Futures Rise As China Reopening Hopes Return

And just like that, sentiment has turned on a dime… or rather a yuan.

One day after global stocks and commodities tanked following a weekend of violent protests swept across China, Beijing appears to have learned its lesson and overnight Chinese government health experts made an unscheduled overnight announcement in which they not only vowed to speed up Covid shots for the elderly – a move regarded as crucial to the reopening – but to avoid excessive restrictions, fueling a new round of bets that Beijing is bending to the pressure of an economic reopening. A spokesman for the National Health Commission also said local officials must avoid excessive restrictions.

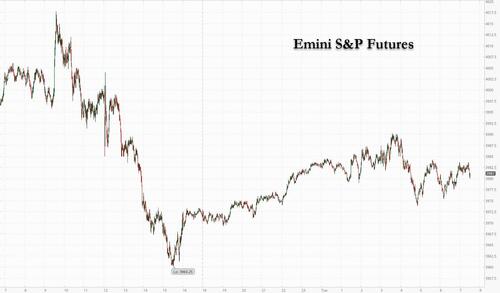

As a result, contracts on the Nasdaq 100 were up 0.4% at 7:30 a.m. in New York, while S&P 500 futures rose 0.2%, erasing earlier gains which pushed spoos as high as 3990. Both underlying indexes tumbled about 1.5% on Monday amid fears that protests in China about Covid restrictions would affect the pace of the reopening.

In premarket trading, Chinese stocks listed in the US rallied, including internet stocks Alibaba and JD.com, while the exchange-traded KraneShares CSI China Internet Fund rose more than 6%, following on from Asian markets’ sharp bounce earlier in the day. Apple rose along with tech stocks, lifted by the general positive sentiment on China. Roku dropped after a broker downgrade. Here are all notable premarket movers:

- 23andMe is initiated with a buy recommendation at Berenberg, which sees the genomics firm as well-positioned to become a “leader in a redefined individualized healthcare ecosystem.” The broker also sets a Street-high price target for the stock. Shares gain 2.7%.

- AZEK fell 6.2% after the outdoor living products manufacturer reported fourth-quarter revenue that was ahead of consensus, though the company’s first- quarter net sales forecast fell short of expectations. For the analysts, the guide was disappointing, with some highlighting the impact that inventory headwinds would have in the first quarter.

- BigCommerce shares are up 2.9% in premarket trading, after the e-commerce software company said its merchant gross merchandise value rose 31% on Black Friday, a growth rate that analysts see as strong.

- Cryptocurrency-exposed stocks rise in US premarket trading following Monday’s losses, as Bitcoin gained amid the return of risk appetite on China reopening bets, though worries lingered over the fallout from FTX’s collapse. Coinbase shares gained 1.6%.

- Chinese stocks listed in the US rally as officials vowed to speed up Covid shots for the elderly and to avoid excessive restrictions, fueling a new round of bets that Beijing is bending to pressure for a reopening. Alibaba shares gain 5.3%, JD.com shares rise 7.2%, Baidu shares advance 5.9%

- Generac shares fall 2.6% in premarket trading after Jefferies downgraded the backup generator manufacturer to underperform from hold, noting the risk bidirectional charging for electric vehicles poses to home standby penetration over the long-term.

- Lordstown Motors rose as much as 6% in premarket trading upon reaching the conditions to start consumer sales.

- Hibbett Inc reported earnings per share for the third quarter that missed the average analyst estimate. Shares decline 5.8%.

- Microsoft shares advance 0.2% in US premarket trading, as Morgan Stanley says that it has confidence in the software firm’s commercial businesses, which are sending a strong and durable demand signal.

- Mirum Pharmaceuticals fell as much as 9.8% premarket upon deciding to discontinue the OHANA study of volixibat in intrahepatic cholestasis of pregnancy due to enrollment feasibility.

- Novocure is upgraded to overweight at Wells Fargo ahead of results from the company’s LUNAR non-small cell lung cancer trial, expected early next year. Shares decline 1.2%.

- Roku (ROKU) shares decline 3% after the stock was downgraded to sector weight from overweight at KeyBanc, which says consensus for 2023 and 2024 looks “too optimistic.

- United Parcel Service (UPS) shares are up 1.4% in premarket trading, after Deutsche Bank upgraded the package shipping company to buy from hold.

- US-listed shares of Bilibili (BILI) are up 10.4% in premarket trading, after the China-based video game company reported third-quarter results that beat expectations, though it also gave a fourth-quarter revenue forecast that was below the average analyst estimate.

“My guess is China has reached some kind of tipping point on Covid restrictions,” said Christophe Barraud, chief strategists at the Market Securities brokerage in Paris. “Even before the recent unrest, officials were preparing to implement more targeted measures, but the unrest will only accelerate the process.”

Another tailwind for stocks is the likelihood that the Federal Reserve will move to a slower rate-hiking pace, with Fed Chair Jerome Powell seen cementing those bets when he speaks on Wednesday. That view, alongside the easing in China tensions, and expectations for further slowing in payroll gains on Friday, pushed the dollar lower against a basket of peers, following two days of gains.

US stocks have rallied in the past two months on growing optimism that the Federal Reserve would slow the pace of rate hikes as inflation showed signs of cooling and as the US inevitably slides into recession. But policy makers have stressed they will continue to raise borrowing costs further until they see a meaningful dip in prices, and market strategists have warned the rally may fizzle out over the coming weeks amid recession worries.

“Investors don’t want to hear what the Fed says; it says it will hike slower but higher, investors hear that the Fed will hike slower, and so we have rallies that get interrupted by frequent rectification from the Fed officials,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank. “Even soft growth, soft jobs and soft inflation should not lead to a sustained recovery as they would hint at recession.”

That hawkish drumbeat from central bankers has seen global bonds signal a recession, as a gauge measuring the worldwide yield curve inverted for the first time in at least two decades.

Meanwhile UBS Wealth Management Chief Investment Officer Mark Haefele agreed and warned that investors should remain cautious over the revival in risk appetite that has occurred over the past few months. “The path back toward the Fed’s 2% inflation target could be bumpy, sparking renewed concerns about how high rates will have to rise,” he wrote in a note on Tuesday. On the other hand, Deutsche Bank strategists said they expect the rally to continue as both rate and equity volatility falls, while systematic strategies raise equity exposure from extremely low levels, propelling the S&P to 4,500 before it all comes crashing down in Q3 2023 when stocks plunge to 3,250 only to rebound the next quarter.

In Europe, the Stoxx 50 rose 0.3% on speculation that unrest in China over Covid restrictions would force authorities to move faster in loosening curbs. FTSE 100 outperformed peers, adding 0.8%. Here are the most notable European movers:

- Union Financière de France shares rise as much as 53% after majority owner Abeille Assurances lodged a EU21/share buyout offer for the 25% of capital it doesn’t already own.

- Shares in Danish pharma giant Novo Nordisk gained as much as 4% after the FDA cleared forms at Catalent’s Wegovy manufacturing sites in the US and Brussels.

- ASM International shares jump as much as 8% after the Dutch chip-tool maker forecast a less severe sales impact from the US chip export restrictions and raised its fourth-quarter guidance.

- Boozt rises as much as 14%, the most since August, after the Swedish online retailer said it expects to reach the high end of its full-year guidance. The Stoxx 600 Retail subindex is among the best performing in Tuesday trading, with Zalando +3.7%, JD Sports +2.1% and H&M +1.3%

- Mining and energy are the best-performing sectors in Europe on Tuesday amid a rebound in commodity markets as China refined its approach for dealing with Covid-19 and investors looked ahead to an OPEC+ meeting on output policy.

- The Stoxx 600 Basic Resources subindex rises as much as 2.5% to the highest since mid-June, led by heavyweights like Rio Tinto and Anglo American

- Capita shares fall as much as 5.8% in London trading, the steepest intraday decline since Sept. 30.

- Shares in Orlen gain as much as 4.2% as Poland’s biggest refiner boosted Ebitda in 3Q following acquisition of Lotos.

- Greencore Group falls 4.9% after saying that it remains cautious about the potential impact of the recessionary environment and cost-of-living factors on consumer spending through the year ahead.

- Nestle shares drop as much as 1.1%, underperforming the Stoxx 600’s food, beverage and tobacco subgroup, after the Swiss food giant set financial targets and said it’s considering options for Palforzia, just two years after buying the peanut-allergy treatment in a $2.6 billion deal.

Earlier in the session, Asian equities rose as latest official commentary in China bolstered reopening trades, with a weaker dollar adding to tailwinds for the region. The MSCI Asia Pacific Index extended its advance to as much as 1.7% in afternoon trading, with gauges in Hong Kong jumping more than 5% to lead gains in the region. In a briefing, Chinese officials urged elderly vaccination and avoidance of excessive restrictions, which added to reopening optimism. Beijing’s additional support for developers also buoyed stocks. A decline in the dollar boosted benchmarks in South Korea, Taiwan and India, although measures in Japan fell. Consumer discretionary and telecom shares were the biggest sectoral advancers in the region. “It’s been a tough year for most funds, so if they miss out on big moves in China” going into the end of the year, that “would hurt performance,” said Sat Duhra, portfolio manager at Janus Henderson Investors. “From a tactical point of view, that’s the reason China is so volatile.” Asia’s stock gauge has gained 14% in November, on track for its best month since 1998, with beaten-down markets in North Asia showing signs of recovery boosted by month-end positioning. Still, traders will closely monitor a host of US economic data due this week as well as commentary by Federal Reserve officials to gauge global inflation and growth prospects next year.

Japanese equities dropped after Fed policymakers stressed that there will be further monetary-policy tightening ahead to curb inflation. The Topix Index fell 0.6% to 1,992.97 as of market close in Tokyo, while the Nikkei 225 declined 0.5% to 28,027.84. Toyota Motor Corp. contributed the most to the Topix’s decline, as the automaker fell 1.4%. Among 2,164 stocks in the index, 1,478 fell and 586 rose, while 100 were unchanged. “Though Fed officials have been commenting, even in that case, monetary tightening will go in the direction of easing,” said Hideyuki Suzuki, general manager at SBI Securities. “What the market needs to be concerned about is whether the global economy will do okay.”

In rates, Treasuries were moderately higher across the curve, holding gains amassed during the European session as German inflation data unleashed a bull-steepening rally in bunds. Intermediates outperformed slightly on the curve. Home price and consumer confidence data are focal points of US session, along with potential for month-end flows to support long-end. Yields richer by 1bp to 3bp across the curve with belly-led gains tightening the 2s5s30s fly by ~2.5bp; 10-year TSYs around 3.66%, down 2bps on the day and trailing bunds in the sector by 7.5bp. German curve aggressively bull-steepens as ECB hike premium is pared; 2-year German yields richer by 13bp on the day in early US session. Bunds bull steepened, with yields dropping 6-11bps, and money markets aggressively pared ECB tightening wagers. Inflation in German states as well as in Spain pointed toward a faster deceleration than economists forecast for the national figure later today, and sure enough, German CPI came in at -0.5%, well below the -0.2% expected, and a sharp drop from 0.9% last month. Peripheral spreads are mixed to Germany; Italy tightens, Spain widens and Portugal tightens.

In FX, the Bloomberg dollar spot index fell 0.6%, extending losses as the greenback weakened against all of its Group-of-10 peers apart from the Swiss franc. Australian and New Zealand dollars led gains amid optimism after China’s briefing on the implementation of virus prevention and control measures.

- The euro pared most of yesterday’s decline but stopped short of breaching the $1.04 handle as money markets aggressively pared ECB tightening wagers. Inflation in German states as well as in Spain pointed toward a faster deceleration than economists forecast for the national figure later today.

- The pound advanced to trade around 1.20 per dollar. Gilts gained but underperformed bunds. The BOE starts its first “demand-led” sale of long-end bonds and linkers bought after September’s mini-budget

- Sweden’s krona underperformed other risk-sensitive G-10 currencies; GDP expanded by less than forecast in the third quarter while separate data showed retail sales plunged most on record last month

Elsewhere, oil extended a rebound from the lowest level in almost a year, on speculation that the Organization of Petroleum Exporting Countries and its allies will deepen supply cuts to respond to weakening global demand. Crude futures advanced, Brent rises 2.9% near $85.62. Spot gold rises roughly $14 to trade near $1,756/oz

To the day ahead now, and data releases include German CPI for November, UK mortgage approvals for October, Canada’s Q3 GDP, the US Conference Board’s consumer confidence for November, and the FHFA house price index for September. Central bank speakers include BoE Governor Bailey and the BoE’s Mann, ECB Vice President de Guindos and the ECB’s de Cos.

Market Snapshot

- S&P 500 futures up 0.3% to 3,980.75

- STOXX Europe 600 down 0.1% to 437.53

- MXAP up 1.6% to 155.12

- MXAPJ up 2.4% to 499.98

- Nikkei down 0.5% to 28,027.84

- Topix down 0.6% to 1,992.97

- Hang Seng Index up 5.2% to 18,204.68

- Shanghai Composite up 2.3% to 3,149.75

- Sensex up 0.4% to 62,750.28

- Australia S&P/ASX 200 up 0.3% to 7,253.31

- Kospi up 1.0% to 2,433.39

- German 10Y yield down 4.5% to 1.90%

- Euro up 0.3% to $1.0370

- Brent Futures up 2.2% to $84.98/bbl

- Gold spot up 0.8% to $1,755.58

- U.S. Dollar Index down 0.37% to 106.28

Top Overnight News from Bloomberg

- Chinese health authorities struck a conciliatory tone a day after protests against stringent Covid curbs were stymied by a heavy police presence, social media censorship and quiet pandemic concessions

- China’s worsening economic slump and a likely disruptive rollback of Covid restrictions will keep the central bank on its easing path, economists said, with calls growing for more interest rate cuts

- The ECB must continue monitoring underlying inflation as it determines what dose of monetary-policy tightening is needed to tame record price gains, according to Vice President Luis de Guindos

- The minutes of the UK DMO’s meeting with gilt-edged market makers (GEMMs) and investors on Nov. 28 showed a preference for either a new 30- or 40-year bond syndication in the final quarter of this financial year

- OPEC and its allies are expected to consider deeper supply curbs when they meet this weekend against the backdrop of a faltering global oil market

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive with the improvement in risk appetite spurred after China protests were clamped down on by police and after the country also announced support measures for developers, while there was also speculation of a potential easing of COVID controls ahead of a press briefing by China’s State Council. ASX 200 pared its early losses after rebounding from a floor around the 7,200 level although gains were contained amid the lack of pertinent domestic catalysts. Nikkei 225 was subdued after Unemployment Rate and Retail Sales data disappointed expectations and with automakers Toyota and Honda adjusting or suspending factories in China due to the COVID situation, while Eisai was the worst performer after a second death was linked to the Co. and Biogen’s Lecanemab Alzheimer’s drug. Hang Seng and Shanghai Comp were lifted with outperformance in developers after China resumed approving listed developers’ mergers and is also to ease rules on developer bond state guarantees, while hopes of a relaxation of COVID restrictions added to the tailwinds.

Top Asian News

- China is aiming to increase the pace of COVID vaccination for those 80 and above, according to the Health Authority, to allow elderly to take a booster three months after vaccine. CDC Official says they will promptly and effectively solve difficult problems reported by the masses; when asked if protests will prompt them to reconsider zero-COVID policy, says they will continue to fine tune policy to reduce the impact on the economy and society.

- Beijing City reports 2,126 (prev. 2,086) COVID infections on November 29th as of 3pm, according to a health official.

- UK PM Sunak called for Britain to evolve its foreign policy approach to China, while he also said the golden era of UK-China relations is over and criticised China’s crackdown, according to SCMP and The Mirror.

European bourses trade mixed after the initial China-led optimism petered out in early European hours, Euro Stoxx 50 +0.2%. Sectors are mostly firmer following choppiness in the European morning, but base metals remain the marked outperformer. US equity futures meanwhile remain modestly firmer across the board but off best levels as participants look ahead to Fed Chair Powell tomorrow, followed by US PCE on Thursday and NFP on Friday, ES +0.3%.

Top European News

- UK government is abandoning controversial powers from the Online Safety Bill that would have forced internet companies to take down legal but harmful content following backlash from the tech industry and free speech advocates, according to FT.

- UK Oct. Mortgage Approvals Fall to 28-Month Low of 59k

- UK Rewrites Online Safety Bill After Free Speech Backlash

- Goldman Moves Some London Traders to Milan in Fresh Brexit Shift

- EasyJet Targets Full Capacity as Discounters Thrive in Slump

- Ørsted Offers to Buy Certain Sub Capital Securities

FX

- Antipodean Dollars revived alongside Yuan as Chinese Covid cases dip to provide some respite, AUD/USD and NZD/USD firmly back above 0.6700 and 0.6200, while Usd/Cnh retreats from just shy of 7.2500.

- Buck off Monday’s recovery highs, but DXY underpinned between 106.050-750 parameters on hawkish Fed rhetoric.

- Yen rebounds through 138.00 vs Greenback as bond yields recede to offset disappointing Japanese data.

- Euro and Pound bounce against the Dollar towards 1.0400 and over 1.2050 at one stage.

- Loonie pares declines in tandem with WTI as Usd/Cad recoils within a 1.3497-09 range ahead of Canadian GDP metrics.

- PBoC set USD/CNY mid-point at 7.1989 vs exp. 7.2077 (prev. 7.1617)

Fixed Income

- Another firm recovery in debt futures, with EGBs encouraged by slowdowns in German state and Spanish national CPI readings.

- Bunds reach 141.74 from 140.08 at worst and Bonos 130.20 vs 129.46.

- BTPs outperform either side of solid month end Italian auctions as the 10 year benchmark tops out at 120.67 for a 169 tick gain on the day.

- Gilts cautious around 106.00 ahead of BoE commentary, but T-note firm on 113-00 handle awaiting US consumer confidence.

Commodities

- WTI and Brent Jan futures have been trending higher since the APAC session on speculation China could that China could ease its COVID restrictions, although the Chinese health officials instead boosted the vaccination drive for the elderly and stressed they must keep avoiding excessive COVID curbs.

- Spot gold trades in tandem with the Dollar and remains within recent ranges on either side of USD 1,750/oz ahead of key risk events later this week.

- Base metals are lifted by the overnight China COVID optimism alongside support measures announced for China’s property sector, in turn boosting demand for raw materials, with 3M LME copper back on a USD 8,000/t level and extending on gains.

- China’s President Xi says China is ready to boost Russian energy cooperation, via CCTV.

- Russian Deputy PM Novak says they are discussing with Kazakhstan and Uzbekistan a gas union for shipments, which would include shipments to China, via Ifx.

- CNOOC is planning a 50-day overhaul at their 240k BPD Huizhou site from March, via Reuters citing sources.

- Euronext has informed clients that due to a technical incident, a failover has occurred on the commodities segment at 09:46GMT; Order Entry on all commodities contracts will be enabled at 10:45 GMT. These contracts will move into continuous tradable phase at 11:00 GMT.

Geopolitics

- US official said Washington will announce significant financial assistance to Ukraine today and the new aid aims to mitigate damage caused by Russian bombing of Ukraine’s energy grid, while the official said the Biden administration has allocated over USD 1bln to support the energy sector in Ukraine and Moldova, according to Sky News Arabia.

- China’s military said a US cruiser illegally intruded into waters near the Spratly Islands in the South China Sea, while it added that it followed the US cruiser and said the US move infringes China’s sovereignty, according to Reuters.

- China’s ambassador to Britain has been summoned to the Foreign Office following the police “beating” of a BBC journalist in Shanghai, according to the Evening Standard.

- South Korean President Yoon said China can and should influence North Korea’s behaviour to stop weapons development and he warned that any new North Korean nuclear test will be met with a joint response not seen in the past. Yoon also stated he is firmly opposed to any attempt to change the status quo unilaterally regarding Taiwan and said that in the event of a Taiwan conflict, South Korean troops’ imminent concern would be any North Korean military action, according to Reuters.

US Event Calendar

- 09:00: Sept. S&P CS Composite-20 YoY, est. 10.50%, prior 13.08%

- S&P/CS 20 City MoM SA, est. -1.20%, prior -1.32%

- FHFA House Price Index MoM, est. -1.2%, prior -0.7%

- 10:00: Nov. Conf. Board Consumer Confidence, est. 100.0, prior 102.5

- Expectations, prior 78.1

- Present Situation, prior 138.9

DB’s Jim Reid concludes the overnight wrap

I’ve been writing the EMR for nearly 16 years and before yesterday I can remember only one previous day where we couldn’t distribute it for technical reasons. So apologies for the non-appearance yesterday in your email boxes. Given the size of the distribution list we use an external vendor to publish and our respective systems had a bit of a fight yesterday. The EMR was the loser. We think they have sat down and reconciled their differences now so fingers crossed this reaches you before you retire.

Moving on, over the next 25 hours we’ll perhaps have a few more clues as to whether the ECB will hike 50bps or 75bps two weeks on Thursday. I say next 25 hours but if the EMR is 6 hours late today then you’ll already know the German CPI numbers out today. The NRW region, which has the highest weighting in the national number, should be out around the time we hit inboxes with other regions at 9am London time and the country-wide number at 1pm. Our German economists previewed the release last night (link here) suggesting the YoY for the country will likely only ease a tenth to 10.3% and might only dip below 10% from March when the government’s “energy price breaks” kick in. We also see the Spanish print today and then the French equivalent at 7.45am London time tomorrow (hence the 25 hours). As a reminder, our economists expect the Eurozone November print to tick up a further tenth to 10.7% tomorrow (10am), which would be another record since the single currency’s formation.

Ahead of these we had several hawkish developments yesterday, with the Netherlands’ central bank governor Knot describing inflation risks as “entirely tilted to the upside”, and describing talk of over-tightening was “a bit of a joke”. Furthermore, Knot made the point that the declining downside risks to growth over recent weeks had hawkish implications for the ECB.

In this context, global markets got the week off to a rough start yesterday, with the S&P 500 (-1.54%) and other risk assets losing ground as investors sought to understand the consequences of the ongoing Covid situation in China. Understandably, the initial reaction has been pretty negative, since rising cases have generally led to a greater chance of restrictions in every country as the pandemic got underway, particularly as policymakers sought to avoid healthcare services becoming overwhelmed. And just as Chinese markets had surged in recent weeks on speculation about an earlier reopening in China, the last 24 hours have seen that process go into reverse as the prospect of further lockdowns come into view.

However, much as the initial reaction has been pretty negative, in some ways the read-across from the current situation to markets is more difficult. On the one hand, it’s plausible that the months ahead see fresh lockdowns as we saw in Shanghai in Q2. But it’s also possible that the protests lead to a quicker move away from the zero Covid strategy, which based on past performance would prove fairly supportive. Indeed, sentiment was very positive 2-3 weeks ago after it was announced that the quarantine time for close contacts and inbound travellers was being cut from 10 days to 8, since it was seen as signalling a move away from the restrictive approach that had previously been adopted. And as the US session got underway there were signs of that dynamic taking place. For instance, the NASDAQ Golden Dragon China index surged by +2.83% yesterday, which is an index of US-listed stocks for whom most of their business is done in China. In the meantime, futures on the Hang Seng were more than +1% higher during the US session, indicating that there could be some sort of bounceback following the initial slump.

This more positive momentum has carried into Asia helped by an absence of any further escalations in the protests against Covid-19 restrictions in China. Across the region, the Hang Seng Tech index is leading gains rising past +6.0% with the Hang Seng +4.31% higher alongside the CSI (+3.26%) and the Shanghai Composite (+2.35%) ahead of a newly arranged State Council Covid briefing today (3pm local time. 7am London) to discuss prevention and control measures. It’s not clear whether any new polices will be implemented. The country reported 38,421 new local cases on Monday down from a record high of 40,052 reported for Sunday with no deaths reported for two consecutive days. This was the first decline in cases for more than a week.

Elsewhere, the KOSPI (+1.02%) is trading higher in early trade while the Nikkei (-0.53%) is bucking the regional trend. In overnight trading, US stock futures are indicating a more positive start with contracts on the S&P 500 (+0.32%) and the NASDAQ 100 (+0.44%) moving higher.

Early morning data showed that Japan’s jobless rate for October remained steady from the prior month’s reading of +2.6% (v/s +2.5% expected). At the same time, the jobs-to-applicant ratio climbed to 1.35, in-line with market expectations and compared to a level of 1.34 in September highlighting that the nation’s labour market remains tight. A separate report showed that retail sales (+0.2% m/m) rose less than expected in October following an upwardly revised increase of +1.5% in September as household spending was squeezed by inflation running at its fastest pace in 40 years.

The China whipsaw over the last 24 hours seems to have had most impact on oil, where prices fell to their lowest intraday levels in months on the back of the weekend developments. For instance, WTI hit an intraday low of $73.60/bbl during the European morning, which briefly put it in negative territory on a YTD basis, before recovering sharply into the US session to actually gain ground on the day and close at $77.24/bbl and up another +1.8% to $78.65 in Asia.

It was a similar story for Brent crude, which hit its lowest intraday level since January at $80.61/bbl, before recovering into the close to end just a hair lower at $83.45/bbl. It’s at $84.75 in Asia. The recent fall in oil has fed through to consumer prices as well, with the US AAA’s data on the average national pump price down at $3.546 on Sunday, marking its lowest level since Russia’s invasion of Ukraine began.

Incidentally, we had another positive development in Europe yesterday as the immediate threat of a further Russian gas cutoff was avoided. This stemmed from Gazprom’s threat last week that they would curb gas shipments to Moldova via Ukraine from November 28, but shipments continued yesterday, which is important more broadly since the route is also used for further transport to Europe. In the meantime, ECB President Lagarde said that there was “too much uncertainty” to assume that inflation had peaked, particularly in terms of how wholesale energy costs were passed through to the retail level, and said “it would surprise me” if it had peaked in October.

As investors dwelled on the prospects of a more hawkish ECB, yields on 10yr government debt rose across the continent, with yields on 10yr bunds (+1.1bps), OATs (+2.5bps) and BTPs (+5.6bps) all moving higher on the day. Treasury yields were a bit more subdued after back-and-forth price action through the day, with yields on 10yr Treasuries finally rising a marginal +0.4bps to 3.68% before climbing 2.5bps in Asia. For yesterday, the China story growth fears netted out with hawkish Fed officials to leave yields roughly flat across the curve. On the Fed, St. Louis Fed President Bullard noted that markets were underestimating the chances of a more aggressive stance from the Fed next year. New York Fed President and FOMC Vice Chair Williams emphasised that the Fed still needed to impart further tightening, and that unemployment would be climbing next year. He noted that recession was not a part of his baseline forecast but that there were downside looks to the outlook. So the Fed continues to get closer to our Street-leading recession forecast. Before the talk of tighter policy, 10yr Treasuries did sink as low as 3.62% after the China news hit trading. Earlier in the day, the 2s10s curve had also hit a new intraday low for the current cycle, falling as far as -81bps at one point, before recovering into the close to hit -76.3bps.

Equities struggled against this backdrop, with the S&P 500 (-1.54%) losing ground for a second day running. The decline was a fairly broad-based one, with just 37 companies in the index rising on the day, and other indices including the NASDAQ (-1.58%) and the Dow Jones (-1.45%) saw similar declines. Over in Europe, the STOXX 600 also shed -0.65%, with declines for the DAX (-1.09%) and the CAC 40 (-0.70%) as well.

To the day ahead now, and data releases include German CPI for November, UK mortgage approvals for October, Canada’s Q3 GDP, the US Conference Board’s consumer confidence for November, and the FHFA house price index for September. Central bank speakers include BoE Governor Bailey and the BoE’s Mann, ECB Vice President de Guindos and the ECB’s de Cos.

Tyler Durden

Tue, 11/29/2022 – 08:18

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com