist investor Elliott Investment Management confirmed a major stake in the company. US-listed Chinese stocks were on track to fall for a fourth day, which would mark the group’s longest streak of losses since late-June, amid the rising geopolitical tensions. In premarket trading, bank stocks are lower amid rising tensions between the US and China. S&P 500 futures are also lower, falling as much as 0.9%, while the 10-year Treasury yield falls to 2.56%. Cowen Inc. shares gained as much as 7.5% after Toronto-Dominion Bank agreed to buy the US brokerage for $1.3 billion in cash. Meanwhile, KKR’s distributable earnings fell 9% during the second quarter as the alternative-asset manager saw fewer deal exits amid tough market conditions. Here are some other notable premarket movers:

- Activision Blizzard (ATVI US Equity) falls 0.6% though analysts are positive on the company’s plans to roll out new video game titles after it reported adjusted second-quarter revenue that beat expectations. While the $68.7 billion Microsoft takeover deal remains a focus point, the company is building out a “robust” pipeline, Jefferies said.

- Arista Networks (ANET US) analysts said that the cloud networking company’s results were “impressive,” especially given supply-chain constraints, with a couple of brokers nudging their targets higher. Arista’s shares rose more than 5% in US after-hours trading on Monday after the company’s revenue guidance for the third quarter beat the average analyst estimate.

- Avis Budget (CAR US) saw a “big beat” on low Americas fleet costs and strong performance for its international segment, Morgan Stanley says. The rental-car firm’s shares rose 5.5% in US after-hours trading on Monday, after second-quarter profit and revenue beat the average analyst estimate.

- Snowflake (SNOW US) falls 5.3% after being cut at BTIG to neutral from buy, citing field checks that show a potential slowdown in product revenue growth in the coming quarters.

- Clarus Corp. (CLAR US) should continue to see “outsized demand” from the “mega-trend” of people seeking the great outdoors, Jefferies says, after the sports gear manufacturer reported second-quarter sales that beat estimates. Clarus’s shares climbed 9% in US postmarket trading on Monday.

- Cryptocurrency-exposed stocks are lower in US premarket trading as Bitcoin falls for the third consecutive session as global markets and cryptocurrencies remain pressured over deepening US-China tension. Coinbase (COIN US) falls 2.3% while Marathon Digital (MARA US) drops 3.3%.

- Transocean (RIG US) rises 18% in US premarket trading after 2Q Ebitda beat estimates, with other positives including a new contract and a 2-year extension of a revolver.

- US-listed Chinese stocks are on track to fall for a fourth day, which would mark the group’s longest streak of losses since end-of-June, amid geopolitical tensions related to House Speaker Nancy Pelosi’s expected visit to Taiwan. Alibaba (BABA) falls 2.5% and Baidu (BIDU US) dips 2.7%

- ZoomInfo Technologies analysts were positive on the software firm’s raised guidance and improved margins, with Piper Sandler saying the firm is “in a class of its own.” The shares rose more than 11% in US after-hours trading, after closing at $37.73.

Pelosi is expected to land in Taiwan on Tuesday, the highest-ranking American politician to visit the island in 25 years, a little after 10pm local time evening in defiance of Chinese threats. China, which regards Taiwan as part of its territory, has vowed an unspecified military response to a visit that risks sparking a crisis between the world’s biggest economies. “There is no way people will want to put on risk right now with this potential boiling point,” said Neil Campling, head of tech, media and telecom research at Mirabaud Securities. The potential ramifications of Pelosi’s planned visit “are huge.”

The growing tensions are the latest addition to a myriad of challenges facing equity investors going into the second half of the year. Fears of a US recession as the Federal Reserve tightens policy to tame soaring inflation have weighed on risk assets. US manufacturing activity continued to cool in July, with the data highlighting softer demand for merchandise as the economy struggles for momentum. In the off chance we avoid world war, there will be a shallow recession that could start by the end of the year, according to Rupert Thompson, chief investment officer at Kingswood Holdings. Meanwhile, the market is too optimistic about the path of monetary policy and “the risk is the Fed goes further than the markets are building in in terms of hiking,” Thompson said in an interview with Bloomberg Television.

Goldman Sachs strategists also said it was too soon for stock markets to fade the risks of a recession on expectations of a pivot in the Fed’s hawkish policy. On the other hand, JPMorgan strategists said the outlook for US equities is improving for the second half of the year on attractive valuations and as the peak in investor hawkishness has likely passed.

“Although the activity outlook remains challenging, we believe that the risk-reward for equities is looking more attractive as we move through the second half,” JPMorgan’s Marko Kolanovic wrote in a note dated Aug. 1. “The phase of bad data being interpreted as good is gaining traction, while the call of peak Federal Reserve hawkishness, peak yields and peak inflation is playing out.”

Markets are also bracing for commentary on the US interest-rate outlook from Chicago Fed President Charles Evans and St. Louis Fed President James Bullard.

In Europe, tech, financial services and travel are the worst-performing sectors. Euro Stoxx 50 falls 0.8%. FTSE 100 is flat but outperforms peers. Here are some of the biggest European movers today:

- BP shares rise as much as 4.8% on earnings. The oil major’s quarterly results look strong with an earnings beat, dividend hike and increased buyback all positives, analysts say.

- OCI rises as much as 8.6%, the most since March, on its latest earnings. Analysts say the results are ahead of expectations and the fertilizer firm’s short-term outlook remains robust.

- Maersk shares rise as much as 3.7% after the Danish shipping giant boosted its underlying Ebit forecast for the full year. Analysts note the boosted guidance is significantly above consensus estimates.

- Greggs shares rise as much as 4% after the UK bakery chain reported an increase in 1H sales. The 1H results are “solid,” while the start to 2H is “robust,” according to Goodbody.

- Delivery Hero shares gain as much as 3.8%. The stock is upgraded to overweight from neutral at JPMorgan, which said many of the negatives that have weighed on the firm are starting to turn.

- Rotork gains as much as 4%, the most since June 24, after beating analyst expectations for 1H 2022. Shore Capital says the company shows “good momentum” in the report.

- Credit Suisse shares decline as much as 6.4% after its senior debt was downgraded by Moody’s, and its credit outlook cut by S&P, while Vontobel lowered the PT following “disappointing” 2Q earnings.

- Travis Perkins shares drop as much as 11%, the most since March 2020. Citi says the builders’ merchant’s results are “slightly weaker than expected,” with RBC noting shortfalls in sales and Ebita.

- DSM shares drop by as much as 4.9% as Citi notes weak free cash flow after company reported adjusted Ebitda for the second quarter up 5.3% with FY22 guidance unchanged.

- UK homebuilders fall after house prices in the country posted their smallest increase in at least a year, indicating that the property market is starting to cool, with Crest Nichols dropping as much as 5.2%.

- Wind-turbine stocks fall in Europe after Spain’s Siemens Gamesa cut sales and margin guidance, with Siemens Energy dropping as much as 6.1%, with Vestas Wind Systems down as much as 4.7%.

Earlier in the session, Asian stocks fell as traders braced for a potential escalation of US-China tensions given a possible visit by US House Speaker Nancy Pelosi to Taiwan. The MSCI Asia Pacific Index dropped as much as 1.4%, poised for its worst day in five weeks. All sectors, barring real estate, were lower with chipmaker TSMC and China’s tech stocks among the biggest drags on the regional measure. Pelosi is expected to arrive in Taipei late on Tuesday. Beijing regards Taiwan as part of its territory and has promised “grave consequences” for her trip. Benchmarks in Hong Kong, China and Taiwan were among the laggards in Asia, slipping at least 1.4% each. Japan’s Topix declined as the yen received a boost from safe-haven demand.

还没打就见血了。4400个股票受伤。

Chinese stocks collapsed in the shadow of a looming conflict. 4400 of 4800 stocks hurt. pic.twitter.com/zo66di9W7I

— Hao HONG 洪灝, CFA (@HAOHONG_CFA) August 2, 2022

“I do expect a negative feedback loop into China-related equities especially those related to the semiconductor and technology sectors as Pelosi’s potential visit to Taiwan is likely to harden the current frosty US-China tech war,” said Kelvin Wong, analyst at CMC Markets (Singapore). Pelosi’s controversial trip is souring a nascent revival in risk appetite in the region that saw the MSCI Asia gauge rise in July to cap its best month this year. China’s economic slowdown continues to weigh on sentiment, as authorities said this year’s economic growth target of “around 5.5%” should serve as a guidance rather than a hard target.

Japanese equities fell as the yen soared to a two month high over concerns of US-China tensions escalating with US House Speaker Nancy Pelosi expected to visit Taiwan on Tuesday. The Topix fell 1.8% to 1,925.49 as of the market close, while the Nikkei declined 1.4% to 27,594.73. Toyota Motor Corp. contributed the most to the Topix Index decline, decreasing 2.6%. Out of 2,170 shares in the index, 227 rose and 1,903 fell, while 40 were unchanged. Pelosi would become the highest-ranking American politician to visit Taiwan in 25 years. China views the island as its territory and has warned of consequences if the trip takes place. “The relationship between the US and China was just about to enter into a period of review, with a move from the US to reduce China tariffs,” said Ikuo Mitsui a fund manager at Aizawa Securities. That could change now as a result of Pelosi’s visit, he added

Meanwhile, Australia’s S&P/ASX 200 index erased an earlier loss of as much as 0.7% to close 0.1% higher after the Reserve Bank’s widely-expected half-percentage point lift of the cash rate to 1.85%. The index wiped out a loss of as much as 0.7% in early trade. The RBA’s statement was “not as hawkish as anticipated and the lower growth forecast suggests the RBA is aware of both the domestic and international drags on the economy,” said Kerry Craig, global market strategist at JPMorgan. “We expect the RBA will continue to push interest rates back to a neutral level this year given the successive upgrades to the inflation outlook, but 2023 looks to be a much less eventful year for the RBA,” Craig said. Banks and consumer discretionary advanced to boost the index, while miners and energy shares declined. In New Zealand, the S&P/NZX 50 index rose less than 0.1% to 11,532.46.

Indian stock indexes are on course to claw back this year’s losses on steady buying by foreigners. The S&P BSE Sensex closed little changed at 58,136.36 in Mumbai, after falling as much as 0.6% earlier in the day. The measure is now just 0.2% away from turning positive for the year. The NSE Nifty Index too is a few ticks away from moving into the green. Nine of the BSE Ltd.’s 19 sector sub-indexes advanced on Tuesday, led by power and utilities companies. Foreigners bought local shares worth $836.2 million in July, after pulling out a record $33 billion from the Indian equity market since October. July was the first month of net equity purchases by foreign institutional investors, after nine months of outflows. Still, “choppiness would remain high due to the upcoming RBI policy meet outcome and prevailing earnings season,” Ajit Mishra, vice-president for research at Religare Broking Ltd. wrote in a note. “Participants should continue with the buy-on-dips approach.” The Reserve Bank of India is widely expected to raise interest rates for a third straight time on Friday. Of the 33 Nifty companies that have reported results so far, 18 have beaten the consensus view while 15 have trailed. Of the 30 shares in the Sensex index, 16 rose, while 14 fell. IndusInd Bank and Asian Paints were among the key gainers on the Sensex, while Tech Mahindra Ltd. and mortgage lender Housing Development Finance Corp were prominent decliners.

In FX, the Bloomberg dollar spot index rises 0.1%. JPY and CAD are the strongest performers in G-10 FX, NOK and AUD underperforms, after Australia’s central bank hiked rates by 50 basis-points for a third straight month and signaled policy flexibility. USD/JPY dropped as much as 0.9% to 130.41, the lowest since June 3, in the longest streak of daily losses since April 2021. Leveraged accounts are adding to short positions on the pair ahead of Pelosi’s visit, Asia-based FX traders said.

In rates, treasuries extended Monday’s rally in early Asia session as 10-year yields dropped as low as 2.514% amid escalating US-China tension over Taiwan. Treasury yields were richer by up to 5bp across long-end of the curve, where 20-year sector continues to outperform ahead of Wednesday’s quarterly refunding announcement, expected to make extra cutbacks to the tenor. US 10-year yields off lows of the day around 2.55%, lagging bunds by 4bp and gilts by 4.5bp. US stock futures slumped given risk adverse backdrop, adding support into Treasuries while bunds outperform as traders scale back ECB rate hike expectations. The yield on the two-year German note, among the most sensitive to rate hikes, fell as low as 0.17%, its lowest since May 16. Gilts also gained across the curve. Bund curve bull-steepens with 2s10s widening ~2 bps. Gilt and Treasury curves mostly bull-flatten. Australian bonds soared after RBA delivered a third- straight 50bp rate hike as expected, but gave itself wriggle room to slow the pace of tightening in the coming months.

In commodities, WTI trades within Monday’s range, falling 0.6% to trade around $93, while Brent falls below $100. Spot gold is little changed at $1,779/oz. Base metals are mixed; LME nickel falls 2% while LME zinc gains 0.6%.

Bitcoin remains under modest pressure and has incrementally lost the USD 23k mark, but remains comfortably above last-week’s USD 20.6k trough.

Looking to the day ahead now and there is a relatively short list of economic indicators to watch, including June JOLTS report and total vehicle sales (July) for the US, UK’s July Nationwide house price index and July PMI for Canada. Given the apparent uncertainty about the direction of the Fed in markets, many will be awaiting Fed’s Bullard, Mester and Evans, who will speak throughout the day. And in corporate earnings, it will be a busy day featuring results from BP, Caterpillar, Ferrari, Marriott, KKR, Uber, S&P Global, Occidental Petroleum, Electronic Arts, Gilead Sciences, Advanced Micro Devices, Starbucks, Airbnb, PayPal, Marathon Petroleum.

Market Snapshot

- S&P 500 futures down 0.6% to 4,096.50

- STOXX Europe 600 down 0.5% to 435.13

- MXAP down 1.3% to 159.73

- MXAPJ down 1.3% to 516.82

- Nikkei down 1.4% to 27,594.73

- Topix down 1.8% to 1,925.49

- Hang Seng Index down 2.4% to 19,689.21

- Shanghai Composite down 2.3% to 3,186.27

- Sensex little changed at 58,120.97

- Australia S&P/ASX 200 little changed at 6,998.05

- Kospi down 0.5% to 2,439.62

- German 10Y yield little changed at 0.74%

- Euro down 0.3% to $1.0231

- Brent Futures down 0.6% to $99.44/bbl

- Gold spot down 0.1% to $1,770.93

- U.S. Dollar Index up 0.15% to 105.61

Top Overnight News from Bloomberg

- Oil Steadies Before OPEC+ as Traders Weigh Up Market Tightness

- China Slaps Export Ban on 100 Taiwan Brands Before Pelosi Visit

- Pozsar Says L-Shaped Recession Is Needed to Conquer Inflation

- Pelosi’s Taiwan Trip Raises Angst in Global Financial Markets

- Taiwan Risk Joins Long List of Reasons to Shun China Stocks

- Biden Says Strike in Kabul Killed a Planner of 9/11 Attacks

- Biden Team Tries to Blunt China Rage as Pelosi Heads for Taiwan

- The Best and Worst Airlines for Flight Cancellations

- GOP Plans to Deploy Obscure Rule as Weapon Against Spending Bill

- US to Stop TSMC, Intel From Adding Advanced Chip Fabs in China

- US Anti-Terrorism Operation in Afghanistan Kills Al-Qaeda Leader

- They Quit Goldman’s Star Trading Team, Then It Raised Alarms

- Sinema’s Silence on Manchin’s Deal Keeps Everyone Guessing

- Manchin Side-Deal Seeks to Advance Mountain Valley Pipeline

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the weak performance across global counterparts as tensions simmered amid Pelosi’s potential visit to Taiwan. ASX 200 was initially pressured ahead of the RBA rate decision where the central bank hiked by 50bp, as expected, although most of the losses in the index were pared amid a lack of any hawkish surprises in the statement and after the central bank noted it was not on a pre-set path. Nikkei 225 declined amid a slew of earnings and continued unwinding of the JPY depreciation. Hang Seng and Shanghai Comp underperformed due to the ongoing US-China tensions after reports that House Speaker Pelosi will arrive in Taiwan late on Tuesday despite the military threats by China, while losses in Hong Kong were exacerbated by weakness in tech and it was also reported that Chinese leaders said the GDP goal is guidance and not a hard target which doesn’t provide much confidence in China’s economy.

Top Asian News

- Tourism Jump to Power Thai GDP Growth to Five-Year High in 2023

- China in Longest Streak of Liquidity Withdrawals Since February

- Singapore Says Can Tame Wild Power Market Without State Control

- India’s Zomato Appoints Four CEOs, to Change Name to Eternal

- Taiwan Tensions Raise Risks in One of Busiest Shipping Lanes

- Japan Trading Giants Book $1.7 Billion Russian LNG Impairment

- Japan Proposes Record Minimum Wage Hike as Inflation Hits

European bourses are pressured as the general tone remains tentative ahead of Pelosi’s visit to Taiwan, Euro Stoxx 50 -0.9%; note, FTSE 100 -0.1% notably outperforms following earnings from BP +3.0%. As such, the Energy sector bucks the trend which has the majority in the red and a defensive bias in-play. Stateside, futures are similarly downbeat and have been drifting lower amid the incremental updates to Pelosi and her possible Taiwan arrival time of circa. 14:30BST/09:30ET; ES -1.0%. Apple (AAPL) files final pricing term sheet for four-part notes offering of up to USD 5.5bln, according to a filing.

Top European News

- Ukraine Sees Slow Return of Grain Exports as World Watches

- Ruble Boosts Raiffeisen’s Russian Unit Despite Credit Halt

- DSM 2Q Adj. Ebitda Up; Jefferies Sees ‘Muted’ Reaction

- Credit Suisse Hit by More Rating Downgrades After CEO Reboot

- Man Group Sees Assets Decline for First Time in Two Years

- Exodus of Young Germans From Family Nest Is Getting Ever Bigger

FX

- Yen extends winning streak through yet more key levels vs Buck and irrespective of general Greenback recovery on heightened US-China tensions over Taiwan

- USD/JPY breaches support around 131.35 and probes 130.50 before stalling, but remains sub-131.00 even though the DXY hovers above 105.500 within a 105.030-710 range.

- Aussie undermined by risk aversion and no hawkish shift by RBA after latest 50bp hike; AUD/USD nearer 0.6900 having climbed to within a few pips of 0.7050 on Monday.

- Kiwi holds up better with AUD/NZD tailwind awaiting NZ jobs data, NZD/USD hovering just under 0.6300 and cross closer to 1.1000 than 1.1100.

- Euro and Pound wane after falling fractionally short of round number levels vs Dollar, EUR/USD back under 1.0250 vs 1.0294 at best, Cable pivoting 1.2200 from 1.2293 yesterday.

- Loonie and Franc rangy after return from Canadian and Swiss market holidays, USD/CAD straddling 1.2850 and USD/CHF rotating around 0.9500.

- Yuan off lows after slightly firmer PBoC midpoint fix, but awaiting repercussions of Pelosi trip given Chinese warnings about strong reprisals, USD/CNH circa 6.7700 and USD/CNY just below 6.7600 vs 6.7950+ and 6.7800+ respectively.

- South Africa’s Eskom says due to a shortage of generation capacity, Stage Two loadshedding could be implemented at short notice between 16:00-00:00 over the next three days.

Fixed Income

- Taiwan-related risk aversion keeps bonds afloat ahead of relatively light pm agenda before a trio of Fed speakers.

- Bunds hold above 159.00 within 159.70-158.57 range, Gilts around 119.50 between 119.70-20 parameters and T-note nearer 122-02 peak than 121-17+ trough.

- UK 2032 supply comfortably twice oversubscribed irrespective of little concession.

Commodities

- WTI Sept and Brent Oct futures trade with both contracts under the USD 100/bbl mark as the participants juggle a myriad of major factors, incl. the JTC commencing shortly.

- Spot gold is stable and just below the 50-DMA at USD 1793/oz while base metals succumb to the broader tone.

- A source with knowledge of last month’s meeting between President Biden and Saudi King Salman said the Saudis will push OPEC+ to increase oil production at their meeting on Wednesday and that the Saudi King made the assurance to President Biden during their face-to-face meeting July 16th, according to Fox Business’s Lawrence.

- US Senator Manchin “secured a commitment” from President Biden, Senate Majority Leader Schumer and House Speaker Pelosi for completion of the Mountain Valley Pipeline, according to 13NEWS.

US Event Calendar

- July Wards Total Vehicle Sales, est. 13.4m, prior 13m

- 10:00: June JOLTs Job Openings, est. 11m, prior 11.3m

- 10:00: Fed’s Evans Hosts Media Breakfast

- 11:00: NY Fed Releases 2Q Household Debt and Credit Report

- 13:00: Fed’s Mester Takes Part in Washington Post Live Event

- 18:45: Fed’s Bullard Speaks to the Money Marketeers

DB’s Jim Reid concludes the overnight wrap

In thin markets, US House Speaker Nancy Pelosi’s visit to Taiwan today for meetings tomorrow (as part of her tour of Asia) could be the main event. She’s scheduled to land tonight local time which will be mid-morning US time. She’ll be the highest ranking US politician to visit in 25 years. Expect some reaction from the Chinese and markets to be nervous. Meanwhile to dial back rising tensions, the White House has urged China to refrain from an aggressive response as speaker Pelosi’s visit does not change the US position toward the island.

As the headline confirming her visit was going ahead broke, 10 year US Treasuries immediately fell a handful of basis point from 2.69% (opened at 2.665%) and continued falling to around 2.58% as Europe retired for the day, roughly where it closed (-6.8bps). Breakevens led most of the move. 2 year notes actually held in which inverted the curve a further -6.12bps and to the lowest this cycle at -30.84bps. Remember that August is the best month of the year for fixed income (see my CoTD last week here for more on this) so the month has started off in line with the textbook. This morning 10yr USTs yields have dipped another -3bps to 2.55%, some 14bps lower than when Pelosi stopover was first confirmed 18 hours ago. 2yr yields have slightly out-performed with the curve just back below -30bps again.

Lower yields initially helped to lift equities yesterday, with the Nasdaq being up more than a percent at one point before falling with the rest of the market and closing -0.18%. The S&P 500 was -0.28% and dragged lower by energy (-2.17%). The latter came as crude prices moved substantially lower, with WTI losing -4.91% and Brent (-3.97%) dipping below $100 per barrel as well. Growth concerns, partly due to the weekend and yesterday’s data from China, and partly due to the US risk off yesterday, were mainly to blame. These worries filtered through other commodities as well, including industrial metals and agriculture. For the latter, Ukraine’s first grain shipment since the war began was a contributing factor. European gas was a standout, notching a +5.2% gain as the relentless march continues.

In an overall risk-off market, staples (+1.21%) were the only sector meaningfully advancing on the day, followed by discretionary (+0.51%) stocks. Meanwhile, real estate (-0.90%), financials (-0.89%) and materials (-0.82%) dragged the index lower. Although yesterday’s earnings stack was light, today’s line up includes BP, Starbucks, Airbnb and PayPal.

Asian equity markets opened sharply lower this morning on the fresh geopolitical tensions between the US and China over Taiwan. Across the region, the Hang Seng (-2.96%) is leading losses after yesterday’s data showed that Hong Kong slipped into a technical recession as Q2 GDP shrank by -1.4%, contracting for the second consecutive quarter as global headwinds mount. Mainland China stocks are also sliding with the Shanghai Composite (-2.90%) and CSI (-2.33%) trading deep in the red whilst the Nikkei (-1.59%) is also in negative territory. Elsewhere, the Kospi (-0.77%) is also weak in early trade. Outside of Asia, DMs stock futures point to a lower restart with contracts on the S&P 500 (-0.38%), NASDAQ 100 (-0.40%) and DAX (-0.50%) all turning lower.

As we go to print, the RBA board has raised rates by another 50 basis points to 1.85%. Their economic forecasts seem to have been lowered and they have now said monetary policy is “not on a pre-set path” which some are already interpreting as possibly meaning 25bps instead of 50bps at the next meeting. Aussie 10yr yields dropped 7-8bps on the announcement and 10bps on the day.

Back to yesterday, and the important US ISM index, on balance, painted a slightly more comforting picture than it could have been – although the index slowed to the lowest since June 2020. The headline came in above the median estimate on Bloomberg (52.8 vs 52.0). We did see a second month in a row of below-50 score for new orders, but a fall in prices paid from 78.5 to 60.0, the lowest since August 2020, offered some respite to fears about price pressures. Similarly, a rise in the employment gauge from 47.3 to 49.9, beating estimates, was also a positive. The manufacturing PMI was revised down a tenth from the preliminary reading which didn’t move the needle. JOLTS today will be on my radar given it’s been the best measure of US labour market tightness over the past year or so. Also Fed hawks Mester (lunchtime US) and Bullard (after the closing bell) will be speaking today.

Turning to Europe, price action across sovereign bond markets was driven by dovish repricing of ECB’s monetary policy, in contrast to the US where the front end held up. A cloudier growth outlook from yesterday’s European data releases helped drive yields lower – retail sales in Germany unexpectedly contracted in June (-1.6% vs estimates of +0.3%) and Italy’s manufacturing PMI slipped below 50 (48.5 vs 49.0 expected). So Bund yields fell -3.8bps, similar to OATs (-3.1bps). The decline was more pronounced in peripheral yields and spreads, with BTPs (-12.9bps) in particular dropping below 3% for the first time since May of this year, perhaps on further follow through from last week’s story that the far right party leading the polls aren’t planning to break EU budget rules. Spreads have recovered the lost ground from Draghi’s resignation announcement now. Weaker economic data overpowered the effect of lower yields and sent European stocks faded into the close after being higher most of the day with the STOXX 600 eventually declining -0.19%. The Italian market outperformed (+0.11%) for the reasons discussed above.

Early this morning, data showed that South Korea’s July CPI inflation rate rose to +6.3% y/y, hitting its highest level since November 1998 (v/s +6.0% in June), in line with the market consensus. The strong inflation data comes as the Bank of Korea (BOK) mulls further interest rate hikes at its next policy meeting on August 25.

To the day ahead now and there is a relatively short list of economic indicators to watch, including June JOLTS report and total vehicle sales (July) for the US, UK’s July Nationwide house price index and July PMI for Canada. Given the apparent uncertainty about the direction of the Fed in markets, many will be awaiting Fed’s Bullard, Mester and Evans, who will speak throughout the day. And in corporate earnings, it will be a busy day featuring results from BP, Caterpillar, Ferrari, Marriott, KKR, Uber, S&P Global, Occidental Petroleum, Electronic Arts, Gilead Sciences, Advanced Micro Devices, Starbucks, Airbnb, PayPal, Marathon Petroleum.

Tyler Durden

Tue, 08/02/2022 – 08:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com