“Smart Money”? – Hollywood Celebs And Sports Icons Got Crushed In Mattress-Maker Casper

“Smart money” investors, such as some Hollywood actors and sports icons, are linked up with top VC firms and investment banks, have been stung by the VC bubble of overinflated unicorns that see a valuation collapse right before IPO.

Think WeWork, and what happened to the office-sharing space company last fall, it’s valuation plunged as it attempted to IPO. The company then ran out of money and was bailed out by its largest shareholder, SoftBank.

Leonardo DiCaprio and rapper 50 Cent have been the latest “smart money” investors to feel the pain of plunging valuations, after their investments in Casper Sleep Inc., an online mattress retailer, saw valuations fall as it attempts to IPO.

Reuters notes that the unicorn mattress company will issue 9.6 million shares between the $17 to $19 level, which is at the top part of the range, giving the company $182.4 million in IPO proceeds. Such a level would also give the company a $768 million valuation, or about a -23% drop in book value from its latest funding round.

In 1Q19, the money-losing company was valued at $1.1 billion, which is a -30% decline in today’s valuation versus what was seen early last year.

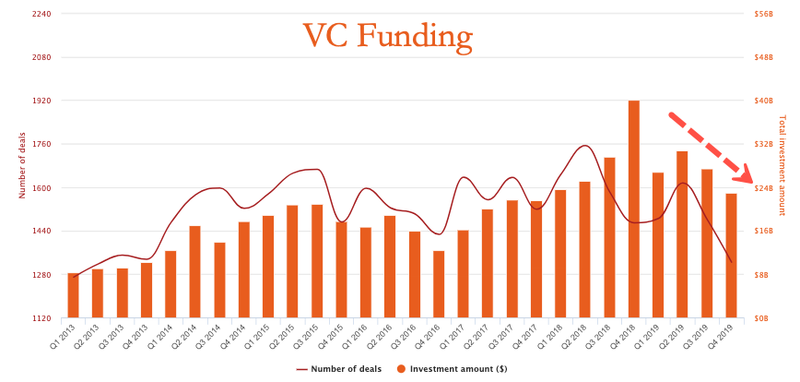

We noted since WeWork imploded last fall, investors’ risk appetite for money-losing companies has collapsed. This has also marked the top of not just the VC bubble, but also the IPO bubble.

“Valuations in the private market are currently under the microscope, especially with unicorns, as they attempt to tap the public markets,” said Jeff Zell, a senior research analyst at IPO Boutique.

“The biggest hurdle that Casper Sleep is going to have during the roadshow process is proving to investors a viable path to profitability while competing in a highly competitive industry,” Zell said.

Even “smart money” in Hollywood is feeling the pressure as the bubble of everything deflates.

Tyler Durden

Tue, 01/28/2020 – 15:35

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com