NY Fed Finds Near-Term Inflation Expectations Tumble To Lowest Since April 2021

Just a few days after a somewhat subdued CPI print prompted many analysts to erroneously declare a “mission accomplished” for the Fed because the lagged YoY change in rent inflation was sliding – even though as we explained rents are not only rising again for 6 months in a row, but are about to hit all time highs again…

… this morning the New York Fed demonstrated once again that there is ample confusion when it comes to the difference between a change in prices and change in the annual change of prices, when its latest consumer poll found that Americans expected weaker inflation over the next few years – including expectations for the lowest increase in rents since January 2021 – while also marking up their own views of their personal financial situations.

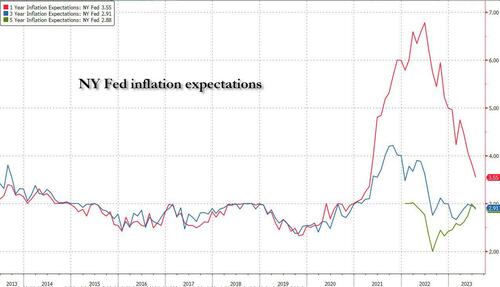

In its latest survey of consumer expectations, the regional Fed bank reported that respondents to its poll said inflation a year from now will stand at 3.55% compared to an expectation of 3.83% in June; this was the lowest reading in over two years, since April 2021. Expectations at the three- and five-year horizons both moderated to 2.9% from 3%, the New York Fed said.

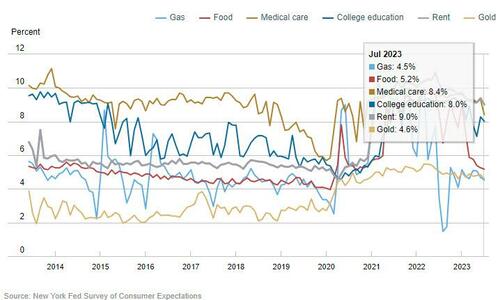

The improvement in the short-term inflation outlook was “broad based” across demographic groups, and consumers said they expect smaller price increases for virtually all essential living expenses.

In keeping with the overall erroneous “mission accomplished” sentiment, the NY Fed found that in July the public predicted lower rates of inflation for gasoline, food, medical costs, college costs and rent, with that last measure ebbing to its lowest point since January 2021. Specifically, over the next year consumers expect gasoline prices to rise 4.52%; food prices to rise 5.17%; medical costs to rise 8.41%; the price of a college education to rise 8.01%; rent prices to rise 9.01%.

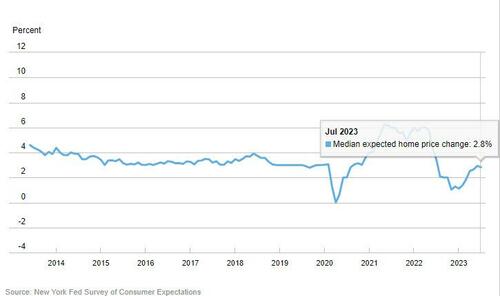

Meanwhile, the expected rise in home prices moved to 2.8% in July from 2.9% in June

Lower inflation expectations usually means a more bullish outlook, and sure enough households’ perceptions about their current financial situations and expectations for the future improved dramatically, with the share of respondents expecting to be better off a year from now is the highest since September 2021.

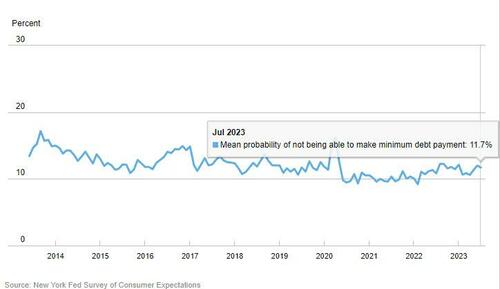

Elsewhere, a smaller percentage of consumers, 11.68% vs 11.99% in prior month, expect to not be able to make minimum debt payment over the next three months

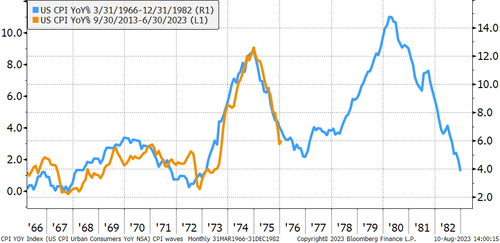

The sharp moderation in inflation (which should have been obvious to all, as we reported two months ago in “CPI Set For Historic Drop Over “Next Two Months“) has raised question as to whether the Fed will need to hike interest rates again after lifting its benchmark overnight target rate by a quarter of a percentage point to the 5.25%-5.50% range at a policy meeting last month. The answer, by the way, is yes although we will first see a sharp bounce in inflation in the coming months as Powell makes all the same errors of the 1970s playbook.

Tyler Durden

Mon, 08/14/2023 – 12:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com