Bond Bloodbath Builds, Yield Curve Steepens, Black Gold Bounces Ahead Of Payrolls

Another day, another clubbing of bond bulls (and oil bears)…

Services surveys signaled ‘stickier’ inflation, jobless claims (and falling challenger job cuts YoY) confirmed labor market remains strong, and factory orders jumping all helped send Treasury yields to new cycle highs (and initially weighed on stocks before the ubiquitous wave of buying came back in).

Futures were slammed around the Asia-close-Europe-open and then again at the US cash open before bouncing back aggressively after the ISM data at 10ET. Once Europe closed, stocks faded to end in the red…

Will AMZN/AAPL mark the top?

Source: Bloomberg

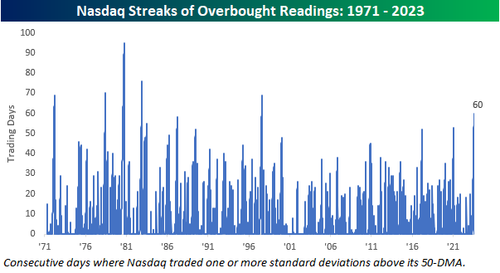

Nasdaq has now been ‘overbought’ for 60 days – its longest period since the run-up to the bursting of the dot-com bubble…

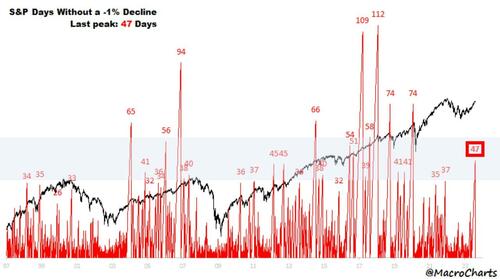

As @MacroCharts noted, yesterday’s sharp decline broke the S&P’s longest low-Volatility streak in years. Many similar breaks ended with some big Volatility spikes & Stock declines.

VIX remains elevated but VVIX leaked a little lower today ahead of tomorrow’s payrolls print (but VVIX is definitely still stressed)…

Source: Bloomberg

The recent acceleration in yields appears to have had an effect on long-duration risk-assets…

Source: Bloomberg

Treasuries were clubbed like a baby seal once again with the long-end the ugliest horse in today’s glue factory (30Y +13bps, 2Y +2bps). On the week, 30Y Yields are up 30bps (2Y only +2bps)…

Source: Bloomberg

30Y yields are back up near last October’s highs…

Source: Bloomberg

The 5s30s segment of the yield un-inverted today

Source: Bloomberg

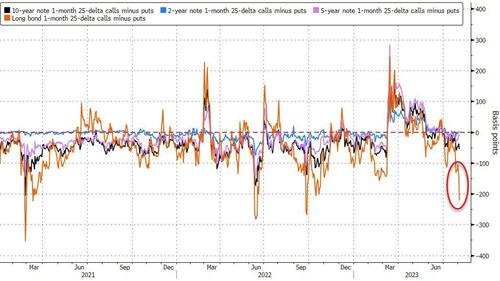

Notably, long-end futs vol has picked up significantly while 10Y Futs vol has risen only modestly…

Source: Bloomberg

Interest-rate options traders are paying through the nose for protection against further increases in long-maturity Treasury yields that are already at their highest levels of the year.

Source: Bloomberg

The dollar ended the day flat, having retraced July’s losses; perfectly round-tripping to the last payrolls print…

Source: Bloomberg

Oil soared back, erasing yesterday’s decline after Saudis were reported as extending their 1m,m b/d production cut through September (and could “deepen” cuts)…

Gold and Bitcoin were noisy but quiet today, modestly lower and higher respectively…

Source: Bloomberg

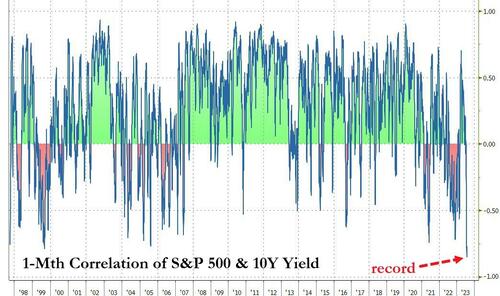

Finally, we note that the relationship between bonds and stocks is at an extreme…

Source: Bloomberg

Will tomorrow’s payrolls print break it bad?

Tyler Durden

Thu, 08/03/2023 – 16:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com