Morgan Stanley Sales And Trading Smash Expectations; Stock Drops

Tyler Durden

Thu, 10/15/2020 – 08:23

Concluding a rather quick earnings season for financials which has seen mixed results from money-center banks, whose sharp revenue declines and tepid outlook on loss provisions – and outright misses in the case of Wells and BofA – sent their stocks lower, offset by strong performance by pure-play “hedge funds” such as Goldman, moments ago Morgan Stanley reported Q3 earnings which smashed expectations thanks to another quarter of stellar revenue from both equity and FICC sales and trading.

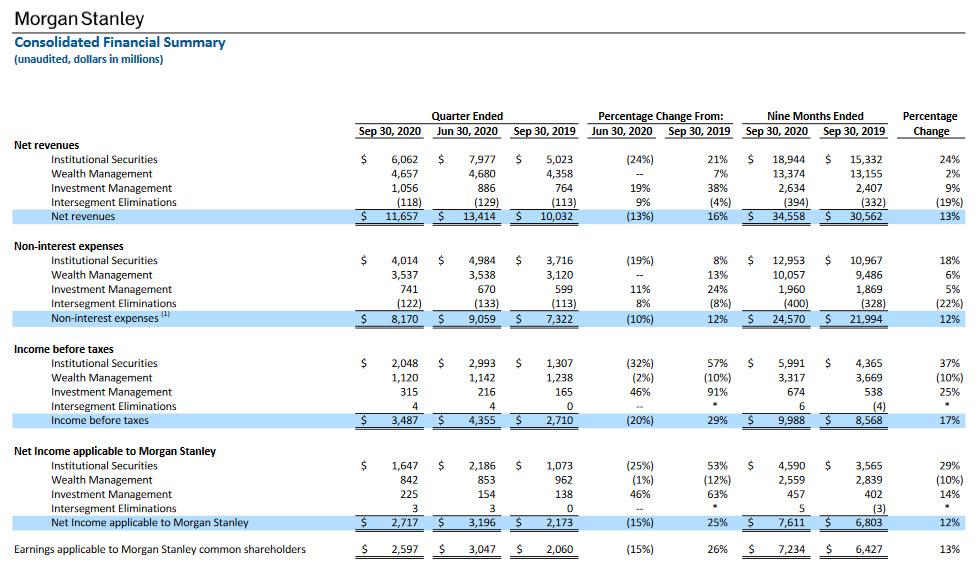

Morgan Stanley reported Q3 net revenues of $11.7 billion, up 16% from $10.0 billion a year ago, and solidly beating expectations of $10.6BN. Net income was $2.7 billion, or $1.66 per diluted share, up 25% from $2.2 billion, or $1.27 per share, a year ago, while adjusted EPS also jumped from $1.21 to $1.59, beating expectations of $1.28 (EPS was adjusted by tax benefits of $113 million which had an impact of $0.07 per diluted share; as a result, the effective tax rate was 21.1% vs. 18.2% y/y, below the expected 23.5%). As Bloomberg observes, it is “fascinating that some of these firms, including Morgan Stanley, were able to pull off better results than a year ago despite being in the middle of a pandemic.”

“We delivered strong quarterly earnings as markets remained active through the summer months,” CEO James Gorman said in a statement Thursday, adding that completing the E*Trade acquisition, the “subsequent ratings upgrade from Moody’s, and the recently announced acquisition of Eaton Vance significantly strengthen our firm and position us well for future growth.”

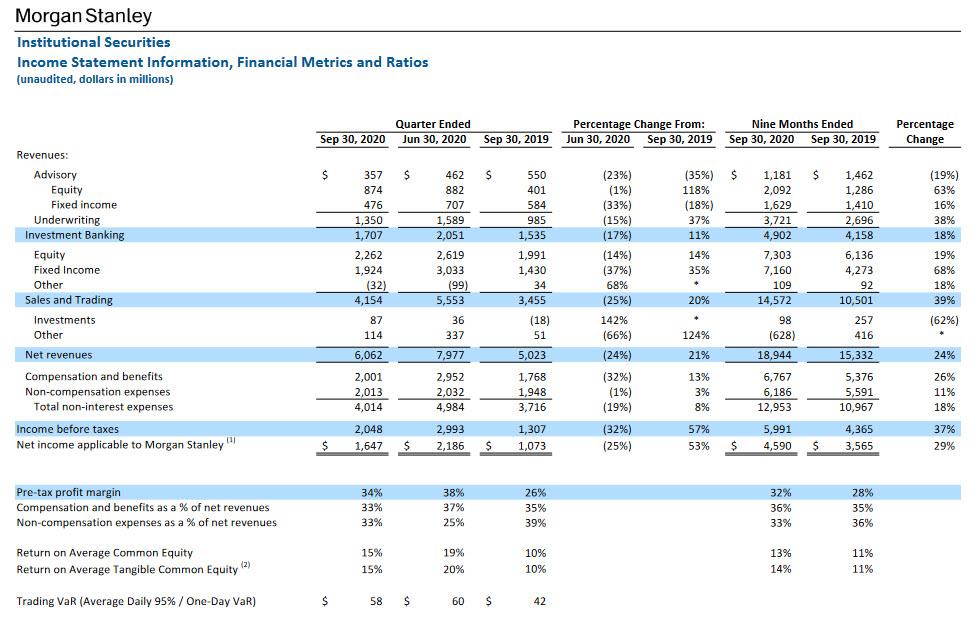

The biggest highlight was the latest jump in sales and trading revenue which while down notably from the Q2 record bonanza, surged 20% in the third quarter to $4.2 billion from $3.5BN a year ago, lifting the firm’s profit to the second-highest ever.

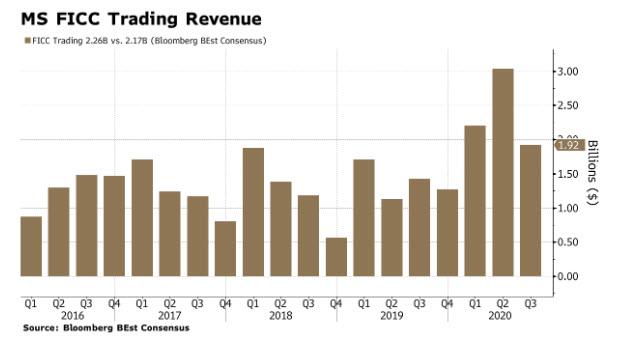

- FICC revenues surged by 35%, from $1.4BN to $1.924BN, above the $1.7BN consensus estimate, and the second-best among the big banks. MS said the strong performance was due to “strength in credit products benefitting from an active primary market.”

- Equity sales and trading revenue also jumped Y/Y, rising by 22% to $2.26BN, and beating the $2.17BN estimate. The firm cited “strong performance across products on continued client engagement, with notable strength in Asia” for the year-over-year increase.

- Other sales and trading net revenues decreased from a year ago due to losses on economic hedges associated with certain of the Firm’s borrowings and corporate lending activity, partially offset by gains on investments associated with certain employee deferred compensation plans (DCP).

Investment banking was also solid, with revenues up 11% from a year ago to $1.7BN from $1.5BN. According to MS, while advisory revenues decreased from a year ago due to lower completed M&A activity and fewer large transactions, equity underwriting revenues increased significantly from a year ago on higher revenues from IPOs, follow-on offerings and blocks as clients continued to access capital markets. Specifically, equity underwriting more than doubled to $874 million from $401 million, while advisory was down to $357 million from $550 million, and fixed income underwriting likewise fell to $476 million from $584 million due to “declines in loan issuances as large event-driven and M&A financings were muted.”

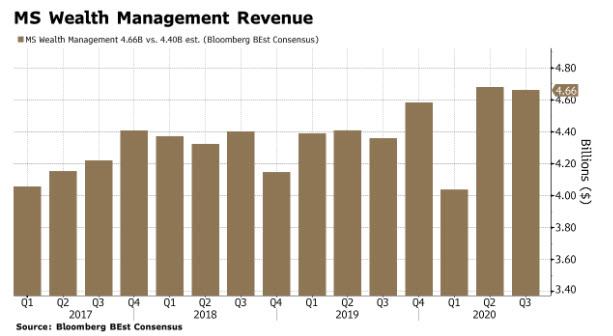

Wealth management net revenue in Q3 rose 6.9% from the prior year to $4.66 billion, also beating an estimate of $4.40 billion. In its statement, the bank said that excluding the impact of DCP – its employee compensation plan – wealth management’s reported net revenues of $4.4 billion “increased slightly” from a year ago.

Investment Management reported net revenues of $1.1 billion compared with $764 million a year ago, while pre-tax income doubled to $315 million compared with $165 million a year ago. The bank said the 20% increase was “driven by record AUM on strong investment performance and positive long-term net flows,” and that “investments revenues increased significantly from a year ago on higher accrued carried interest and investment gains primarily in Asia private equity.” Naturally, compensation expense increased from a year ago on higher asset management revenues and an increase in carried interest.

While of secondary importance for a non-balance sheet intensive bank, Morgan Stanley set aside just $111 million in provisions for credit losses, compared with $51 million a year ago and $239 million in the second quarter. The firm now has $1.3 billion set aside for soured loans.

On the expense side, Morgan Stanley reported $5.086 billion in compensation expense, higher than the $4.82 billion analyst expectation, with the firm cited higher revenues across the firm for the increase. Non-compensation expense came in at $3.08 billion, also slightly higher than the exp. $3.02 billion.

In response to these stellar results the stock… dropped in kneejerk reaction, suggesting it had been priced to perfection, and was down more than 2% at 49.70 at last check.

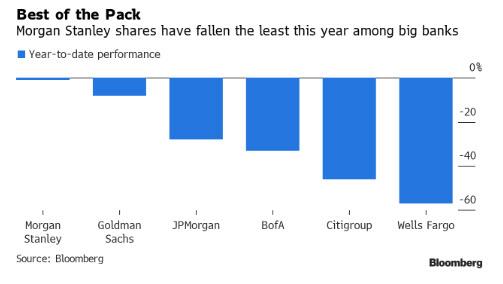

Still, despite the muted response, Morgan Stanley is the best performing stock among all major US financials, and is effectively flat for the year, compared to far worse results for the rest of the sector.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com