Goldman Raises China 2023 GDP Growth Forecast To 6.0% From 5.5%

Earlier this week, amid the deflationary panic that suddenly swept the US banking sector and in no uncertain terms, the US economy, we joked that ‘by the end of this month, markets will be hoping China gets to export some of that sweet, sweet inflation.’

By the end of this month, markets will be hoping China gets to export some of that sweet, sweet inflation

— zerohedge (@zerohedge) March 13, 2023

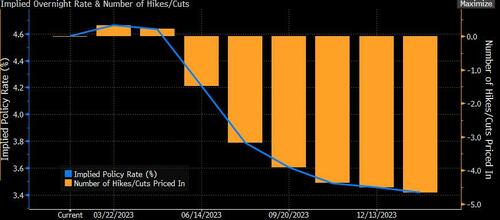

Well, after today’s implosion of Credit Suisse, the renewed liquidation of US small and regional banks, the huge miss in PPI, the drop in retail sales, oil plunging to levels which scream recession, and the market now saying odds of a permanent pause are higher than 50% with more than 100bps of rate cuts following by year end…

… suddenly what we joked about just two days about China being the global source of “sweet, sweet” inflation is no longer a joke.

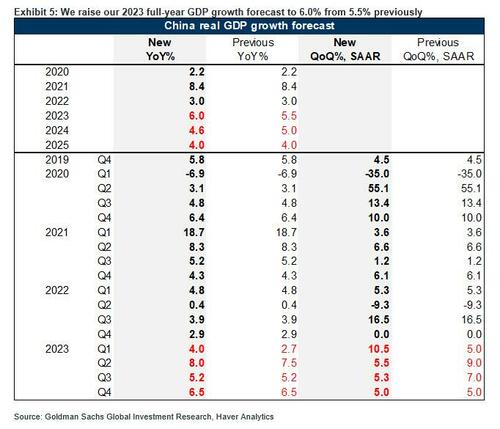

So perhaps sensing that the market desperately needs some good news, moments ago Goldman – which was the first bank to correctly predict no more rate hikes on Sunday night – raised its Chinese GDP forecast following last night’s Chinese data dump, and now sees Q1 and 2023 full-year China GDP growth of 4.0% yoy and 6.0% yoy, up respectively, from 2.7% and 5.5% previously. At the same time, however, Goldman also cuts its 2024 GDP growth forecast to 4.6% from 5.0% previously, “as more of the reopening boost will have played out by the end of this year than in our previous baseline.” By then, of course, it will be a whole new ballgame after Western central banks are forced to inject trillions in liquidity to prevent another global depression so take that number with a grain of salt.

Below we excerpt from the Goldman report (full note available to pro subs).

Thanks to China’s rapid reopening, January-February activity data broadly improved from December. Retail sales and especially the Services Industry Output Index both rose significantly in January-February, led mainly by the strong recovery in Covid-sensitive services consumption. Year-on-year industrial production growth rose modestly in January-February, though slightly less than expected, driven by faster output growth of automobiles, electric machinery and ferrous metal smelting. Fixed asset investment growth increased further in January-February from December, beating market consensus but in line with our forecast, mainly led by stronger services- and infrastructure-related investment. Property-related activity growth improved broadly and meaningfully in January-February, on the back of continued housing easing measures, delayed home purchases during the Covid “exit wave” and a low base last year.

Taking consideration of the rapid improvement in domestic mobility and solid January-February activity data, particularly in services, we upgrade our Q1 and 2023 full-year GDP growth forecast to 4.0% yoy and 6.0% yoy, respectively, from 2.7% and 5.5% previously, but lower our 2024 GDP growth forecast to 4.6% from 5.0% previously, as more of the reopening boost will have played out by the end of this year than in our previous baseline.

The conclusion:

The rapid improvement in domestic mobility and solid January-February activity data suggest China’s post-reopening recovery appears stronger than our previous expectations, thanks mainly to the frontloading of reopening impulse and fiscal support. However, this also leaves less of a reopening boost for 2024 and slightly increases the risk of earlier policy normalization later this year than our previous baseline (though we are not changing our policy expectations in our baseline). As such, we upgrade our Q1 GDP growth forecast to 10.5% qoq sa annualized from 5.0% previously, while lowering our forecast for Q2 and Q3 to 5.5% and 5.3% qoq sa annualized, respectively, from 9.0% and 7.0% previously, with other quarterly sequential growth forecasts unchanged. These adjustments boost our 2023 full-year GDP growth forecast to 6.0% yoy from 5.5% previously (well above the government target of “around 5%” GDP growth this year), but lower our 2024 forecast to 4.6% from 5.0% previously, as more of the reopening boost will have played out by the end of this year than in our previous baseline (Exhibit 5). In year-on-year terms, our Q1-Q4 2023 GDP growth forecast is 4.0%, 8.0%, 5.2% and 6.5%, respectively (vs. 2.7%, 7.5%, 5.2% and 6.5% previously).

More in the full note available to pro subscribers.

Tyler Durden

Wed, 03/15/2023 – 11:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com