Morgan Stanley: After A Chaotic 2022, The Rest Of The World Will Outperform US Stocks

By Andrew Sheets, Chief Cross-Asset Strategist for Morgan Stanley

Safety Varies Significantly

2022 is now over, safely encased in history. It was notable not only for the severity of losses but also their breadth – the first year, since at least the 1870s, that both US stocks and long-term bonds fell by more than 10%. That historical anomaly hints at a broader theme – ‘safety’ varied significantly. Some traditional ‘defensive’ assets worked as advertised. Others didn’t. And some traits associated with higher risk actually protected portfolios. Depending on the asset class, the environment was reliably straightforward or unusually divergent. It was a good reminder that correlations can change, with important lessons for the year ahead.

Some assets stuck to the script: In a poor year for equity returns, defensive stocks outperformed (as one would expect). US defensives are up 6% (with dividends) over the last 12 months against a broader market down 17%. Our US equity strategy team, led by Mike Wilson, remains overweight US defensive stocks, while Graham Secker and our European equity strategists remain underweight EU cyclicals. Both views are linked to the idea that near-term risk/reward is poor given risks to earnings, and that cyclicality will show ‘usual’ high-beta characteristics.

Next was the US dollar. A traditional ‘safe haven’, that’s exactly how it behaved, with the correlation between the DXY and global equities comfortably negative throughout 2022. Indeed, despite the dollar’s recent weakness, its diversifying power has actually been increasing, with the 120-day correlation between the dollar and US stocks at its lowest level since April 2012.

Momentum (the factor) also delivered. Momentum isn’t the cross-asset factor with the highest return, but it can be a powerful diversifier, especially around major turning points. Trend-following/CTA strategies posted strong returns despite widespread cross-asset losses while, more narrowly, momentum was very effective in commodities and short-term rates, and a major driver of returns in our Cross-Asset Systematic Trading (CAST) framework. We think that momentum remains an attractive cross-asset factor.

But there were also plenty of areas where ‘beta’ was less predictable.

Small cap and Value equities, often bucketed as ‘high beta’, outperformed in a year where markets fell considerably. The same goes for stocks in Europe and Japan, which are ‘only’ down ~8-10% in the last year if you hedged the currency.

Meanwhile, the only sector that did better than defensives was…energy. The ‘high-beta’ sector rose 64% in the US and 30% in Europe in 2022. Financials, another ‘risky’ sector, was the second-best-performing sector in Europe, Japan and EM (in the US, financials outperformed the market).

Latin America’s two largest economies, Mexico and Brazil, also bucked conventional ‘beta’. Despite global cross-asset weakness, Mexican and Brazilian equities are both higher over the last 12 months (in USD terms), and both countries’ currencies are stronger against the mighty US dollar.

In contrast, high-quality bonds were clearly more risky than advertised. The Bloomberg US Aggregate 10yr+ bond index, the definition of a ‘safe’ asset with an average rating of AA-, is down more than 20% over the last 12 months, more than the S&P 500.

All this has a few important implications.

-

First, a year like 2022 doesn’t come around very often. But it is a good reminder that concepts like ‘beta’ and ‘defensiveness’ aren’t as cast iron as they may seem. Correlations can change.

-

Second, some of those ‘reliable’ diversifiers remain important. We continue to prefer defensives over cyclicals in the US and Europe and think that the momentum factor remains effective on a cross-asset basis in 1H23, with both themes aided by a continued deceleration in nominal growth. And while our macro narrative is less dollar friendly, USD still provides high carry and diversification. Our FX strategists are currently neutral on USD.

-

Third, a common theme among those ‘beta outliers’ was valuation. MXN, Brazilian equities, financials, energy…where traditional high-beta sectors did better, there was often strong valuation support. Bonds, which did poorly, were at some of their richest valuations in centuries. Real yields have now normalised significantly.

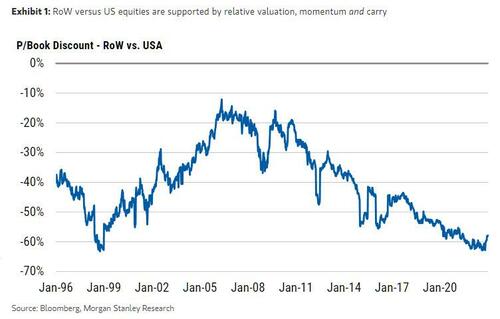

It’s important to keep this in mind. In a still-tough US equity environment, we think that RoW equities will do better (despite historical ‘beta’), boosted by attractive relative valuation, carry and momentum. [ZH: this is essentially identical to Michael Hartnett’s thesis laid out here on Friday)

We also like Mexican assets and see the economy as a structural winner in a multipolar world. And we think that high grade bonds will do well, helped in part by real yields that have risen back to their highest levels since 2009. We see high grade bonds outperforming equities in the US and Europe, and also returning to a much more diversifying role within cross-asset portfolios.

Tyler Durden

Sun, 01/08/2023 – 17:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com