Stock Gains Resemble Typical Bear Market Rally

By Ye Xie, Bloomberg Markets Live commentator and reporter

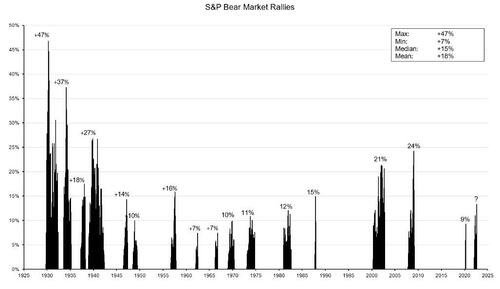

While the S&P 500’s rebound since mid-June has been impressive, it’s within the historical norm of a bear market rally.

Since the 1920s, the trough-to-peak rally in a bear market averaged about 18%, as noted by Nick Reece, strategist at Merk Investments. But the post-WWII average was only 13%, which is exactly where we are right now.

Part of the recent stock gains were driven by short covering from extremely negative positions and sentiments, and better-than-expected earnings. It also helped that rate volatility has died down a bit. Ironically, the stock rally has eased financial conditions, which is counterproductive for the Fed’s campaign to cool inflation.

Tyler Durden

Tue, 08/09/2022 – 14:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com