With the recent 2-10 curve inversion, the probabilities of a recession next year are climbing, which means private credit funds and business development companies (BDCs) are actively preparing portfolios for an economic downturn, reported Reuters.

A downturn in employment, inflation, and industrials have stoked fears of a possible recession in the next 12 months. A drop in treasury yields, an overcrowded lending market, and macroeconomic deterioration are forcing debt funds to become more defensive in investment strategies in 2H19.

“2018 was the year of asset compression, and we’ve had three straight quarters of asset spread widening that benefits us,” said Grier Eliasek, chief operating officer at Prospect Capital on the BDC’s recent earnings call.

“Some people have been predicting it (a downturn) for five years. I guess if you predicted five years ahead of time, you’re right eventually. But eventually the cycle turns, and we want to have the strongest fortress to handle that,” Eliasek added.

Reuters notes increased recession risk has forced BDCs to pare down risky high-yielding assets and move into lower-yielding ones.

Goldman Sachs BDC saw first-lien assets increase to 74.43% from 65.16% and second-lien assets fall to 18.48% from 20.71% over the second quarter. The BDC’s total debt increased to US$842.8m from US$704.4m in that period.

New Mountain Finance has steadily increased the proportion of its portfolio in first-lien assets to 52.75% and decreased its second-lien assets to 27.35% at the end of the second quarter, up from 39.48% in first-lien and 34.03% in the same period last year. Over that time, the firm’s total debt has risen from US$1.2bn to US$1.7bn.

Andrew Stewart, executive director-sales at MUFG Investor Service, said there’d been a rise of co-investment strategies that enable managers to increase deal diversity while continuing to underwrite large deals in an increasingly competitive market.

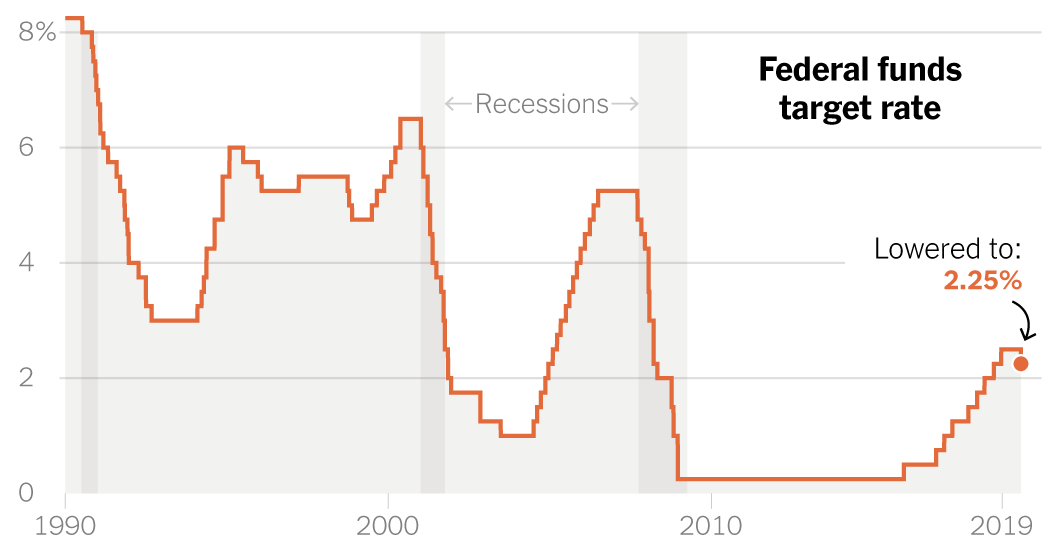

The flight to safety started when the Federal Reserve slashed interest rates in July for the first time since 2007. Private credit funds and BDCs invest in debt that is sometimes floating and move in real-time to policy changes.

Some of these floating-rate loans are known as bank loans, senior loans, and leveraged loans. The loans are typically supplied to companies with higher levels of debt relative to their cash flows, and because of this, their cash flows could be at risk in the next economic downturn. But also, since the rates of these loans are floating, or otherwise tied to the Libor benchmark, private credit funds and BDCs don’t receive an acceptable level of yield on loans in an interest rate cut cycle. So what are these financial institutions doing as the Federal Reserve cuts? They’re rotating into lower-yielding assets, seen as a defensive move.

According to data from Refinitiv, yields on first-lien loan and unitranche loans have declined as lenders compete to put an abundance of available debt capital to work in US middle-market firms. Middle market term loan yields tightened to 7.95% in August, down from 8.85% in July.

The 2019 Preqin Global Private Equity and Venture Capital Report said 61% of private debt investors saw a period of challenging returns ahead, while 48% warned about credit spreads, and 47% said credit profiles. 49% of the respondents said senior loans remained the most popular destination for investors in the loan market.

The Small Business Credit Availability Act has allowed BDCs to take on additional leverage, which is currently being used to rotate portfolios into less risky and lower-yielding assets before the next recession.

Leverage is a major problem for lenders. If firms are caught on the wrong side of a trade, it could severely increase losses during a downturn.

“Leverage cuts both ways. It can enhance fund returns, but if you lose money on a deal it can amplify the impact,” Harris said.

“So in a fund with leverage, it is critically important to understand the credit risk of the underlying investments.”

And while President Trump continues to call the economy the “greatest ever,” and the media talking heads at Fox Business call anyone with a bearish macro tilt on the economy “radical democrats” – it seems that some of the smartest money on Wall Street has already started to de-risk their debt portfolios ahead of an economic downturn that could strike as soon as next year.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com