It was about 10 years ago that Bank of America first declared, and many other Wall Street firms followed, that the “Great Rotation” in capital away from bond funds and toward equity funds was just around the corner. Boy, was BofA wrong.

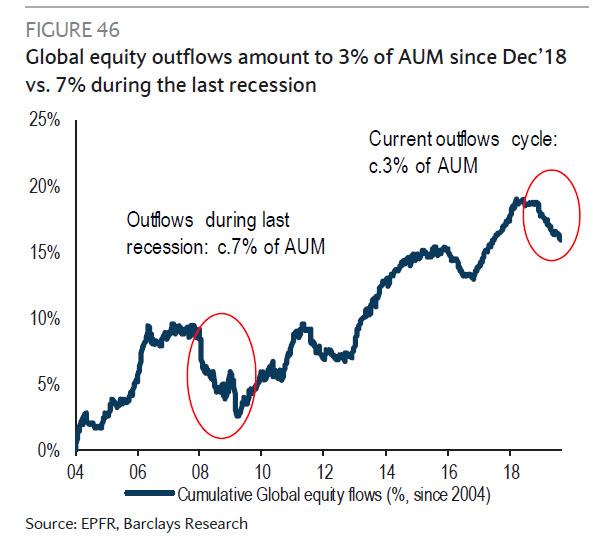

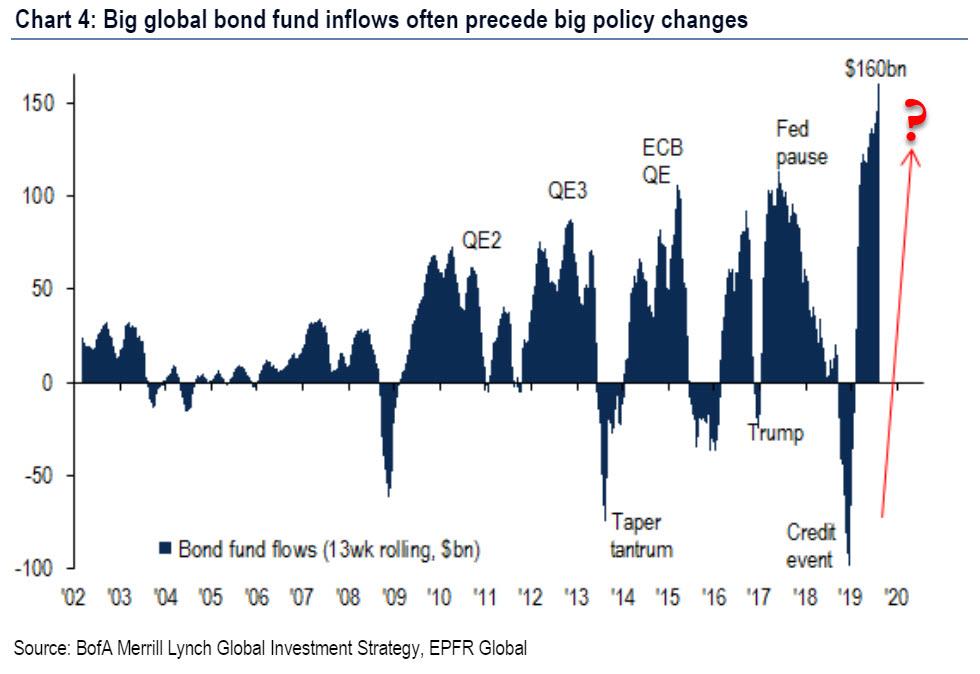

As the chart of the week from, you guessed it, Bank of America published in Friday’s Flow Show weekly by BofA’s Michael Hartnett shows, not only has there not been a “great rotation” out of bonds funds, but on the contrary, a record $160bn inflows to bond funds in the past 3 months reveal deep global recession fear and global capitulation into “Japanification” theme; indeed, as a separate chart from Barclays shows, the global equity outflows in 2019 amount to a whopping 3% of total AUM, which is almost half the outflows seen during the last downturn.

What is more notable is that going back to the BofA chart referenced above, “big bond inflows often precede big policy changes (e.g. 2010/12/15)”, in other words, the market is convinced that something big is about to happen.

The silver lining? The chart also illustrates that periods of big bond outflows (e.g. 2008/13/18) coincide with the most bearish returns across asset classes, which may explain why in a time of record bond inflows, stocks are trading near all time highs…

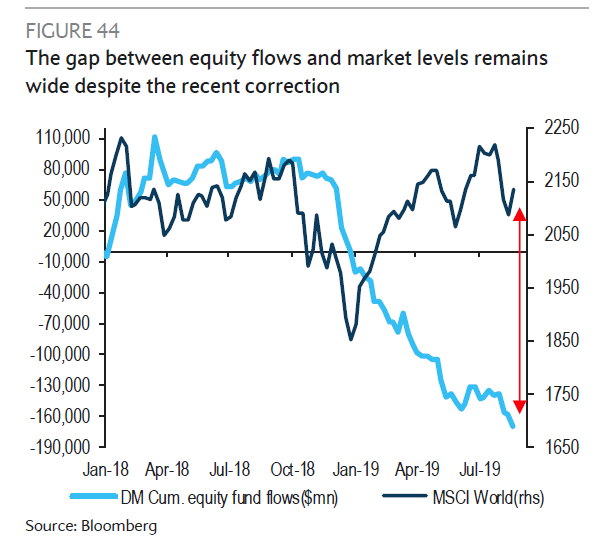

… even if it does pose the question: just who is buying stocks here?

Perhaps as a function of said record bond inflows, Bank of America remains bullish on risk assets for 2019, particularly stocks & commodities, due to the combination of Hartnett says is “bearish positioning and bullish monetary policy” pointing out that trade war has thus far been bullish via lower rates rather than recession.

However, the bank’s optimism fades in 2020, when Hartnett’s outlook turns bearish “as recession/policy impotence/bond bubble risks induce Big Top in credit & equity prices as credit spreads trough & equity multiples peak.“

Looking at a more short-term picture, BofA notes that despite wild day to day volatility, august asset prices remained amazingly resilient in the face of “China FX deval, Trump tariffs on China consumer goods, HK/Japan-Korea/India-Pakistan geopolitics, yield curve inversion, global EPS & PMI recessions”… yet the S&P was down just 100 points.

Looking ahead at September, Hartnett predicts that the “pain trade” this month is up (contrary to the prediction from Nomura’s Charlie McElligott) on the back of the temporary peak in trade war fear + “monetary policy easing month” (Fed/ECB/BoJ) + bearish positioning (BofAML Bull & Bear Indicator); all this translates to “pain trade” up in stocks & commodities.

As for specific September trades, Hartnett recommends: buy Hang Seng, KOSPI, DAX, EU banks (note US stocks at 70-year high versus Europe just as BREXIT kick starts European fiscal stimulus )…

… EM currencies (Brazilian real at 30-year low versus US dollar)…

… industrial metals, CCC-rated HY bonds; BofA also expects the SPX to lag equity rally while the 30-year Treasury is most vulnerable to risk-on trade, while any short-term sell-off in silver, gold & volatility should be viewed as entry point to hedge against the bond bubble risk.

Finally, looking at the the unknown unknowns, Hartnett lists the two possible shocks that may surprise traders: positive and negative:

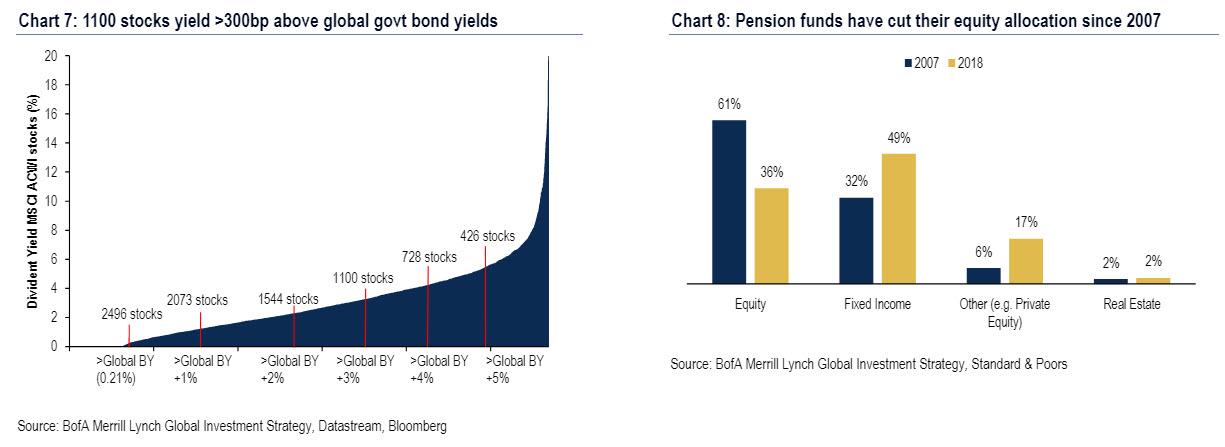

- The positive shock: positive risk is orderly rise in yields and Great Rotation from bonds to stocks as policy makers successfully postpone recession + combo of low allocations to equities (down from 61% in 2007 to 36% in 2018 at S&P500 corporate pension funds – Chart 8) and 1100 global stocks with DY over 300bps in excess of global government bond yield (Chart 7) + absurd level of rates (European IG bond yield @ 0.24%) = pension funds & endowments shift from bonds to stocks.

- The negative shock: negative risk is bond bubble bursts causing disorderly rise in yields; surging bond prices + surging bond inflows + belief central banks will underwrite bond prices = bubble; disorderly rise of interest rates could cause Wall St deleveraging deleveraging in public & private markets as investors leveraged to everlasting low rates and thereafter a Main St recession.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com