Pound Tumbles After BOE Hikes 50bps In 7-2 Vote, Signals Pause At Lower Rate Of 4%

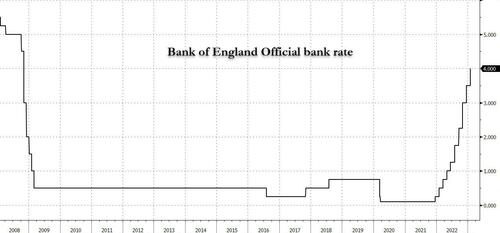

In the first of two big central bank decisions today, moments ago the Bank of England hiked by 50bps – as expected – raising the overnight rate for a 10th time to 4%…

… in a 7-2 vote (the two doves on the committee Swati Dhingra and Silvana Tenreyro voted for no hike) which was a two-way split and not a repeat of December’s bizarro three-way.

The Monetary Policy Committee voted by a majority of 7-2 to raise #BankRate to 4%. Find out more in our #MonetaryPolicyReport: https://t.co/n7j94kKQlp pic.twitter.com/wudQD5gZy5

— Bank of England (@bankofengland) February 2, 2023

Looking at the statement, the Committee continued to judge that the risks to inflation are skewed “significantly to the upside”

At the same time the committee dropped language in its statement saying it could act “forcefully” in future, adding that further rate rises would only be needed if there were new signs that inflation would stay too high for too long, i.e., this was struck down: “the Committee continues to judge that if the outlook suggests more persistent inflationary pressures, it will respond forcefully, as necessary.”

The BOE also said that If there “were to be evidence of more persistent pressures, then further tightening in monetary policy would be required” vs the previous comment that a “majority” of the Committee judges that further increases in Bank Rate may be required for a sustainable return of inflation to target.

The new statement, which makes further increases conditional on bad inflation news, suggests interest rates might peak at the new rate of 4%, lower than the 4.5% expected by financial markets.

50bps hike by the BoE but clearly of the view that current rate levels are inconsistent with their target over the medium term

“on the alternative assumption of constant interest rates at 4%, CPI is projected to be 0.8% and 0.2% in two years’ and three years’ time respectively”

— Adam Linton (@Adamlinton1) February 2, 2023

The Bank of England raised rates by a half percentage point to 4% but signaled it might pause its increases as the economy struggles and inflation slows https://t.co/hVBjvo09ax

— Nick Timiraos (@NickTimiraos) February 2, 2023

Discussing the economy, the statement said that:

- Both private sector regular pay growth and services CPI inflation have been notably higher than forecast in the November Monetary Policy Report.

- Labor market remains tight and domestic price and wage pressures have been stronger than expected suggesting risks of greater persistence in underlying inflation

- Some survey indicators of wage growth have eased, alongside a gradual decline in underlying output

- The increases in Bank Rate since December 2021 are expected to have an increasing impact on the economy in the coming quarters.

Looking at the BOE’s MPR Forecasts, the 2023 inflation forecast was revised down, while 2023 growth view was revised up.

- Says in projections conditioned on the alternative assumption of constant interest rates at 4%. the unemployment rate rises by slightly more in the medium term than in the MPC s forecast conditional on market rates

- In projections conditioned on the alternative assumption of constant interest rates at 4%. CPI inflation is projected to be 0.8% and 0.2% in two years’ and three years’ time respectively, slightly lower than the Committee’s forecasts at the same horizons conditioned on market rates.

GDP Growth Forecasts:

- 2022 GDP 4.0% (prev. 4.25%)

- 2023 GDP -0.5% (prev.-1.50%)

- 2024 GDP -0.25% (prev-1.00%)

- 2025 GDP 0.25%(prev. 0.50%)

Unemployment Rate Forecasts:

- 2022 Unemployment Rale 3.75% (prev. 3.75%)

- 2023 Unemployment Rale 4.5% (prev. 5.00%)

- 2024 Unemployment Rale 4.75% (prev. 5.75%)

- 2025 Unemployment Rale 5.25% (prev. 6.50%)

CPI Inflation Forecasts:

- 2022 CPI: 10.75% (prev. 10 75%)

- 2023 CPI: 4.00% (prev. 5.25%)

- 2024 CPI: 1.50% (prev. 1 50%)

- 2025 CPI: 0.50% (prev. 0 00%)

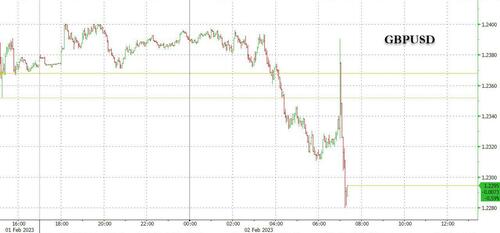

Since a 50 basis-point hike wasn’t fully priced in, the news offered some support to sterling at least initially. Yet it’s mostly the comments on inflation persistence and the vote split that sent the UK currency higher on knee-jerk flows. Cable briefly erased losses and now stands 0.2% lower on the day at 1.2348; it fell as much as 0.5% to 1.2311 before the policy decision.

Still not everyone was convinced the BOE decision was purely hawkish, with Vanda’s Vitaj Patel noting that while the headlines are hawkish, the “key word in the statement is “IF there is more persistent price pressures… further tightening will be required”. I think that’s a pause & pivot from the BoE. Not entirely clear though. Presser will tell us more $GBP”

⚠️ BoE hike rates 50bps. Headlines are hawkish. But key word in the statement is “IF there is more persistent price pressures… further tightening will be required”. I think that’s a pause & pivot from the BoE. Not entirely clear though. Presser will tell us more $GBP pic.twitter.com/Rt1AXIIIWs

— Viraj Patel (@VPatelFX) February 2, 2023

And indeed, after the initial hawkish reaction, markets realized that there was no attempt by the BoE to suggest that financial markets were misguided in expecting interest rate cuts later this year (not very much unlike Powell yesterday), even as the committee made it clear it needed to see evidence that underlying inflation was coming down and it was not yet declaring victory.

As a result, after initially spiking, cable has since dumped to session lows with markets starting to price in the possibility that the BOE’s hiking cycle is now over.

Tyler Durden

Thu, 02/02/2023 – 07:26

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com