Gruesome, Tailing 2Y Auction Sends Yields To Session High, 10Y At 3.99%

One day after a dismal 2Y auction, moments ago the Treasury held another dismal auction , this time for 5Y paper, which just like yesterday immediately sent yields to session highs.

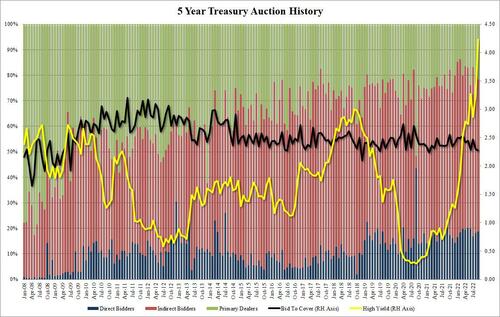

Today’s sale of $44BN in 5Y paper priced at a high yield of 4.228%, some 100bps higher than August’s 3.220%, and the highest since the global financial crisis. The auction was also a 2.6bps tail to the 4.202% When Issued, one of the biggest tails on record.

The bid to cover was 2.26, the lowest since Feb 2021, and down from the already dire 2.30 last month.

The internals were just a bit better, with Indirects at 59.6%, below last month’s 61.18% and also below the six-auction average of 61.9%, if above June’s low of 56.5%. And with Directs awarded 18.7%, or just around the recent average of 19.0%, Dealers were left holding 21.7%, the highest since June.

Overall, this was another catastrophic TSY auction coming at a time when every day we see more blow ups in bonds around the world, and sure enough the 10Y promptly spiked to session highs, rising just above 3.99% if not crossing 4.00% just yet.

Tyler Durden

Tue, 09/27/2022 – 13:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com